Sports memorabilia trading offers unique opportunities for collectors to invest in rare, appreciating items with historical and emotional value, often providing higher liquidity than traditional assets. Real estate investing involves acquiring physical properties that generate rental income and capital appreciation, supported by tangible asset value and tax advantages. Explore the advantages and risks of both investment avenues to determine the best strategy for your financial goals.

Why it is important

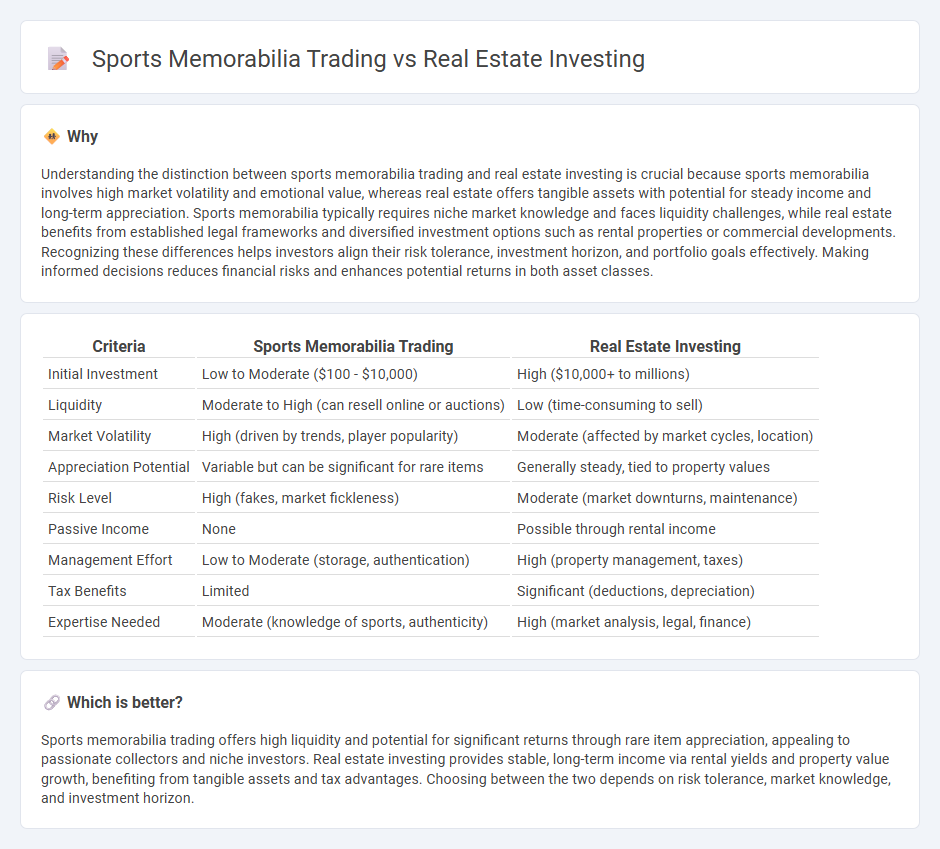

Understanding the distinction between sports memorabilia trading and real estate investing is crucial because sports memorabilia involves high market volatility and emotional value, whereas real estate offers tangible assets with potential for steady income and long-term appreciation. Sports memorabilia typically requires niche market knowledge and faces liquidity challenges, while real estate benefits from established legal frameworks and diversified investment options such as rental properties or commercial developments. Recognizing these differences helps investors align their risk tolerance, investment horizon, and portfolio goals effectively. Making informed decisions reduces financial risks and enhances potential returns in both asset classes.

Comparison Table

| Criteria | Sports Memorabilia Trading | Real Estate Investing |

|---|---|---|

| Initial Investment | Low to Moderate ($100 - $10,000) | High ($10,000+ to millions) |

| Liquidity | Moderate to High (can resell online or auctions) | Low (time-consuming to sell) |

| Market Volatility | High (driven by trends, player popularity) | Moderate (affected by market cycles, location) |

| Appreciation Potential | Variable but can be significant for rare items | Generally steady, tied to property values |

| Risk Level | High (fakes, market fickleness) | Moderate (market downturns, maintenance) |

| Passive Income | None | Possible through rental income |

| Management Effort | Low to Moderate (storage, authentication) | High (property management, taxes) |

| Tax Benefits | Limited | Significant (deductions, depreciation) |

| Expertise Needed | Moderate (knowledge of sports, authenticity) | High (market analysis, legal, finance) |

Which is better?

Sports memorabilia trading offers high liquidity and potential for significant returns through rare item appreciation, appealing to passionate collectors and niche investors. Real estate investing provides stable, long-term income via rental yields and property value growth, benefiting from tangible assets and tax advantages. Choosing between the two depends on risk tolerance, market knowledge, and investment horizon.

Connection

Sports memorabilia trading and real estate investing both capitalize on market trends and asset appreciation to generate returns. Collectors and investors analyze demand, rarity, and location-based value fluctuations to maximize profits in each field. Both markets require strategic timing and extensive knowledge of asset valuation to succeed.

Key Terms

**Real estate investing:**

Real estate investing offers tangible assets with potential for passive income through rental properties and long-term capital appreciation, making it a stable and scalable investment strategy. Market trends indicate steady growth in property values across major urban areas, supported by demographic shifts and economic development. Explore detailed insights to understand how real estate can diversify your investment portfolio effectively.

Property valuation

Property valuation in real estate investing relies on factors such as location, market trends, and property condition to determine asset worth, offering long-term appreciation and rental income potential. Sports memorabilia trading depends on rarity, authenticity, and athlete significance, often resulting in volatile pricing influenced by fan demand and market hype. Explore deeper insights into how property valuation strategies enhance investment decisions for both sectors.

Cash flow

Real estate investing generates consistent cash flow through rental income and property appreciation, offering long-term financial stability and tax advantages. Sports memorabilia trading provides cash flow via buying low and selling high, but it carries higher market volatility and liquidity risks. Explore deeper insights into cash flow strategies for both to optimize your investment portfolio.

Source and External Links

Real Estate Investing: 5 Ways to Get Started - Real estate investing can be approached through REITs, online platforms, rental properties, flipping homes, or renting, with REITs offering dividend income through shares in commercial properties.

Arrived | Easily Invest in Real Estate - Arrived provides an accessible platform to invest in rental properties starting at $100, offering passive income and property appreciation while handling property management for investors.

Real Estate Investing for Beginners: 5 Skills of Successful Investors - Real estate is the world's largest asset class with various property types--residential, commercial, and land--each requiring knowledge of zoning and investment skills to succeed.

dowidth.com

dowidth.com