Virtual land real estate offers a unique investment opportunity in digital environments, representing tangible assets within metaverse platforms that can appreciate based on location and demand. Stocks provide ownership stakes in companies, with returns driven by corporate performance and market trends, offering liquidity and dividend potential. Explore how these contrasting asset classes can diversify your investment portfolio.

Why it is important

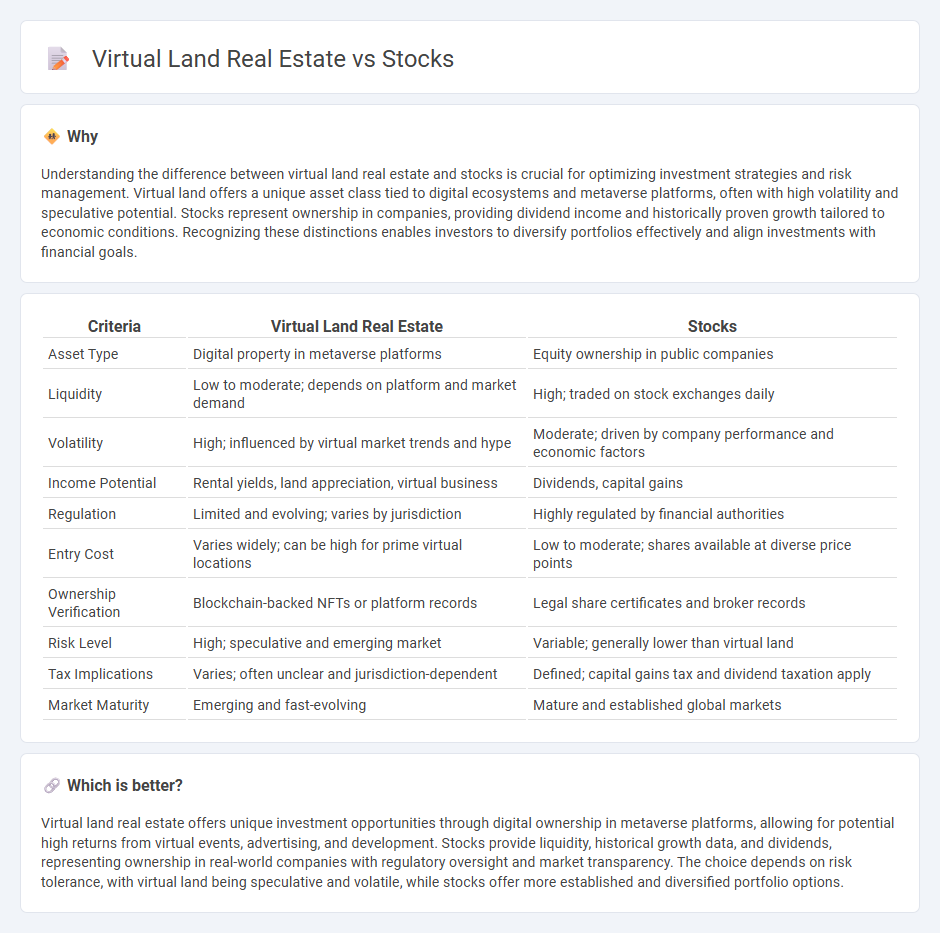

Understanding the difference between virtual land real estate and stocks is crucial for optimizing investment strategies and risk management. Virtual land offers a unique asset class tied to digital ecosystems and metaverse platforms, often with high volatility and speculative potential. Stocks represent ownership in companies, providing dividend income and historically proven growth tailored to economic conditions. Recognizing these distinctions enables investors to diversify portfolios effectively and align investments with financial goals.

Comparison Table

| Criteria | Virtual Land Real Estate | Stocks |

|---|---|---|

| Asset Type | Digital property in metaverse platforms | Equity ownership in public companies |

| Liquidity | Low to moderate; depends on platform and market demand | High; traded on stock exchanges daily |

| Volatility | High; influenced by virtual market trends and hype | Moderate; driven by company performance and economic factors |

| Income Potential | Rental yields, land appreciation, virtual business | Dividends, capital gains |

| Regulation | Limited and evolving; varies by jurisdiction | Highly regulated by financial authorities |

| Entry Cost | Varies widely; can be high for prime virtual locations | Low to moderate; shares available at diverse price points |

| Ownership Verification | Blockchain-backed NFTs or platform records | Legal share certificates and broker records |

| Risk Level | High; speculative and emerging market | Variable; generally lower than virtual land |

| Tax Implications | Varies; often unclear and jurisdiction-dependent | Defined; capital gains tax and dividend taxation apply |

| Market Maturity | Emerging and fast-evolving | Mature and established global markets |

Which is better?

Virtual land real estate offers unique investment opportunities through digital ownership in metaverse platforms, allowing for potential high returns from virtual events, advertising, and development. Stocks provide liquidity, historical growth data, and dividends, representing ownership in real-world companies with regulatory oversight and market transparency. The choice depends on risk tolerance, with virtual land being speculative and volatile, while stocks offer more established and diversified portfolio options.

Connection

Virtual land real estate and stocks share a common foundation in investment strategies centered on asset appreciation and market-driven value. Both markets rely on supply and demand dynamics, investor sentiment, and technological advancements to influence price fluctuations and portfolio diversification. Virtual land in metaverses and publicly traded stocks offer liquidity options and potential passive income through leasing or dividends, attracting investors seeking growth and innovation.

Key Terms

Ownership

Stocks represent fractional ownership in publicly traded companies, allowing investors to hold shares and benefit from company profits through dividends and stock price appreciation. Virtual land real estate provides exclusive ownership of digital parcels within metaverse platforms, granting rights to develop, monetize, and trade virtual properties. Explore the nuances of ownership rights and investment potential in both markets to make informed decisions.

Liquidity

Stocks offer high liquidity, enabling investors to buy and sell shares quickly through established exchanges like the NYSE or NASDAQ, often within seconds. Virtual land real estate, traded on blockchain platforms such as Decentraland or The Sandbox, generally experiences lower liquidity due to a smaller market and fewer buyers. Explore the dynamics of liquidity in digital and traditional asset markets to make informed investment decisions.

Volatility

Stocks typically exhibit higher volatility due to market fluctuations influenced by economic indicators, corporate earnings, and geopolitical events, often resulting in rapid price changes. Virtual land real estate, trading within blockchain-based platforms, may experience volatility driven by market demand, platform popularity, and speculative interest but tends to have less frequent price swings compared to traditional stocks. Explore the nuances of volatility between these asset classes to better understand risk and investment strategy.

Source and External Links

Stocks - Stocks represent ownership shares in a company, with types including common stock (voting rights and possible dividends) and preferred stock (priority dividends but usually no voting rights), and can be classified by growth potential, dividend income, value, company size, or market capitalization.

What are stocks? - Stocks offer partial ownership and a claim on company earnings and assets, traded mainly on stock exchanges, and historically provide higher long-term returns with volatility, making them a key part of diversified investment strategies.

Stocks | FINRA.org - Common stockholders share in a company's success with variable dividends and share prices, while preferred stockholders receive fixed dividends with priority but generally less price fluctuation; margin buying allows for leverage but increases risk.

dowidth.com

dowidth.com