Investment in music royalties offers a unique asset class characterized by steady cash flows from intellectual property, contrasting sharply with hedge funds that rely on diverse strategies aiming for high returns through market speculation. Music royalties provide income stability linked to the success of songs and catalogs, while hedge funds often involve higher volatility and risk across equities, derivatives, and other instruments. Explore further to understand the comparative advantages and risks of investing in music royalties versus hedge funds.

Why it is important

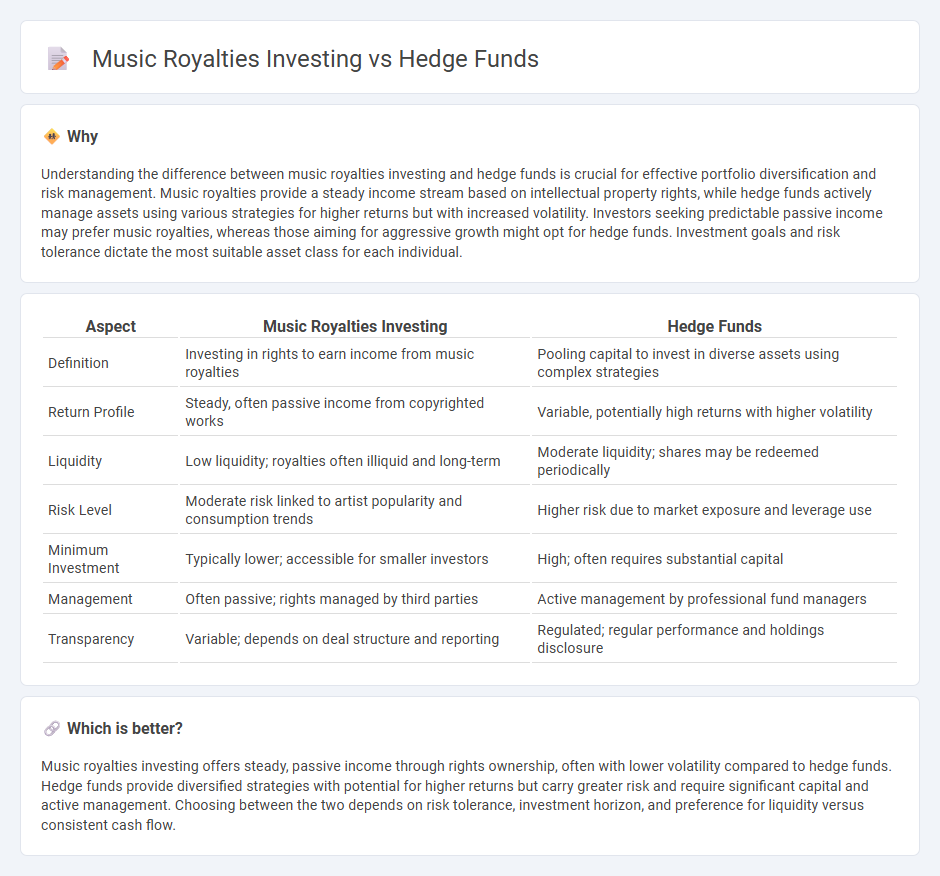

Understanding the difference between music royalties investing and hedge funds is crucial for effective portfolio diversification and risk management. Music royalties provide a steady income stream based on intellectual property rights, while hedge funds actively manage assets using various strategies for higher returns but with increased volatility. Investors seeking predictable passive income may prefer music royalties, whereas those aiming for aggressive growth might opt for hedge funds. Investment goals and risk tolerance dictate the most suitable asset class for each individual.

Comparison Table

| Aspect | Music Royalties Investing | Hedge Funds |

|---|---|---|

| Definition | Investing in rights to earn income from music royalties | Pooling capital to invest in diverse assets using complex strategies |

| Return Profile | Steady, often passive income from copyrighted works | Variable, potentially high returns with higher volatility |

| Liquidity | Low liquidity; royalties often illiquid and long-term | Moderate liquidity; shares may be redeemed periodically |

| Risk Level | Moderate risk linked to artist popularity and consumption trends | Higher risk due to market exposure and leverage use |

| Minimum Investment | Typically lower; accessible for smaller investors | High; often requires substantial capital |

| Management | Often passive; rights managed by third parties | Active management by professional fund managers |

| Transparency | Variable; depends on deal structure and reporting | Regulated; regular performance and holdings disclosure |

Which is better?

Music royalties investing offers steady, passive income through rights ownership, often with lower volatility compared to hedge funds. Hedge funds provide diversified strategies with potential for higher returns but carry greater risk and require significant capital and active management. Choosing between the two depends on risk tolerance, investment horizon, and preference for liquidity versus consistent cash flow.

Connection

Music royalties investing offers hedge funds a unique asset class that generates predictable, long-term cash flows through royalty payments. Hedge funds leverage this stable income source to diversify portfolios and mitigate volatility associated with traditional equities and bonds. By acquiring music rights, hedge funds capitalize on the growing demand for alternative investments with non-correlated returns.

Key Terms

Leverage

Hedge funds often employ high financial leverage, using borrowed capital to amplify returns on investments, which increases both potential gains and risks in volatile markets. In contrast, music royalties investing typically involves minimal leverage, focusing on steady cash flow from intellectual property rights with lower market correlation and reduced systemic risk. Explore the nuanced leverage strategies behind hedge funds and music royalties investment to enhance your portfolio diversification.

Diversification

Hedge funds offer portfolio diversification by investing across various asset classes such as equities, bonds, and derivatives, aiming to reduce risk through complex strategies. Music royalties investing provides diversification by generating steady income streams from intellectual property rights, independent of traditional financial markets and economic cycles. Explore the unique benefits and strategies of both to enhance your investment diversification.

Passive income

Investing in hedge funds offers diversified portfolios managed by professionals aimed at high returns but often involves higher risk and less transparency. Music royalties provide a unique passive income stream through licensing payments, offering consistent cash flow tied to the entertainment industry's performance. Explore more on how these investment strategies can align with your passive income goals.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - Hedge funds are investment firms that pool capital from institutional and accredited investors to pursue alternative investment strategies aimed at outperforming the market or reducing risk, often using techniques like short selling, derivatives, and complex trades not available to traditional funds.

Hedge Funds - Hedge funds are private, unregistered investment pools that use flexible, often high-risk strategies and are generally limited to sophisticated investors, unlike mutual funds or ETFs, which are more regulated and accessible to the general public.

Hedge fund - With over $3.8 trillion in assets, hedge funds are significant players in asset management that employ complex strategies, extensive leverage, and performance-based fees--2% of assets and 20% of annual profits--while contributing to financial system risk due to interconnectedness and potential for rapid investor withdrawals during crises.

dowidth.com

dowidth.com