Fractional real estate offers individual investors the opportunity to purchase a specific share of a property, granting direct ownership rights and potential rental income. Real estate syndication pools funds from multiple investors to collectively invest in larger properties managed by a syndicator, focusing on diversified portfolios and professional oversight. Explore the nuances between these investment methods to determine which aligns best with your financial goals.

Why it is important

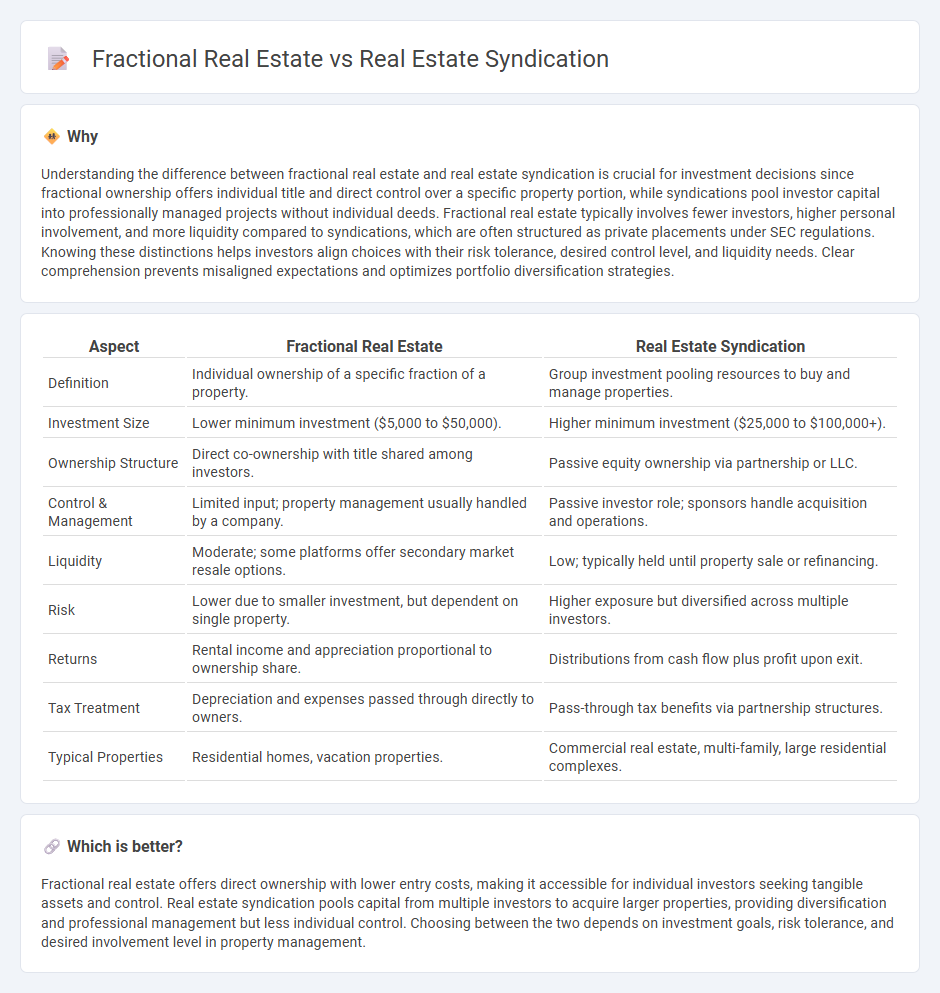

Understanding the difference between fractional real estate and real estate syndication is crucial for investment decisions since fractional ownership offers individual title and direct control over a specific property portion, while syndications pool investor capital into professionally managed projects without individual deeds. Fractional real estate typically involves fewer investors, higher personal involvement, and more liquidity compared to syndications, which are often structured as private placements under SEC regulations. Knowing these distinctions helps investors align choices with their risk tolerance, desired control level, and liquidity needs. Clear comprehension prevents misaligned expectations and optimizes portfolio diversification strategies.

Comparison Table

| Aspect | Fractional Real Estate | Real Estate Syndication |

|---|---|---|

| Definition | Individual ownership of a specific fraction of a property. | Group investment pooling resources to buy and manage properties. |

| Investment Size | Lower minimum investment ($5,000 to $50,000). | Higher minimum investment ($25,000 to $100,000+). |

| Ownership Structure | Direct co-ownership with title shared among investors. | Passive equity ownership via partnership or LLC. |

| Control & Management | Limited input; property management usually handled by a company. | Passive investor role; sponsors handle acquisition and operations. |

| Liquidity | Moderate; some platforms offer secondary market resale options. | Low; typically held until property sale or refinancing. |

| Risk | Lower due to smaller investment, but dependent on single property. | Higher exposure but diversified across multiple investors. |

| Returns | Rental income and appreciation proportional to ownership share. | Distributions from cash flow plus profit upon exit. |

| Tax Treatment | Depreciation and expenses passed through directly to owners. | Pass-through tax benefits via partnership structures. |

| Typical Properties | Residential homes, vacation properties. | Commercial real estate, multi-family, large residential complexes. |

Which is better?

Fractional real estate offers direct ownership with lower entry costs, making it accessible for individual investors seeking tangible assets and control. Real estate syndication pools capital from multiple investors to acquire larger properties, providing diversification and professional management but less individual control. Choosing between the two depends on investment goals, risk tolerance, and desired involvement level in property management.

Connection

Fractional real estate and real estate syndication both enable multiple investors to co-own properties, spreading risk and reducing individual capital requirements. Fractional real estate offers discrete ownership shares in a single property, often allowing more active investor control. Real estate syndication pools funds from numerous investors to acquire larger assets managed by syndicators, providing passive income and diversified portfolio exposure.

Key Terms

Ownership Structure

Real estate syndication involves multiple investors pooling funds to collectively own a property, with a syndicator managing operations, while fractional real estate grants individual investors direct ownership of a specific share of the property. Syndication offers indirect ownership through a limited partnership or LLC, whereas fractional ownership provides tangible title interest in the asset. Explore further to understand which ownership structure best suits your investment goals.

Liquidity

Real estate syndication pools investments from multiple investors to acquire large properties, often resulting in lower liquidity due to longer hold periods and limited secondary markets. Fractional real estate ownership offers more liquidity by allowing investors to buy and sell shares of properties on established platforms with shorter investment horizons. Explore further to understand how liquidity impacts your investment strategy in both structures.

Minimum Investment

Real estate syndication typically requires a higher minimum investment, often ranging from $25,000 to $100,000, as investors pool funds to acquire large commercial properties. Fractional real estate investment allows for much lower minimums, sometimes as low as $1,000, enabling broader access to property ownership by dividing the asset into smaller shares. Explore more to understand which investment model aligns best with your financial goals.

Source and External Links

An Introduction to Real Estate Syndication - Real estate syndication is the pooling of capital from multiple investors, led by a sponsor, to invest together in specific real estate opportunities such as commercial buildings or apartment complexes.

Real Estate Syndication - RealtyMogul - Real estate syndication involves a sponsor who finds and manages properties, and investors who contribute capital and gain ownership shares without managing the properties themselves.

Real Estate Syndications vs. REITs for Investors - SmartAsset - Real estate syndications provide direct ownership stakes by pooling funds from investors under a sponsor's management, differentiating them from REITs which offer indirect ownership through shares in real estate companies.

dowidth.com

dowidth.com