Carbon credit arbitrage leverages price discrepancies in carbon markets to generate profits while encouraging emission reductions. ESG-focused ETFs invest in companies meeting environmental, social, and governance criteria, targeting sustainable, long-term growth. Explore these investment strategies to align your portfolio with emerging sustainability trends.

Why it is important

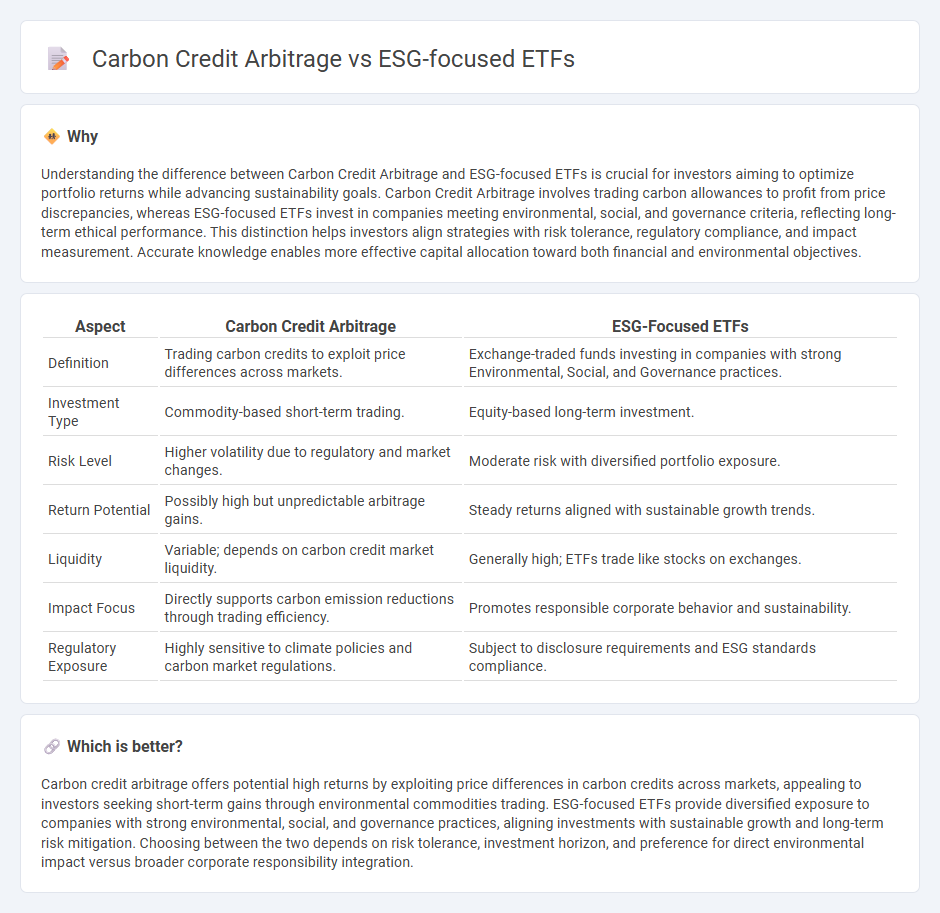

Understanding the difference between Carbon Credit Arbitrage and ESG-focused ETFs is crucial for investors aiming to optimize portfolio returns while advancing sustainability goals. Carbon Credit Arbitrage involves trading carbon allowances to profit from price discrepancies, whereas ESG-focused ETFs invest in companies meeting environmental, social, and governance criteria, reflecting long-term ethical performance. This distinction helps investors align strategies with risk tolerance, regulatory compliance, and impact measurement. Accurate knowledge enables more effective capital allocation toward both financial and environmental objectives.

Comparison Table

| Aspect | Carbon Credit Arbitrage | ESG-Focused ETFs |

|---|---|---|

| Definition | Trading carbon credits to exploit price differences across markets. | Exchange-traded funds investing in companies with strong Environmental, Social, and Governance practices. |

| Investment Type | Commodity-based short-term trading. | Equity-based long-term investment. |

| Risk Level | Higher volatility due to regulatory and market changes. | Moderate risk with diversified portfolio exposure. |

| Return Potential | Possibly high but unpredictable arbitrage gains. | Steady returns aligned with sustainable growth trends. |

| Liquidity | Variable; depends on carbon credit market liquidity. | Generally high; ETFs trade like stocks on exchanges. |

| Impact Focus | Directly supports carbon emission reductions through trading efficiency. | Promotes responsible corporate behavior and sustainability. |

| Regulatory Exposure | Highly sensitive to climate policies and carbon market regulations. | Subject to disclosure requirements and ESG standards compliance. |

Which is better?

Carbon credit arbitrage offers potential high returns by exploiting price differences in carbon credits across markets, appealing to investors seeking short-term gains through environmental commodities trading. ESG-focused ETFs provide diversified exposure to companies with strong environmental, social, and governance practices, aligning investments with sustainable growth and long-term risk mitigation. Choosing between the two depends on risk tolerance, investment horizon, and preference for direct environmental impact versus broader corporate responsibility integration.

Connection

Carbon credit arbitrage leverages price discrepancies in carbon markets to generate profits while promoting environmental sustainability. ESG-focused ETFs integrate companies with strong environmental, social, and governance practices, often benefiting from regulatory support around carbon credits. Investing in both can enhance a portfolio's exposure to climate-positive opportunities and drive long-term value through sustainable investment trends.

Key Terms

Sustainability Screening

ESG-focused ETFs prioritize sustainability screening by integrating environmental, social, and governance criteria to select companies with responsible practices, reducing exposure to high-risk sectors. Carbon credit arbitrage involves trading emission allowances for profit, leveraging discrepancies in carbon markets but often lacking stringent sustainability screening compared to ESG ETFs. Explore how targeted sustainability screens distinguish ESG investments from carbon credit strategies and impact portfolio risk management.

Carbon Allowance Pricing

ESG-focused ETFs primarily invest in companies with strong environmental, social, and governance practices, while carbon credit arbitrage exploits price differences in carbon allowance markets to generate profits. Carbon allowance pricing is influenced by regulatory frameworks, market demand, and the supply of carbon permits in emissions trading systems such as the EU ETS. Explore deeper insights on how carbon allowance pricing affects investment strategies and market dynamics.

Regulatory Compliance

ESG-focused ETFs prioritize investments in companies meeting strict environmental, social, and governance criteria, ensuring alignment with evolving regulatory compliance standards worldwide. Carbon credit arbitrage involves exploiting price differences in carbon markets, demanding rigorous adherence to international carbon trading regulations and verification processes. Explore the complexities of regulatory compliance in these strategies to better understand their impact and opportunities.

Source and External Links

7 Best-Performing ESG ETFs and 7 Cheapest ESG ETFs for July 2025 - This article identifies top ESG ETFs for performance (e.g., Stance Sustainable Beta ETF, Franklin Responsibly Sourced Gold ETF) and lists their recent returns, highlighting funds that screen for environmental, social, and governance criteria.

Best ESG ETFs: Top Funds For Socially Responsible Investing - Reviews leading ESG ETFs like iShares ESG MSCI USA Leaders ETF and Nuveen ESG Large-Cap Value ETF, detailing their strategies, expense ratios, annualized returns, and top holdings, with a focus on sector leaders and climate-conscious options.

Five Top ESG ETFs for US Investors - Analyzes large, widely held ESG ETFs such as iShares ESG Aware MSCI USA ETF, discussing their assets, performance relative to broader indices, index methodology, and holdings.

dowidth.com

dowidth.com