Alternative data analytics leverages non-traditional sources such as social media activity, satellite imagery, and web traffic to provide unique insights for investment decisions. Credit card transaction data, a subset of alternative data, offers real-time consumer spending patterns that help predict market trends and company performance with high accuracy. Explore in-depth how these data types transform investment strategies and enhance predictive power.

Why it is important

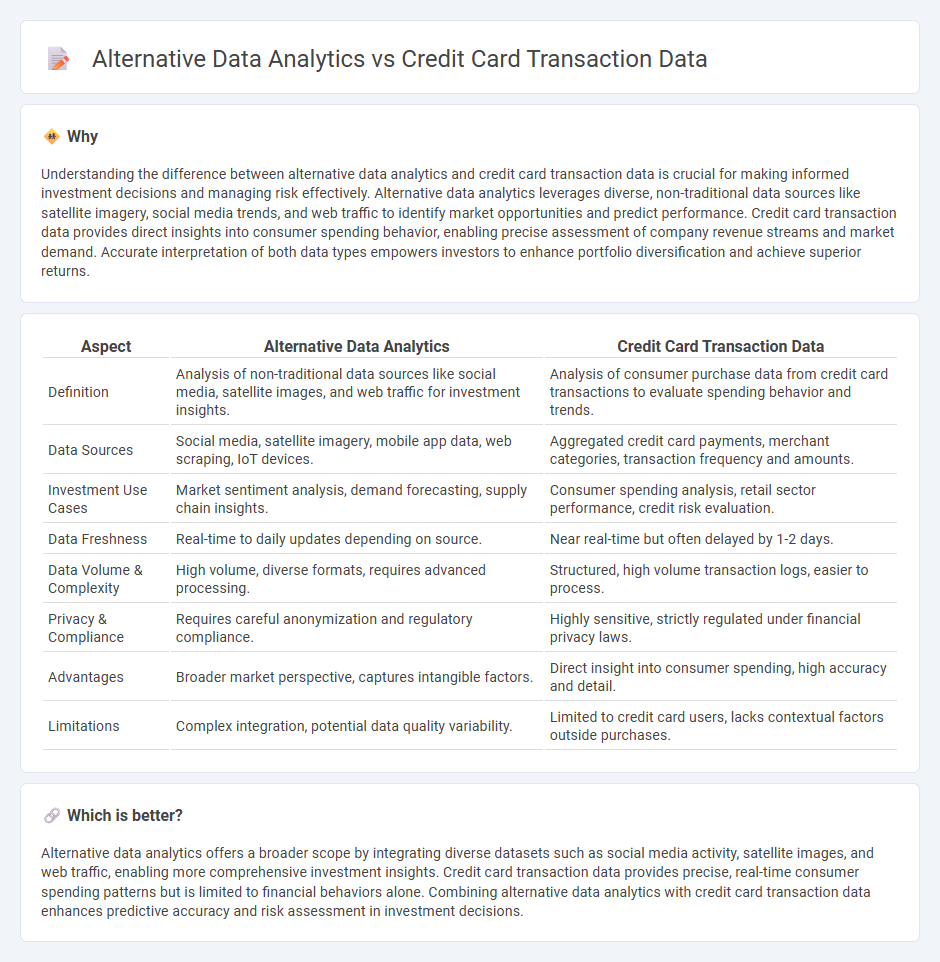

Understanding the difference between alternative data analytics and credit card transaction data is crucial for making informed investment decisions and managing risk effectively. Alternative data analytics leverages diverse, non-traditional data sources like satellite imagery, social media trends, and web traffic to identify market opportunities and predict performance. Credit card transaction data provides direct insights into consumer spending behavior, enabling precise assessment of company revenue streams and market demand. Accurate interpretation of both data types empowers investors to enhance portfolio diversification and achieve superior returns.

