Collectibles investment involves acquiring rare or valuable items such as art, coins, or vintage wines that appreciate based on scarcity and demand, often providing portfolio diversification and potential long-term gains. Infrastructure investment focuses on funding large-scale public systems and services like transportation, energy, and utilities, offering steady cash flows and lower risk through government or institutional backing. Explore more to understand the unique benefits and risks of each investment type.

Why it is important

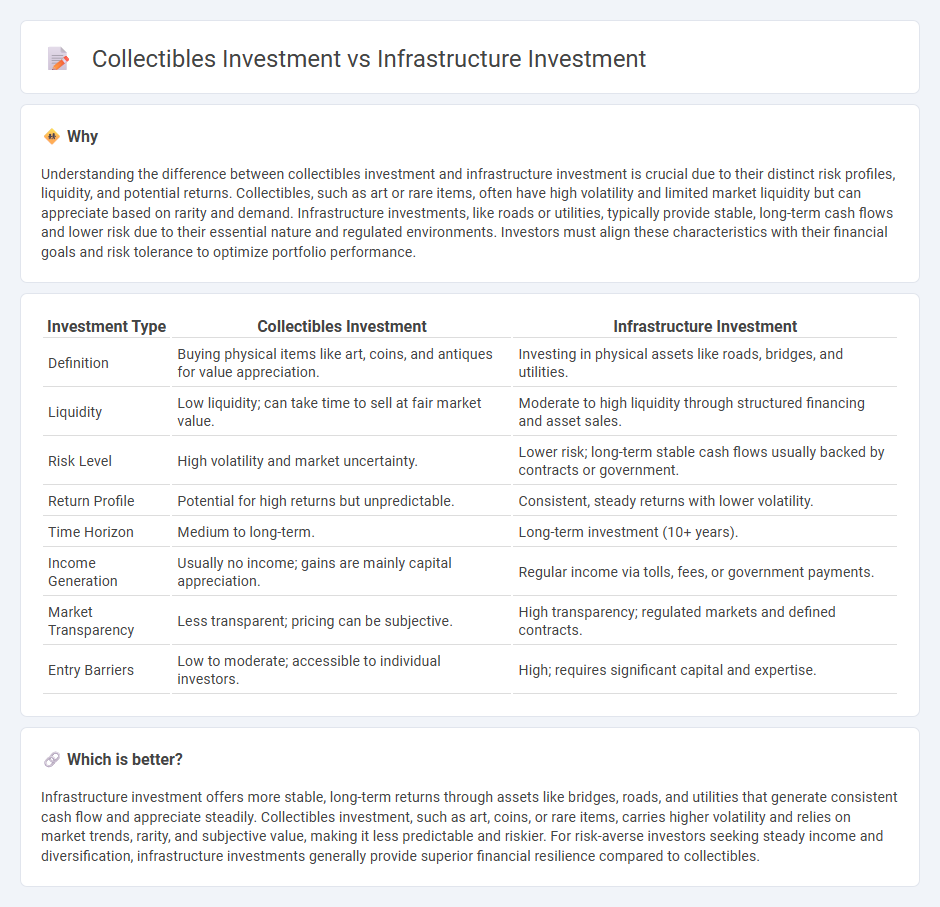

Understanding the difference between collectibles investment and infrastructure investment is crucial due to their distinct risk profiles, liquidity, and potential returns. Collectibles, such as art or rare items, often have high volatility and limited market liquidity but can appreciate based on rarity and demand. Infrastructure investments, like roads or utilities, typically provide stable, long-term cash flows and lower risk due to their essential nature and regulated environments. Investors must align these characteristics with their financial goals and risk tolerance to optimize portfolio performance.

Comparison Table

| Investment Type | Collectibles Investment | Infrastructure Investment |

|---|---|---|

| Definition | Buying physical items like art, coins, and antiques for value appreciation. | Investing in physical assets like roads, bridges, and utilities. |

| Liquidity | Low liquidity; can take time to sell at fair market value. | Moderate to high liquidity through structured financing and asset sales. |

| Risk Level | High volatility and market uncertainty. | Lower risk; long-term stable cash flows usually backed by contracts or government. |

| Return Profile | Potential for high returns but unpredictable. | Consistent, steady returns with lower volatility. |

| Time Horizon | Medium to long-term. | Long-term investment (10+ years). |

| Income Generation | Usually no income; gains are mainly capital appreciation. | Regular income via tolls, fees, or government payments. |

| Market Transparency | Less transparent; pricing can be subjective. | High transparency; regulated markets and defined contracts. |

| Entry Barriers | Low to moderate; accessible to individual investors. | High; requires significant capital and expertise. |

Which is better?

Infrastructure investment offers more stable, long-term returns through assets like bridges, roads, and utilities that generate consistent cash flow and appreciate steadily. Collectibles investment, such as art, coins, or rare items, carries higher volatility and relies on market trends, rarity, and subjective value, making it less predictable and riskier. For risk-averse investors seeking steady income and diversification, infrastructure investments generally provide superior financial resilience compared to collectibles.

Connection

Collectibles investment and infrastructure investment intersect through their long-term value appreciation and diversification benefits in a balanced portfolio. Both asset classes can hedge against inflation, as tangible assets like art, antiques, and physical infrastructure projects gain value when currency declines. Infrastructure investments often provide stable cash flows similar to rental income derived from certain high-demand collectibles, creating complementary streams of financial returns.

Key Terms

Infrastructure Investment:

Infrastructure investment involves allocating capital to physical assets such as transportation networks, utilities, and energy facilities that provide essential services and generate stable, long-term cash flows. This type of investment offers inflation protection, steady income through dividends or toll revenues, and contributes to economic growth by improving public systems. Explore the benefits and risks of infrastructure investment to make informed financial decisions.

Public-Private Partnership (PPP)

Infrastructure investment through Public-Private Partnerships (PPP) involves long-term commitments to projects like highways, airports, and utilities, offering steady returns tied to economic growth and public usage fees. In contrast, collectibles investment, such as art or rare coins, relies heavily on market demand, rarity, and aesthetic value, often exhibiting higher volatility and illiquidity. Explore how PPPs can provide a stable, impact-driven investment alternative compared to the speculative nature of collectibles.

Yield

Infrastructure investments typically offer stable, long-term yields derived from assets such as toll roads, energy facilities, and utilities, providing predictable cash flows often indexed to inflation. Collectibles, including art, coins, and rare wines, yield returns primarily through market appreciation, which can be volatile and less predictable compared to infrastructure assets. Explore more about the yield dynamics and risk profiles between infrastructure and collectibles investments.

Source and External Links

Investment Pays | Infrastructure Investment & Impact | ASCE - The 2025 Report Card estimates that $9.1 trillion is needed over the next decade to maintain and upgrade America's infrastructure across categories like roads, bridges, energy, and water, with a current funding gap of about $3.7 trillion.

The basics of infrastructure investing | abrdn - Infrastructure investment is driven by themes like energy transition, demographic shifts, and urbanisation, involving projects in renewable energy, transport networks, and digital infrastructure to meet changing societal needs.

Infrastructure investment | OECD - Infrastructure investment includes spending on construction and improvement of transport networks, which is vital for economic performance, market accessibility, job creation, and regional development, measured as a share of GDP.

dowidth.com

dowidth.com