Royalty streams provide investors with ongoing revenue based on the sales or profits of a company, offering steady cash flow without equity dilution. Venture capital involves equity investment in early-stage startups, carrying higher risk but potential for significant returns through company growth or exit events. Explore the key differences between these investment strategies to determine which aligns best with your financial goals.

Why it is important

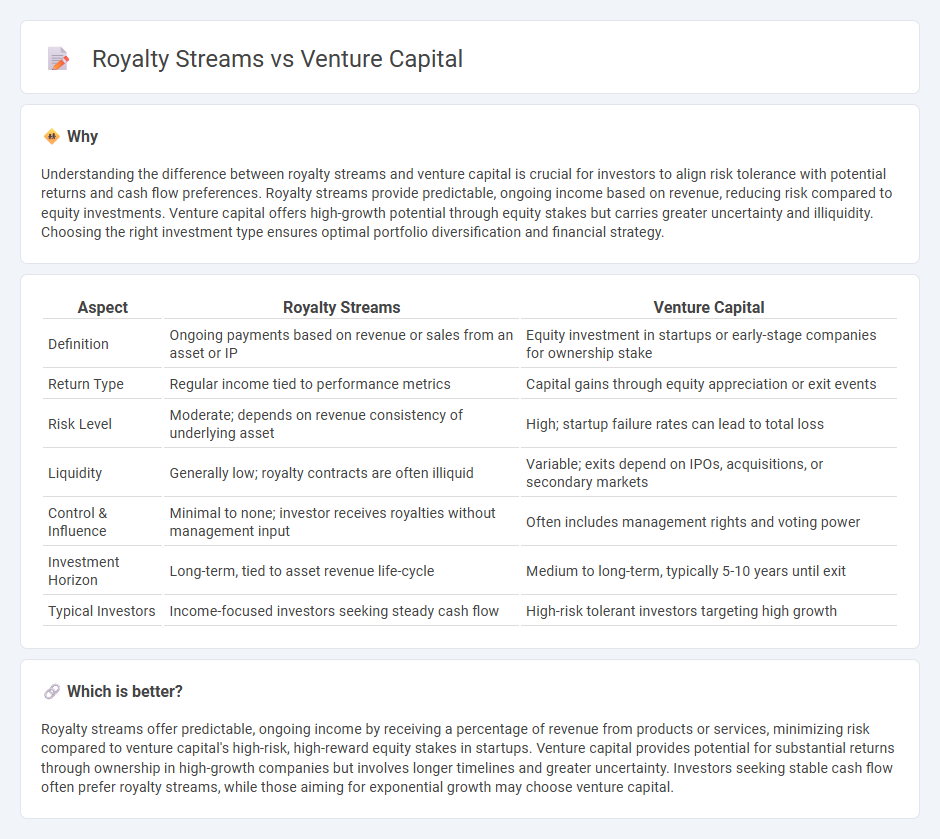

Understanding the difference between royalty streams and venture capital is crucial for investors to align risk tolerance with potential returns and cash flow preferences. Royalty streams provide predictable, ongoing income based on revenue, reducing risk compared to equity investments. Venture capital offers high-growth potential through equity stakes but carries greater uncertainty and illiquidity. Choosing the right investment type ensures optimal portfolio diversification and financial strategy.

Comparison Table

| Aspect | Royalty Streams | Venture Capital |

|---|---|---|

| Definition | Ongoing payments based on revenue or sales from an asset or IP | Equity investment in startups or early-stage companies for ownership stake |

| Return Type | Regular income tied to performance metrics | Capital gains through equity appreciation or exit events |

| Risk Level | Moderate; depends on revenue consistency of underlying asset | High; startup failure rates can lead to total loss |

| Liquidity | Generally low; royalty contracts are often illiquid | Variable; exits depend on IPOs, acquisitions, or secondary markets |

| Control & Influence | Minimal to none; investor receives royalties without management input | Often includes management rights and voting power |

| Investment Horizon | Long-term, tied to asset revenue life-cycle | Medium to long-term, typically 5-10 years until exit |

| Typical Investors | Income-focused investors seeking steady cash flow | High-risk tolerant investors targeting high growth |

Which is better?

Royalty streams offer predictable, ongoing income by receiving a percentage of revenue from products or services, minimizing risk compared to venture capital's high-risk, high-reward equity stakes in startups. Venture capital provides potential for substantial returns through ownership in high-growth companies but involves longer timelines and greater uncertainty. Investors seeking stable cash flow often prefer royalty streams, while those aiming for exponential growth may choose venture capital.

Connection

Royalty streams provide venture capital investors with a steady income derived from a percentage of a portfolio company's revenue, aligning investor returns with business performance. Venture capital firms increasingly incorporate royalty agreements to mitigate risk while maintaining growth potential in early-stage investments. This hybrid financial structure enhances capital allocation efficiency by balancing equity upside with predictable cash flows.

Key Terms

Equity Stake

Venture capital investments involve acquiring an equity stake, granting investors partial ownership and potential capital appreciation as the company grows. In contrast, royalty streams provide investors with ongoing payments based on revenue without granting any equity or ownership rights. Discover more about the advantages and risks of equity stakes versus royalty streams in funding strategies.

Recurring Revenue

Venture capital investments typically involve equity stakes with potential for high returns but come with dilution and exit pressures, whereas royalty streams provide predictable, recurring revenue tied to ongoing sales or asset performance without equity loss. Royalty streams offer steady cash flow and lower risk, making them favorable for businesses seeking sustainable income rather than rapid growth. Explore in-depth comparisons to determine which funding model aligns best with your financial strategy and business goals.

Exit Strategy

Venture capital investments typically rely on high-growth startups achieving an exit through acquisitions or IPOs to deliver significant returns. Royalty streams offer a steady income based on revenue without requiring company ownership or an exit event. Explore the nuances of both models to optimize your investment exit strategy.

Source and External Links

What is Venture Capital? - Venture capital transforms ideas into products and services, supporting high-growth companies and creating jobs.

What is Venture Capital? - Venture capital supports startups with potential for rapid growth, investing in exchange for equity with a long-term view.

Fund Your Business - Venture capital funding involves investing in high-growth companies in exchange for equity, rather than debt, with a focus on high returns.

dowidth.com

dowidth.com