Comparison Table

| Aspect | Alternative Data Analytics | Credit Card Transaction Data |

|---|---|---|

| Definition | Analysis of non-traditional data sources like social media, satellite images, and web traffic for investment insights. | Analysis of consumer purchase data from credit card transactions to evaluate spending behavior and trends. |

| Data Sources | Social media, satellite imagery, mobile app data, web scraping, IoT devices. | Aggregated credit card payments, merchant categories, transaction frequency and amounts. |

| Investment Use Cases | Market sentiment analysis, demand forecasting, supply chain insights. | Consumer spending analysis, retail sector performance, credit risk evaluation. |

| Data Freshness | Real-time to daily updates depending on source. | Near real-time but often delayed by 1-2 days. |

| Data Volume & Complexity | High volume, diverse formats, requires advanced processing. | Structured, high volume transaction logs, easier to process. |

| Privacy & Compliance | Requires careful anonymization and regulatory compliance. | Highly sensitive, strictly regulated under financial privacy laws. |

| Advantages | Broader market perspective, captures intangible factors. | Direct insight into consumer spending, high accuracy and detail. |

| Limitations | Complex integration, potential data quality variability. | Limited to credit card users, lacks contextual factors outside purchases. |

Which is better?

Alternative data analytics offers a broader scope by integrating diverse datasets such as social media activity, satellite images, and web traffic, enabling more comprehensive investment insights. Credit card transaction data provides precise, real-time consumer spending patterns but is limited to financial behaviors alone. Combining alternative data analytics with credit card transaction data enhances predictive accuracy and risk assessment in investment decisions.

Connection

Alternative data analytics leverages credit card transaction data to gain deeper insights into consumer behavior, spending patterns, and creditworthiness beyond traditional financial metrics. This connection enables investors to assess real-time economic activity, identify emerging market trends, and enhance risk assessment models for more informed investment decisions. Utilizing such non-traditional data sources improves predictive accuracy and uncovers hidden opportunities in financial markets.

Key Terms

Transaction Categorization

Credit card transaction data offers precise financial insights by categorizing purchases into detailed segments such as retail, travel, and dining, enabling accurate spending analysis. Alternative data analytics expands this categorization by integrating unconventional sources like social media activity, geolocation data, and online behavior to provide a more comprehensive view of consumer habits. Explore the nuances of transaction categorization to enhance predictive modeling and risk assessment accuracy.

Behavioral Scoring

Credit card transaction data offers precise insights into consumer spending patterns and financial behavior, enabling accurate risk assessment through traditional credit scoring methods. Alternative data analytics, including social media activity, utility payments, and mobile phone usage, enhance behavioral scoring by capturing broader lifestyle and consumption habits for underserved or thin-file borrowers. Explore how integrating credit card transaction data with alternative data can revolutionize behavioral scoring models for more inclusive credit decisions.

Data Enrichment

Credit card transaction data provides detailed insights into consumer spending patterns, offering accurate and real-time financial behaviors essential for risk assessment and personalized marketing. Alternative data analytics, including social media activity and utility payments, enhances traditional datasets by incorporating broader behavioral and demographic indicators for improved credit scoring and customer profiling. Discover how integrating these data sources through advanced enrichment techniques can optimize decision-making and unlock actionable business intelligence.

Source and External Links

Credit Card Transactions Dataset - Kaggle - This dataset contains over 1.85 million anonymized records, including transaction times, amounts, merchant details, user demographics, and more, suitable for fraud detection, customer segmentation, and behavioral analysis.

Credit card transaction data - Techsalerator - Credit card transaction data includes the date, time, merchant, amount, and other details collected by financial institutions and processors, used for analyzing spending, fraud detection, and market research.

Card Transaction Data - Wikipedia - Card transaction data is financial information recorded during fund transfers between cardholders and merchants, with different levels (1-3) indicating the detail of data captured, such as basic transaction info, tax details, or even line-item product descriptions.

dowidth.com

dowidth.com