Litigation finance involves funding legal cases in exchange for a portion of the settlement, offering investors alternative asset exposure with potential high returns and risks linked to courtroom outcomes. Mutual funds pool capital from multiple investors to invest in diversified portfolios of stocks, bonds, or other securities, providing regulated, liquid investment options with managed risk. Explore the key differences between litigation finance and mutual funds to determine which aligns best with your investment strategy.

Why it is important

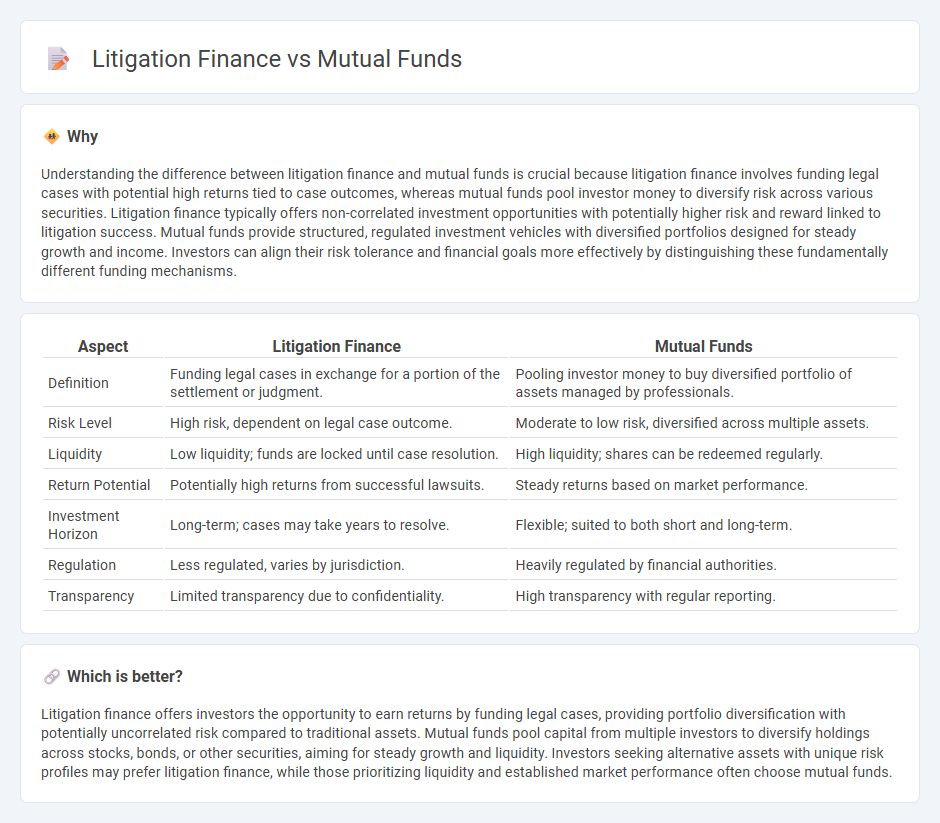

Understanding the difference between litigation finance and mutual funds is crucial because litigation finance involves funding legal cases with potential high returns tied to case outcomes, whereas mutual funds pool investor money to diversify risk across various securities. Litigation finance typically offers non-correlated investment opportunities with potentially higher risk and reward linked to litigation success. Mutual funds provide structured, regulated investment vehicles with diversified portfolios designed for steady growth and income. Investors can align their risk tolerance and financial goals more effectively by distinguishing these fundamentally different funding mechanisms.

Comparison Table

| Aspect | Litigation Finance | Mutual Funds |

|---|---|---|

| Definition | Funding legal cases in exchange for a portion of the settlement or judgment. | Pooling investor money to buy diversified portfolio of assets managed by professionals. |

| Risk Level | High risk, dependent on legal case outcome. | Moderate to low risk, diversified across multiple assets. |

| Liquidity | Low liquidity; funds are locked until case resolution. | High liquidity; shares can be redeemed regularly. |

| Return Potential | Potentially high returns from successful lawsuits. | Steady returns based on market performance. |

| Investment Horizon | Long-term; cases may take years to resolve. | Flexible; suited to both short and long-term. |

| Regulation | Less regulated, varies by jurisdiction. | Heavily regulated by financial authorities. |

| Transparency | Limited transparency due to confidentiality. | High transparency with regular reporting. |

Which is better?

Litigation finance offers investors the opportunity to earn returns by funding legal cases, providing portfolio diversification with potentially uncorrelated risk compared to traditional assets. Mutual funds pool capital from multiple investors to diversify holdings across stocks, bonds, or other securities, aiming for steady growth and liquidity. Investors seeking alternative assets with unique risk profiles may prefer litigation finance, while those prioritizing liquidity and established market performance often choose mutual funds.

Connection

Litigation finance and mutual funds connect through diversified investment strategies targeting alternative asset classes for risk-adjusted returns. Mutual funds increasingly allocate capital to litigation finance vehicles, capitalizing on non-correlated cash flows from legal cases to enhance portfolio diversification. The integration of litigation finance in mutual funds offers investors exposure to the growing legal finance market while managing investment risk.

Key Terms

Diversification

Mutual funds provide diversification by pooling investments across a broad range of assets, reducing risk through exposure to various sectors and industries. Litigation finance diversifies portfolios by including non-correlated legal claims as alternative investments, offering potential returns independent of traditional market fluctuations. Explore the benefits of incorporating both strategies to enhance your investment diversification.

Risk-return profile

Mutual funds typically offer diversified portfolios with moderate risk and steady returns, making them suitable for investors seeking balanced growth and income. Litigation finance involves higher risk due to legal uncertainties but can yield substantial returns if cases succeed, attracting investors with a higher risk tolerance. Explore detailed analyses to understand which investment aligns best with your financial goals and risk appetite.

Liquidity

Mutual funds offer high liquidity with daily redemption options, allowing investors to access their money quickly, while litigation finance typically involves longer lock-in periods until case resolutions generate returns. Mutual funds invest in diversified portfolios of tradable securities, ensuring consistent market-driven liquidity, whereas litigation finance ties capital to legal claim outcomes, making liquidity unpredictable and less frequent. Explore how liquidity characteristics impact investment choices in these two distinct asset classes for optimized portfolio strategy.

Source and External Links

Mutual Funds | Investor.gov - A mutual fund is an SEC-registered open-end investment company pooling money from many investors to invest in diversified portfolios of stocks, bonds, and other securities, managed professionally with features like diversification, liquidity, and low minimum investment requirements.

Mutual fund - Wikipedia - Mutual funds pool money from many investors to purchase securities and are broadly classified by investment type; they provide advantages such as economies of scale, diversification, liquidity, and are regulated to disclose fees and performance.

Understanding mutual funds - Charles Schwab - Mutual funds offer affordable portfolio diversification by pooling money to invest in various assets managed by professional managers, providing exposure to wide asset classes and various investment styles with low costs and convenience.

dowidth.com

dowidth.com