Song catalog purchases generate revenue through royalties and licensing fees tied to music rights, offering long-term, inflation-protected cash flows with growing demand from streaming and media. Timberland investments provide returns via timber sales, land appreciation, and ecosystem services, benefiting from sustainable resource management and increasing global timber demand. Explore the unique risks and benefits of each asset class to determine the best fit for your investment portfolio.

Why it is important

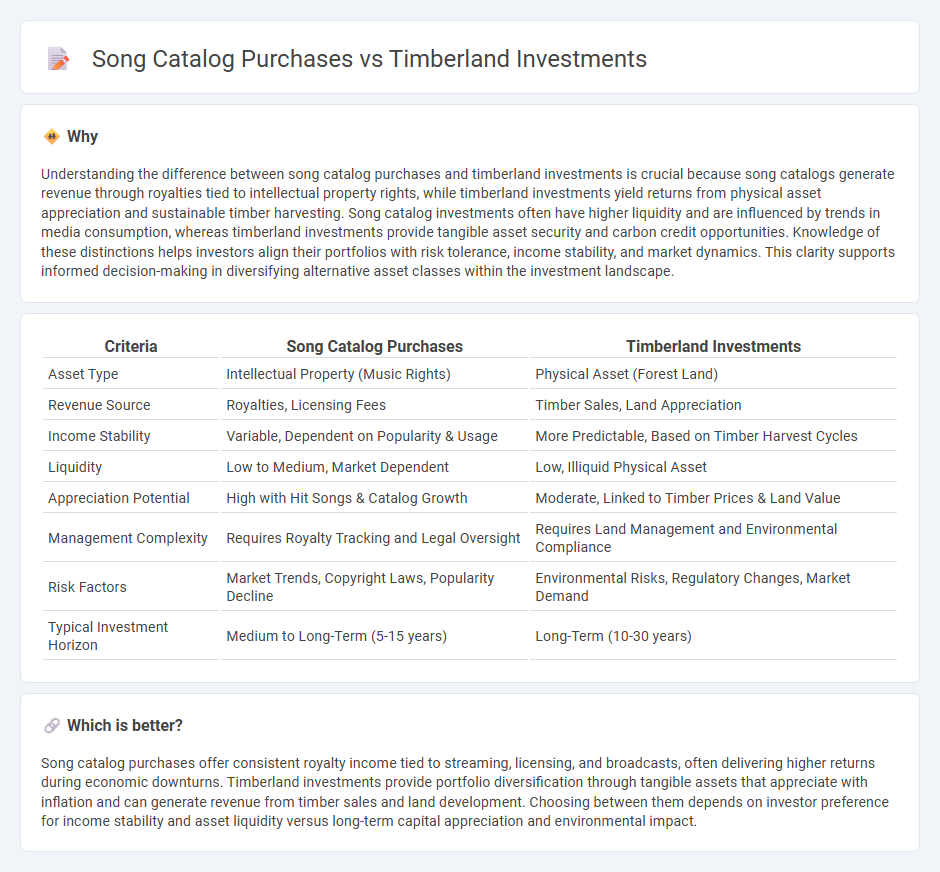

Understanding the difference between song catalog purchases and timberland investments is crucial because song catalogs generate revenue through royalties tied to intellectual property rights, while timberland investments yield returns from physical asset appreciation and sustainable timber harvesting. Song catalog investments often have higher liquidity and are influenced by trends in media consumption, whereas timberland investments provide tangible asset security and carbon credit opportunities. Knowledge of these distinctions helps investors align their portfolios with risk tolerance, income stability, and market dynamics. This clarity supports informed decision-making in diversifying alternative asset classes within the investment landscape.

Comparison Table

| Criteria | Song Catalog Purchases | Timberland Investments |

|---|---|---|

| Asset Type | Intellectual Property (Music Rights) | Physical Asset (Forest Land) |

| Revenue Source | Royalties, Licensing Fees | Timber Sales, Land Appreciation |

| Income Stability | Variable, Dependent on Popularity & Usage | More Predictable, Based on Timber Harvest Cycles |

| Liquidity | Low to Medium, Market Dependent | Low, Illiquid Physical Asset |

| Appreciation Potential | High with Hit Songs & Catalog Growth | Moderate, Linked to Timber Prices & Land Value |

| Management Complexity | Requires Royalty Tracking and Legal Oversight | Requires Land Management and Environmental Compliance |

| Risk Factors | Market Trends, Copyright Laws, Popularity Decline | Environmental Risks, Regulatory Changes, Market Demand |

| Typical Investment Horizon | Medium to Long-Term (5-15 years) | Long-Term (10-30 years) |

Which is better?

Song catalog purchases offer consistent royalty income tied to streaming, licensing, and broadcasts, often delivering higher returns during economic downturns. Timberland investments provide portfolio diversification through tangible assets that appreciate with inflation and can generate revenue from timber sales and land development. Choosing between them depends on investor preference for income stability and asset liquidity versus long-term capital appreciation and environmental impact.

Connection

Song catalog purchases and Timberland investments both represent alternative asset classes that provide steady, long-term revenue streams through royalty payments and lease income, respectively. Investors seeking diversification and inflation protection increasingly favor these non-traditional assets due to their low correlation with stock and bond markets. This trend reflects a broader shift toward acquiring tangible intellectual property rights and real estate holdings to achieve stable cash flow and capital appreciation.

Key Terms

Asset Valuation

Timberland investments offer tangible assets with long-term appreciation potential based on land quality, location, and timber yield, while song catalog purchases derive value from royalty income, streaming trends, and intellectual property rights. Asset valuation for timberland heavily relies on ecological sustainability and market demand for wood products, whereas song catalog valuation hinges on music popularity, licensing deals, and digital consumption metrics. Explore further to understand the strategic financial benefits and risks unique to each alternative asset class.

Revenue Streams

Timberland investments generate revenue primarily through timber sales, land leases, and potential real estate development, offering stable, asset-backed cash flow with appreciation prospects. Song catalog purchases yield income from royalties, licensing fees, and performance rights, driven by music consumption across streaming platforms, broadcasts, and public performances, often providing higher yield potential with market volatility. Explore detailed comparisons to understand where your investment aligns best with your financial goals.

Liquidity

Timberland investments, characterized by physical assets such as forests and land, offer moderate liquidity through selective sales or leasebacks, yet often require longer holding periods due to market dynamics and regulatory complexities. In contrast, song catalog purchases provide higher liquidity, with easier valuation and the potential for quicker sales or licensing deals driven by digital streaming revenue streams and rights management platforms. Explore further to understand how each asset class aligns with your liquidity needs and investment goals.

Source and External Links

Timberland | Institutional - Manulife Investment Management - Provides global, sustainable timberland investment solutions focusing on value creation through sustainable management, portfolio diversification, inflation protection, and climate impact such as carbon credits and ecosystem services.

BTG Pactual Timberland Investment Group - A timberland investment management organization offering sustainable timberland investments to institutional investors with expertise in integrated forest and asset management worldwide.

Resource Management Service: Timberland Investments - One of the largest global providers of timber investment services with over 70 years of experience, managing 2.2 million acres of forest valued at $5.3 billion with a vertically integrated approach along the timberland value chain.

dowidth.com

dowidth.com