Rare streetwear flipping leverages the high demand for limited-edition apparel, capitalizing on scarcity and brand hype to generate substantial profits. NFT trading involves buying and selling unique digital assets secured by blockchain technology, offering a new frontier for collectors and investors in the digital art and virtual goods markets. Explore the intricacies of both investment strategies to discover which aligns with your financial goals.

Why it is important

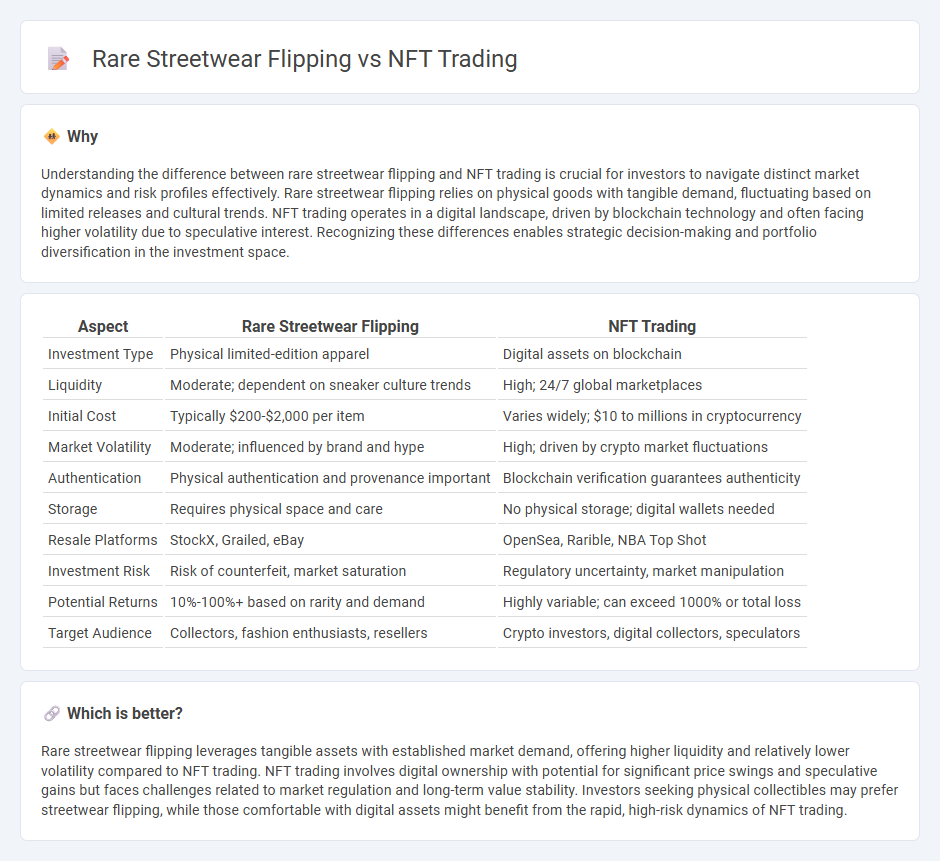

Understanding the difference between rare streetwear flipping and NFT trading is crucial for investors to navigate distinct market dynamics and risk profiles effectively. Rare streetwear flipping relies on physical goods with tangible demand, fluctuating based on limited releases and cultural trends. NFT trading operates in a digital landscape, driven by blockchain technology and often facing higher volatility due to speculative interest. Recognizing these differences enables strategic decision-making and portfolio diversification in the investment space.

Comparison Table

| Aspect | Rare Streetwear Flipping | NFT Trading |

|---|---|---|

| Investment Type | Physical limited-edition apparel | Digital assets on blockchain |

| Liquidity | Moderate; dependent on sneaker culture trends | High; 24/7 global marketplaces |

| Initial Cost | Typically $200-$2,000 per item | Varies widely; $10 to millions in cryptocurrency |

| Market Volatility | Moderate; influenced by brand and hype | High; driven by crypto market fluctuations |

| Authentication | Physical authentication and provenance important | Blockchain verification guarantees authenticity |

| Storage | Requires physical space and care | No physical storage; digital wallets needed |

| Resale Platforms | StockX, Grailed, eBay | OpenSea, Rarible, NBA Top Shot |

| Investment Risk | Risk of counterfeit, market saturation | Regulatory uncertainty, market manipulation |

| Potential Returns | 10%-100%+ based on rarity and demand | Highly variable; can exceed 1000% or total loss |

| Target Audience | Collectors, fashion enthusiasts, resellers | Crypto investors, digital collectors, speculators |

Which is better?

Rare streetwear flipping leverages tangible assets with established market demand, offering higher liquidity and relatively lower volatility compared to NFT trading. NFT trading involves digital ownership with potential for significant price swings and speculative gains but faces challenges related to market regulation and long-term value stability. Investors seeking physical collectibles may prefer streetwear flipping, while those comfortable with digital assets might benefit from the rapid, high-risk dynamics of NFT trading.

Connection

Rare streetwear flipping and NFT trading both capitalize on scarcity and cultural value to generate profit, leveraging limited-edition releases and unique digital assets to attract collectors and investors. These markets thrive on hype cycles and community engagement, driving demand and price volatility that savvy investors exploit for short-term gains. The convergence of physical and digital collectibles reveals evolving investment strategies focused on exclusivity and trend-driven asset appreciation.

Key Terms

NFT trading:

NFT trading offers a digital asset market with high liquidity and global accessibility, allowing investors to quickly buy and sell unique tokens representing art, music, or collectibles. Unlike rare streetwear flipping, which depends heavily on physical item condition and in-person authenticity checks, NFT trading leverages blockchain technology for transparent ownership and provenance verification. Explore the advantages and trends in NFT trading to maximize your digital investment strategies.

Blockchain

NFT trading leverages blockchain technology to ensure transparent ownership verification and secure transactions, offering immutable proof of authenticity for digital assets. Rare streetwear flipping benefits from blockchain through tokenized certificates of authenticity and provenance tracking, reducing counterfeit risks and enhancing trust in the secondary market. Explore how blockchain innovations are revolutionizing asset verification and trading dynamics in both NFT and streetwear markets.

Smart Contract

NFT trading leverages blockchain-based smart contracts to ensure transparent, automatic execution of transactions, eliminating intermediaries and reducing fraud risks. Rare streetwear flipping relies on physical authenticity checks and manual verification, making the process slower and more prone to counterfeits. Explore how smart contract technology revolutionizes ownership verification and trading efficiency in both markets.

Source and External Links

Magic Eden NFT Marketplace: Collect, Buy, Sell & Trade NFTs - Magic Eden is a leading NFT marketplace that supports buying, selling, and trading NFTs across multiple blockchains including Solana, Ethereum, Bitcoin, and others with advanced features like minting, analytics, and collection trait offers.

NFT.com | The Social NFT Marketplace - NFT.com offers a fee-free marketplace to buy and sell NFTs, allowing users to build and customize NFT profiles while gaining insights on NFT trends and communities.

How to Trade NFTs: Beginner's Guide 2025 - CoinLedger - NFT trading involves buying and selling NFTs on marketplaces like OpenSea and Rarible, requiring an understanding of market trends and tax implications for successful trading.

dowidth.com

dowidth.com