Whisky cask investment offers unique asset appreciation driven by aging processes and rarity, appealing to collectors and connoisseurs seeking alternative investments. Timberland investment provides sustainable value through timber growth, carbon credits, and land appreciation, appealing to those interested in natural resource assets and environmental impact. Explore the distinct benefits and risks of whisky cask versus timberland investment to identify the right portfolio fit.

Why it is important

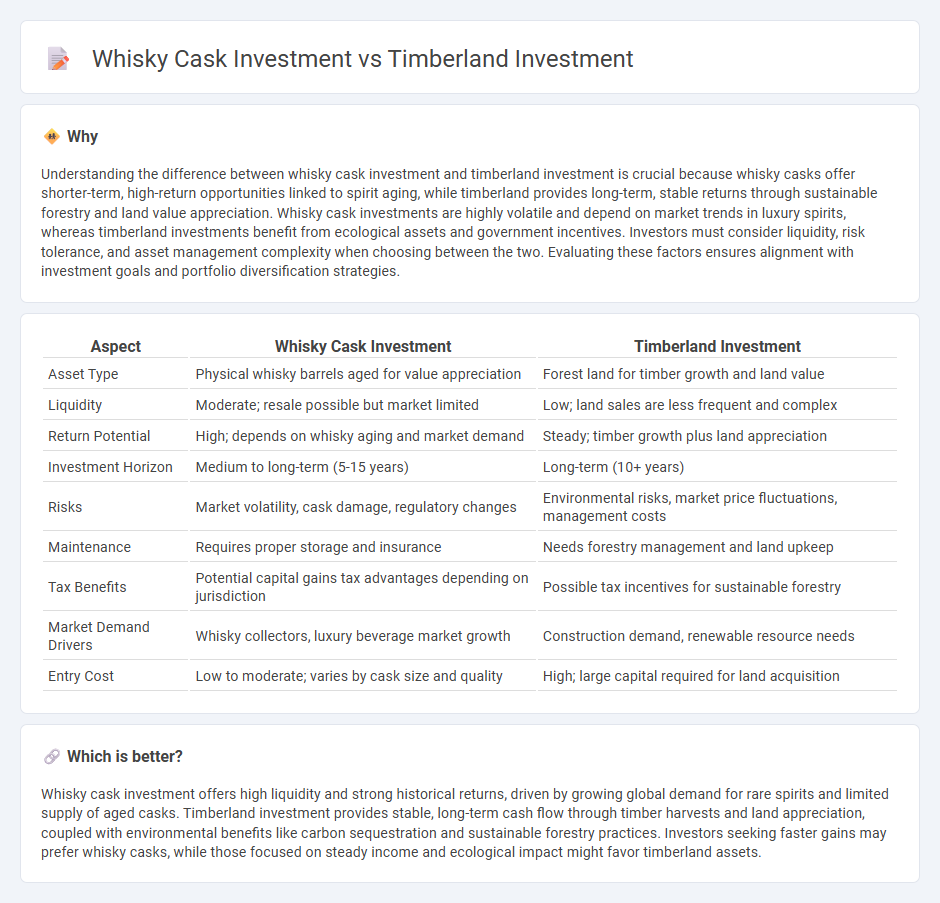

Understanding the difference between whisky cask investment and timberland investment is crucial because whisky casks offer shorter-term, high-return opportunities linked to spirit aging, while timberland provides long-term, stable returns through sustainable forestry and land value appreciation. Whisky cask investments are highly volatile and depend on market trends in luxury spirits, whereas timberland investments benefit from ecological assets and government incentives. Investors must consider liquidity, risk tolerance, and asset management complexity when choosing between the two. Evaluating these factors ensures alignment with investment goals and portfolio diversification strategies.

Comparison Table

| Aspect | Whisky Cask Investment | Timberland Investment |

|---|---|---|

| Asset Type | Physical whisky barrels aged for value appreciation | Forest land for timber growth and land value |

| Liquidity | Moderate; resale possible but market limited | Low; land sales are less frequent and complex |

| Return Potential | High; depends on whisky aging and market demand | Steady; timber growth plus land appreciation |

| Investment Horizon | Medium to long-term (5-15 years) | Long-term (10+ years) |

| Risks | Market volatility, cask damage, regulatory changes | Environmental risks, market price fluctuations, management costs |

| Maintenance | Requires proper storage and insurance | Needs forestry management and land upkeep |

| Tax Benefits | Potential capital gains tax advantages depending on jurisdiction | Possible tax incentives for sustainable forestry |

| Market Demand Drivers | Whisky collectors, luxury beverage market growth | Construction demand, renewable resource needs |

| Entry Cost | Low to moderate; varies by cask size and quality | High; large capital required for land acquisition |

Which is better?

Whisky cask investment offers high liquidity and strong historical returns, driven by growing global demand for rare spirits and limited supply of aged casks. Timberland investment provides stable, long-term cash flow through timber harvests and land appreciation, coupled with environmental benefits like carbon sequestration and sustainable forestry practices. Investors seeking faster gains may prefer whisky casks, while those focused on steady income and ecological impact might favor timberland assets.

Connection

Whisky cask investment and timberland investment are interconnected through their reliance on natural resource appreciation and long-term value growth. Both assets benefit from the scarcity and maturation processes that enhance their worth over time, with whisky casks aging to develop unique flavors while timberland appreciates with forest growth and sustainable management. These investments provide diversification by linking tangible assets tied to environmental resources and collectible commodities.

Key Terms

Asset Liquidity

Timberland investments typically offer moderate liquidity through land sales or timber harvests but often require longer holding periods due to market cycles and transaction complexities. Whisky cask investments provide higher liquidity potential via secondary markets for casks and bottled whisky, allowing quicker asset conversion compared to timberland. Explore detailed comparisons to determine the best asset liquidity fit for your investment goals.

Maturation/Harvest Period

Timberland investment typically involves a maturation period spanning 20 to 30 years, reflecting the slow growth cycle of quality hardwoods, while whisky cask investment matures over a shorter span of 3 to 12 years, depending on the whisky type and cask conditions. Timber generates value through biological growth and sustainable harvesting cycles, offering long-term capital appreciation and carbon credit opportunities. Explore the intricacies of both asset classes to determine which maturation timeline aligns best with your investment strategy.

Market Valuation

Timberland investment offers stable market valuation driven by sustainable timber demand, with asset prices influenced by forest growth cycles and eco-conscious trends, while whisky cask investment fluctuates based on rarity, brand prestige, and aging process, often yielding higher short-term returns but with increased market volatility. The timber industry benefits from consistent global demand for wood products and carbon credit opportunities, whereas whisky cask markets are niche, leveraging collector interest and limited supply. Explore comprehensive market analyses to determine which alternative asset aligns best with your investment goals.

Source and External Links

Timberland | Institutional - Manulife Investment Management - Timberland investments offer portfolio diversification, potential inflation protection, and environmental benefits such as carbon sequestration, driven by sustainable management and growing global timber demand.

Timberland - Overview, How to Diversify, Benefits of Investing - Timberland investment involves funding managed tree plantations or natural forests, providing steady growth and diversification, with significant institutional involvement like pension funds and university endowments.

Timberland - J.P. Morgan Asset Management - Investing in timberland can protect against inflation risk, generate regular income from timber sales, and enhance portfolio diversification, while supporting sustainability through carbon sequestration and biodiversity.

dowidth.com

dowidth.com