Fractionalized art investment allows multiple investors to own shares of high-value artworks, increasing market accessibility and diversification. Intellectual property investing focuses on acquiring rights to patents, copyrights, or trademarks, generating revenue through licensing or royalties. Explore deeper insights into how these innovative investment models can fit your portfolio strategy.

Why it is important

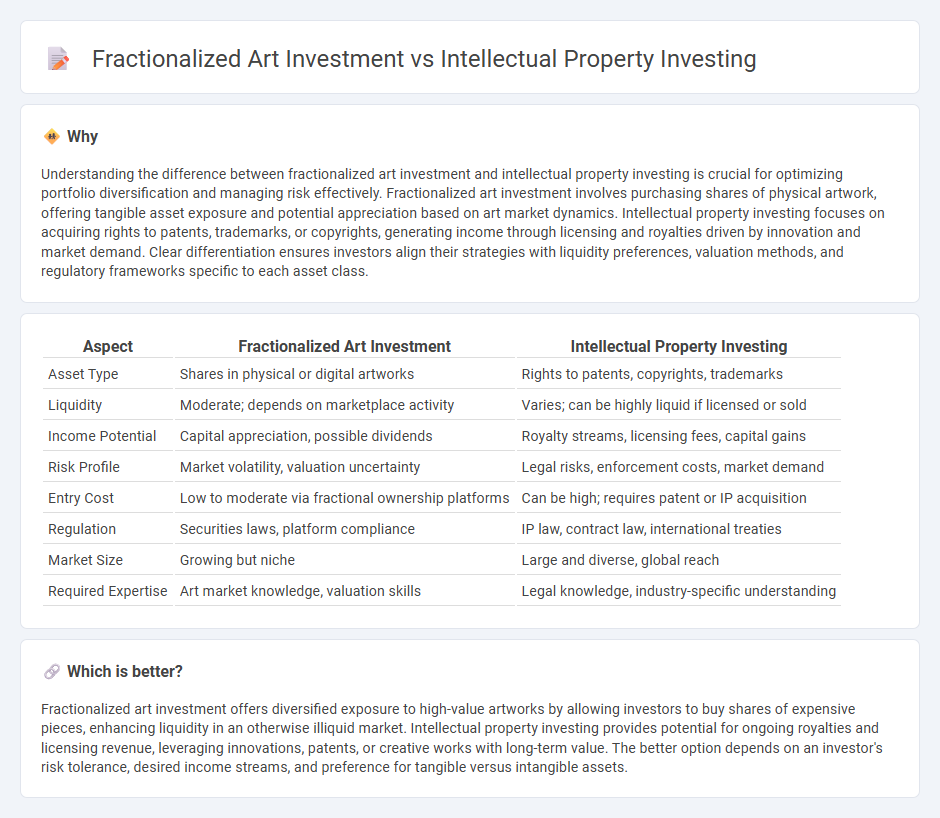

Understanding the difference between fractionalized art investment and intellectual property investing is crucial for optimizing portfolio diversification and managing risk effectively. Fractionalized art investment involves purchasing shares of physical artwork, offering tangible asset exposure and potential appreciation based on art market dynamics. Intellectual property investing focuses on acquiring rights to patents, trademarks, or copyrights, generating income through licensing and royalties driven by innovation and market demand. Clear differentiation ensures investors align their strategies with liquidity preferences, valuation methods, and regulatory frameworks specific to each asset class.

Comparison Table

| Aspect | Fractionalized Art Investment | Intellectual Property Investing |

|---|---|---|

| Asset Type | Shares in physical or digital artworks | Rights to patents, copyrights, trademarks |

| Liquidity | Moderate; depends on marketplace activity | Varies; can be highly liquid if licensed or sold |

| Income Potential | Capital appreciation, possible dividends | Royalty streams, licensing fees, capital gains |

| Risk Profile | Market volatility, valuation uncertainty | Legal risks, enforcement costs, market demand |

| Entry Cost | Low to moderate via fractional ownership platforms | Can be high; requires patent or IP acquisition |

| Regulation | Securities laws, platform compliance | IP law, contract law, international treaties |

| Market Size | Growing but niche | Large and diverse, global reach |

| Required Expertise | Art market knowledge, valuation skills | Legal knowledge, industry-specific understanding |

Which is better?

Fractionalized art investment offers diversified exposure to high-value artworks by allowing investors to buy shares of expensive pieces, enhancing liquidity in an otherwise illiquid market. Intellectual property investing provides potential for ongoing royalties and licensing revenue, leveraging innovations, patents, or creative works with long-term value. The better option depends on an investor's risk tolerance, desired income streams, and preference for tangible versus intangible assets.

Connection

Fractionalized art investment allows multiple investors to own shares of high-value artworks, increasing liquidity and accessibility in the art market. Similarly, intellectual property investing divides ownership rights of patents, trademarks, or copyrights, enabling shared financial participation and risk diversification. Both investment types leverage securitization and digital platforms to democratize access to traditionally illiquid, high-value assets.

Key Terms

**Intellectual property investing:**

Intellectual property investing involves acquiring rights to patents, trademarks, copyrights, or trade secrets, offering potential revenue through licensing, royalties, or asset appreciation. This strategy benefits from the growing digital economy and innovation-driven markets, providing diversification beyond traditional stocks and real estate. Discover how intellectual property investing can maximize your portfolio's growth potential.

Licensing

Intellectual property investing centers on acquiring rights to patents, trademarks, or copyrights that generate revenue through licensing agreements with businesses seeking to utilize protected innovations or brands. Fractionalized art investment involves dividing ownership of high-value artworks into shares, allowing investors to benefit from potential appreciation and licensing opportunities when the art is used commercially. Explore the nuances of licensing strategies to understand which investment aligns best with your financial goals.

Royalties

Investing in intellectual property (IP) primarily generates income through royalties earned from copyrights, patents, or trademarks, providing a steady revenue stream based on the IP's commercial usage. Fractionalized art investment involves purchasing shares of valuable artworks, where royalties can be earned when the art is licensed or reproductions are sold, often capitalizing on the artwork's cultural or brand value. Explore the nuances and benefits of royalties in both investment types to enhance your portfolio strategy.

Source and External Links

Investing in Intellectual Property - Chicago-Kent - Intellectual property investments, including patents, trademarks, copyrights, and trade secrets, provide competitive advantages and can increase in value, allowing investors to benefit from licensing and innovation-driven growth despite high risks and rewards.

Opportunities to finance innovation with IP* - WIPO - Intellectual property rights, especially patents, are critical in raising investment by representing significant intangible assets that often outweigh physical assets in firm valuation, playing a key role in knowledge-based economies and innovation financing.

An Investor's Guide to Investing in Intellectual Property (IP) - Due diligence is essential for evaluating IP's protection strength and market potential, as IP assets enhance competitive positioning and sustainable growth, often containing hidden value that influences investor decisions and company success.

dowidth.com

dowidth.com