Fractionalized art investment allows multiple investors to own shares of high-value artworks, providing liquidity and diversification in the art market, while collectible automobile investing focuses on acquiring rare vehicles that often appreciate due to historical significance and scarcity. Both investment types offer unique opportunities to diversify portfolios with tangible assets linked to cultural and historical value. Explore the advantages and risks of these alternative investments to enhance your portfolio strategy.

Why it is important

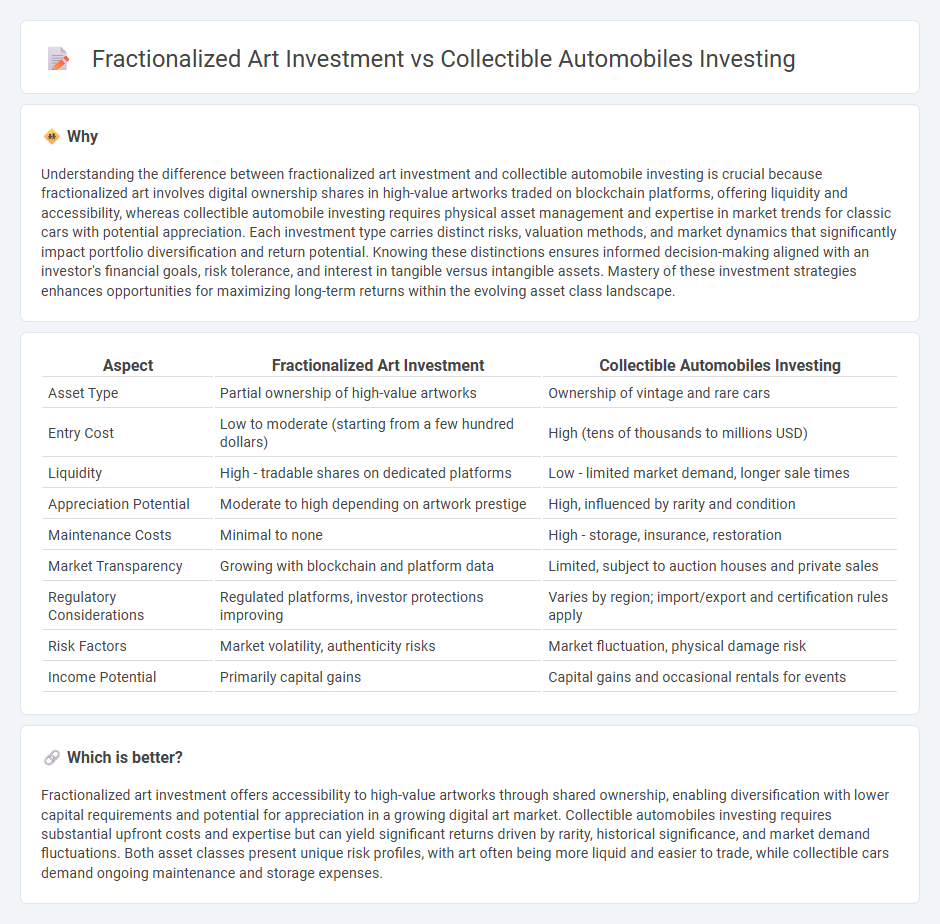

Understanding the difference between fractionalized art investment and collectible automobile investing is crucial because fractionalized art involves digital ownership shares in high-value artworks traded on blockchain platforms, offering liquidity and accessibility, whereas collectible automobile investing requires physical asset management and expertise in market trends for classic cars with potential appreciation. Each investment type carries distinct risks, valuation methods, and market dynamics that significantly impact portfolio diversification and return potential. Knowing these distinctions ensures informed decision-making aligned with an investor's financial goals, risk tolerance, and interest in tangible versus intangible assets. Mastery of these investment strategies enhances opportunities for maximizing long-term returns within the evolving asset class landscape.

Comparison Table

| Aspect | Fractionalized Art Investment | Collectible Automobiles Investing |

|---|---|---|

| Asset Type | Partial ownership of high-value artworks | Ownership of vintage and rare cars |

| Entry Cost | Low to moderate (starting from a few hundred dollars) | High (tens of thousands to millions USD) |

| Liquidity | High - tradable shares on dedicated platforms | Low - limited market demand, longer sale times |

| Appreciation Potential | Moderate to high depending on artwork prestige | High, influenced by rarity and condition |

| Maintenance Costs | Minimal to none | High - storage, insurance, restoration |

| Market Transparency | Growing with blockchain and platform data | Limited, subject to auction houses and private sales |

| Regulatory Considerations | Regulated platforms, investor protections improving | Varies by region; import/export and certification rules apply |

| Risk Factors | Market volatility, authenticity risks | Market fluctuation, physical damage risk |

| Income Potential | Primarily capital gains | Capital gains and occasional rentals for events |

Which is better?

Fractionalized art investment offers accessibility to high-value artworks through shared ownership, enabling diversification with lower capital requirements and potential for appreciation in a growing digital art market. Collectible automobiles investing requires substantial upfront costs and expertise but can yield significant returns driven by rarity, historical significance, and market demand fluctuations. Both asset classes present unique risk profiles, with art often being more liquid and easier to trade, while collectible cars demand ongoing maintenance and storage expenses.

Connection

Fractionalized art investment and collectible automobile investing are connected through the shared principle of asset tokenization, which allows multiple investors to own portions of high-value items, thereby increasing market accessibility and liquidity. Both investment types capitalize on the appreciation potential of rare, tangible assets while leveraging digital platforms to facilitate fractional ownership, enhancing portfolio diversification. This innovative approach democratizes alternative investments by reducing entry barriers and enabling broader participation in exclusive markets.

Key Terms

**Collectible automobiles investing:**

Collectible automobiles investing offers a tangible asset with historical value, often appreciating due to rarity, condition, and provenance, attracting enthusiasts and investors seeking passion combined with profit. Market trends indicate that classic cars, especially limited editions and vintage models from renowned manufacturers like Ferrari, Porsche, and Aston Martin, consistently outperform traditional investment vehicles. Explore the nuances of collectible automobile investments to discover strategies for maximizing returns and preserving value.

Provenance

Collectible automobiles investment offers tangible ownership with verifiable provenance through historical records, maintenance logs, and expert appraisals, enhancing asset authenticity. Fractionalized art investment provides shared ownership in high-value artworks, where provenance is established via blockchain technology and digital certificates, ensuring transparent transaction history. Explore the nuances of provenance verification in both markets to make informed investment decisions.

Restoration quality

Restoration quality significantly impacts the value of collectible automobiles, as meticulous craftsmanship and original parts elevate market demand and resale prices. In fractionalized art investment, the artwork's condition and provenance influence share valuation, with expert restoration enhancing desirability without compromising authenticity. Explore detailed comparisons of restoration effects on both asset classes to optimize your investment strategy.

Source and External Links

Investing in Collectible Cars - Collectible car investment is rewarding and profitable, especially with rising interest in 1980s-1990s models, digital marketplaces enhancing access, and the appeal of rare racing heritage cars as inflation hedges and future-proof electric restorations emerge.

Collectible Cars: Driving Investment Returns in Luxury Markets - Collectible cars offer stable growth and luxurious investment returns driven by rarity, provenance, and historic significance; diversification with these cars can hedge market volatility while blending passion with finance.

Collectible cars: From niche market to growth and innovation - As an asset class, collectible cars show remarkable stability and consistent double-digit annual appreciation with resilience to market downturns, making them an attractive low-risk investment alternative.

dowidth.com

dowidth.com