Wine futures offer investors the chance to purchase wine before it is bottled, leveraging potential appreciation based on vintage quality and market demand, while Timberland investment involves acquiring forested land or timber assets expected to grow in value over time and generate income through timber sales or land appreciation. Both asset classes provide portfolio diversification outside traditional equities and bonds, with wine futures showcasing unique liquidity challenges contrasted by Timberland's tangible, long-term growth prospects. Explore the nuances and benefits of these alternative investments to enhance your financial strategy.

Why it is important

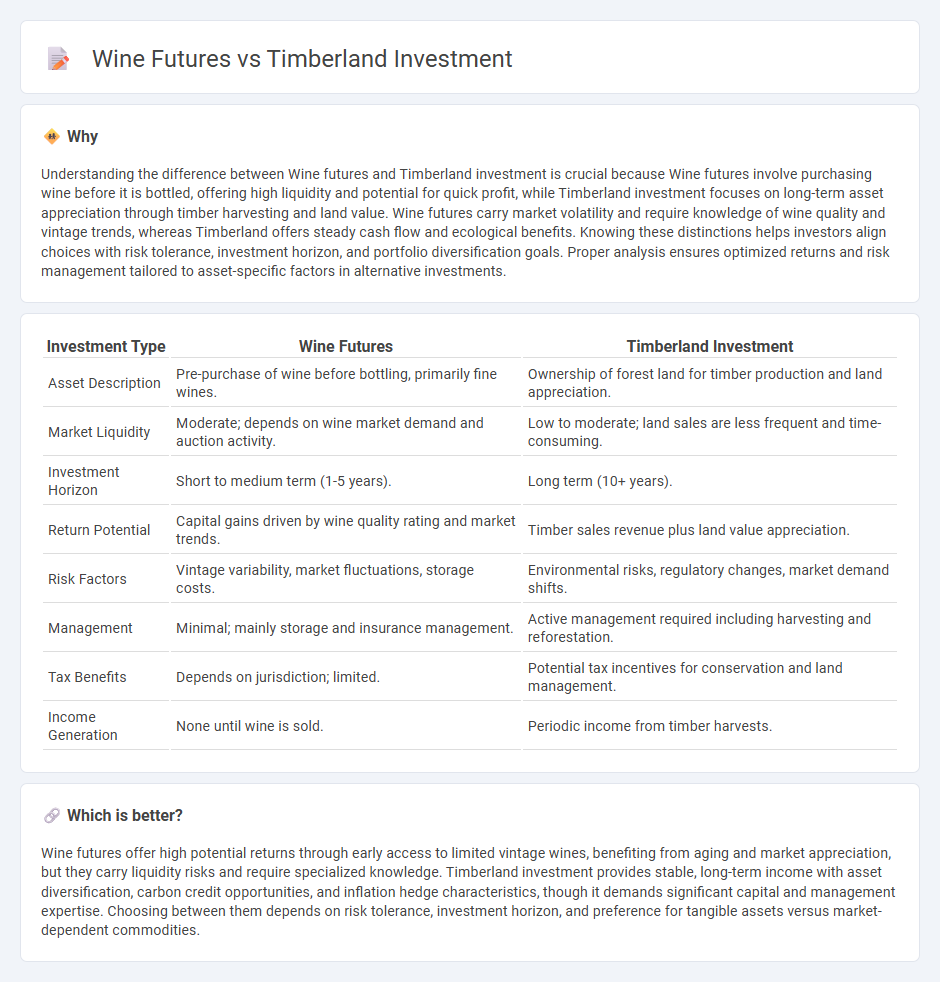

Understanding the difference between Wine futures and Timberland investment is crucial because Wine futures involve purchasing wine before it is bottled, offering high liquidity and potential for quick profit, while Timberland investment focuses on long-term asset appreciation through timber harvesting and land value. Wine futures carry market volatility and require knowledge of wine quality and vintage trends, whereas Timberland offers steady cash flow and ecological benefits. Knowing these distinctions helps investors align choices with risk tolerance, investment horizon, and portfolio diversification goals. Proper analysis ensures optimized returns and risk management tailored to asset-specific factors in alternative investments.

Comparison Table

| Investment Type | Wine Futures | Timberland Investment |

|---|---|---|

| Asset Description | Pre-purchase of wine before bottling, primarily fine wines. | Ownership of forest land for timber production and land appreciation. |

| Market Liquidity | Moderate; depends on wine market demand and auction activity. | Low to moderate; land sales are less frequent and time-consuming. |

| Investment Horizon | Short to medium term (1-5 years). | Long term (10+ years). |

| Return Potential | Capital gains driven by wine quality rating and market trends. | Timber sales revenue plus land value appreciation. |

| Risk Factors | Vintage variability, market fluctuations, storage costs. | Environmental risks, regulatory changes, market demand shifts. |

| Management | Minimal; mainly storage and insurance management. | Active management required including harvesting and reforestation. |

| Tax Benefits | Depends on jurisdiction; limited. | Potential tax incentives for conservation and land management. |

| Income Generation | None until wine is sold. | Periodic income from timber harvests. |

Which is better?

Wine futures offer high potential returns through early access to limited vintage wines, benefiting from aging and market appreciation, but they carry liquidity risks and require specialized knowledge. Timberland investment provides stable, long-term income with asset diversification, carbon credit opportunities, and inflation hedge characteristics, though it demands significant capital and management expertise. Choosing between them depends on risk tolerance, investment horizon, and preference for tangible assets versus market-dependent commodities.

Connection

Wine futures and Timberland investments are connected through their classification as alternative assets that offer portfolio diversification and inflation hedging benefits. Both assets derive value from natural resource scarcity and long-term appreciation, making them attractive to investors seeking non-correlated returns outside traditional equities and bonds. Market trends show growing interest in wine futures and timberland due to increasing demand for luxury collectibles and sustainable land management.

Key Terms

Asset Liquidity

Timberland investment offers moderate liquidity through partial land sales or timber harvests, while wine futures often provide higher liquidity due to established secondary markets and trading platforms. Timberland's liquidity depends on market conditions and asset management, whereas wine futures benefit from shorter investment cycles and quicker turnover. Explore detailed comparisons to determine which asset suits your liquidity preferences best.

Holding Period

Timberland investments typically require a long-term holding period of 10 to 20 years to maximize asset appreciation and sustainable timber yield, offering stable, inflation-hedged returns. Wine futures generally have a shorter holding period, often 2 to 5 years, capitalizing on the maturation process and market demand fluctuations to generate profits. Explore more insights on how holding periods impact returns and risk profiles in timberland versus wine futures investments.

Market Volatility

Timberland investment typically offers lower market volatility due to its tangible asset nature and steady long-term appreciation, while wine futures experience higher volatility influenced by factors such as vintage quality, market demand, and auction results. Timberland markets are less susceptible to rapid price fluctuations compared to the speculative and trend-driven wine futures market, which can be highly sensitive to economic conditions and collector interest. Explore detailed analyses to understand how market volatility impacts returns in timberland versus wine futures investment strategies.

Source and External Links

Timberland | Institutional - Manulife Investment Management - Offers fully integrated, global, and sustainable timberland investment solutions for portfolio diversification and inflation protection.

Timberland - Overview, How to Diversify, Benefits of Investing - Provides an overview of timberland as an alternative investment, suitable for diversifying portfolios due to its predictable biological growth.

Timberland - J.P. Morgan Asset Management - Offers timberland investments as a way to manage inflation risk and enhance portfolio diversification while promoting sustainability.

dowidth.com

dowidth.com