Livestock investment platforms allow investors to directly finance animal farming, generating returns through the sale of livestock products, while venture capital platforms focus on funding startups and innovative businesses with high growth potential. These platforms differ in risk profiles, investment horizons, and asset types, with livestock investments often providing tangible assets and steady income streams. Explore the advantages and challenges of both to determine the best fit for your investment goals.

Why it is important

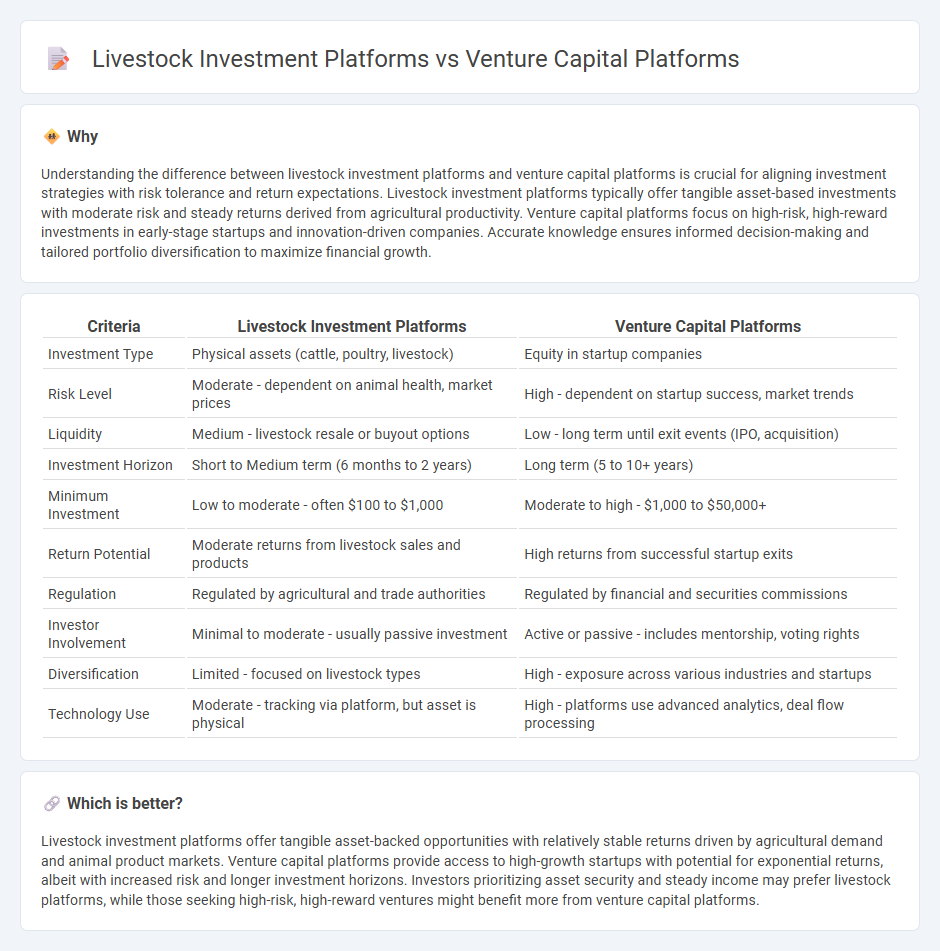

Understanding the difference between livestock investment platforms and venture capital platforms is crucial for aligning investment strategies with risk tolerance and return expectations. Livestock investment platforms typically offer tangible asset-based investments with moderate risk and steady returns derived from agricultural productivity. Venture capital platforms focus on high-risk, high-reward investments in early-stage startups and innovation-driven companies. Accurate knowledge ensures informed decision-making and tailored portfolio diversification to maximize financial growth.

Comparison Table

| Criteria | Livestock Investment Platforms | Venture Capital Platforms |

|---|---|---|

| Investment Type | Physical assets (cattle, poultry, livestock) | Equity in startup companies |

| Risk Level | Moderate - dependent on animal health, market prices | High - dependent on startup success, market trends |

| Liquidity | Medium - livestock resale or buyout options | Low - long term until exit events (IPO, acquisition) |

| Investment Horizon | Short to Medium term (6 months to 2 years) | Long term (5 to 10+ years) |

| Minimum Investment | Low to moderate - often $100 to $1,000 | Moderate to high - $1,000 to $50,000+ |

| Return Potential | Moderate returns from livestock sales and products | High returns from successful startup exits |

| Regulation | Regulated by agricultural and trade authorities | Regulated by financial and securities commissions |

| Investor Involvement | Minimal to moderate - usually passive investment | Active or passive - includes mentorship, voting rights |

| Diversification | Limited - focused on livestock types | High - exposure across various industries and startups |

| Technology Use | Moderate - tracking via platform, but asset is physical | High - platforms use advanced analytics, deal flow processing |

Which is better?

Livestock investment platforms offer tangible asset-backed opportunities with relatively stable returns driven by agricultural demand and animal product markets. Venture capital platforms provide access to high-growth startups with potential for exponential returns, albeit with increased risk and longer investment horizons. Investors prioritizing asset security and steady income may prefer livestock platforms, while those seeking high-risk, high-reward ventures might benefit more from venture capital platforms.

Connection

Livestock investment platforms and venture capital platforms intersect through technology-driven financing models that channel capital into agricultural innovations and scalable livestock businesses. Venture capital firms often invest in livestock tech startups via digital platforms that facilitate crowdfunding and equity investments, accelerating sector growth. This synergy enhances access to capital, improves livestock management technologies, and drives sustainable agricultural development.

Key Terms

**Venture Capital Platforms:**

Venture capital platforms facilitate funding for innovative startups by connecting investors with high-growth potential companies, leveraging data-driven evaluation tools to minimize risk and maximize returns. These platforms often provide diversified portfolios, access to exclusive deals, and streamlined investment processes tailored for accredited investors. Explore how venture capital platforms can enhance your investment strategy and open doors to emerging market opportunities.

Equity

Venture capital platforms primarily focus on equity investments in high-growth startups, offering investors partial ownership and potential for substantial returns through capital appreciation. In contrast, livestock investment platforms often involve equity in agricultural enterprises or direct livestock ownership, providing dividends from operational profits and asset value. Explore further to understand the risks and benefits of equity-based investments in these distinct sectors.

Startups

Venture capital platforms specialize in funding startups across various sectors by providing equity investments and strategic guidance to accelerate growth and innovation. Livestock investment platforms enable investors to participate in agriculture by financing livestock farming projects, offering a tangible asset-backed opportunity that carries different risk profiles compared to tech-centric startups. Explore the evolving dynamics and benefits of these investment avenues for informed decision-making.

Source and External Links

The Best Venture Capital Platform Tools for 2024 - Venture capital platforms like Carta and Proven optimize investment management by offering real-time portfolio tracking, vendor management, and cap table simplification to enhance decision-making and transparency in VC firms.

OpenVC - Raise from 5,000+ investors. For free. - OpenVC is a free platform designed for early-stage startups to efficiently find and pitch vetted investors without intro fees, supporting fundraising from pre-seed to Series A rounds.

AngelList - Build, Lead, Invest - AngelList provides comprehensive tools for venture funds to raise capital, manage portfolios, and launch scout programs, serving as a major infrastructure supporting the startup economy and venture investing.

dowidth.com

dowidth.com