Royalty rights investing involves acquiring the rights to a percentage of revenue generated from natural resources or intellectual property, offering steady income tied to production rather than market price fluctuations. Commodity investing focuses on purchasing physical goods like metals, oil, or agricultural products, often subject to volatile price swings driven by supply and demand dynamics. Explore the distinct benefits and risks of royalty rights versus commodity investments to enhance your portfolio strategy.

Why it is important

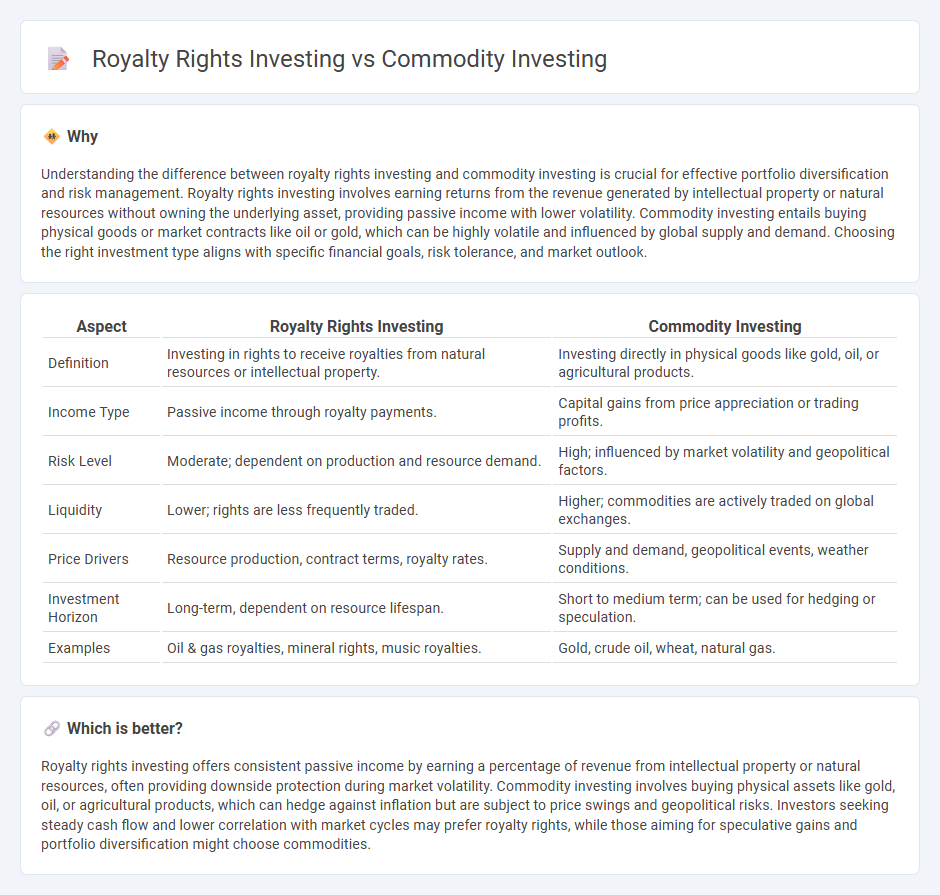

Understanding the difference between royalty rights investing and commodity investing is crucial for effective portfolio diversification and risk management. Royalty rights investing involves earning returns from the revenue generated by intellectual property or natural resources without owning the underlying asset, providing passive income with lower volatility. Commodity investing entails buying physical goods or market contracts like oil or gold, which can be highly volatile and influenced by global supply and demand. Choosing the right investment type aligns with specific financial goals, risk tolerance, and market outlook.

Comparison Table

| Aspect | Royalty Rights Investing | Commodity Investing |

|---|---|---|

| Definition | Investing in rights to receive royalties from natural resources or intellectual property. | Investing directly in physical goods like gold, oil, or agricultural products. |

| Income Type | Passive income through royalty payments. | Capital gains from price appreciation or trading profits. |

| Risk Level | Moderate; dependent on production and resource demand. | High; influenced by market volatility and geopolitical factors. |

| Liquidity | Lower; rights are less frequently traded. | Higher; commodities are actively traded on global exchanges. |

| Price Drivers | Resource production, contract terms, royalty rates. | Supply and demand, geopolitical events, weather conditions. |

| Investment Horizon | Long-term, dependent on resource lifespan. | Short to medium term; can be used for hedging or speculation. |

| Examples | Oil & gas royalties, mineral rights, music royalties. | Gold, crude oil, wheat, natural gas. |

Which is better?

Royalty rights investing offers consistent passive income by earning a percentage of revenue from intellectual property or natural resources, often providing downside protection during market volatility. Commodity investing involves buying physical assets like gold, oil, or agricultural products, which can hedge against inflation but are subject to price swings and geopolitical risks. Investors seeking steady cash flow and lower correlation with market cycles may prefer royalty rights, while those aiming for speculative gains and portfolio diversification might choose commodities.

Connection

Royalty rights investing and commodity investing are connected through their exposure to natural resources and underlying asset values. Both investment types depend on the performance and market demand of commodities such as oil, metals, or agricultural products. Investors benefit from commodity price fluctuations and resource extraction outputs, linking royalty income streams to commodity market dynamics.

Key Terms

Tangible Assets (Commodity investing)

Commodity investing centers on acquiring tangible assets such as gold, oil, or agricultural products, providing direct exposure to physical markets and inherent value. This approach offers liquidity and hedging benefits against inflation but is subject to price volatility driven by supply-demand dynamics and geopolitical factors. Explore further to understand how commodity investing compares to royalty rights in diversifying and enhancing your portfolio.

Passive Income (Royalty rights investing)

Commodity investing involves purchasing physical goods like gold, oil, or agricultural products to capitalize on price fluctuations, often requiring active market monitoring and higher risk exposure. Royalty rights investing generates passive income by acquiring rights to revenue streams from natural resources, intellectual property, or mineral deposits, offering steady cash flow with less direct market involvement. Explore the benefits and strategies of royalty rights investing to enhance your portfolio's passive income potential.

Price Volatility

Commodity investing typically experiences high price volatility due to factors like geopolitical events, weather conditions, and supply-demand imbalances, affecting raw materials such as oil, gold, and agricultural products. Royalty rights investing offers more stable returns by receiving a percentage of revenue from production without direct exposure to market price swings. Explore how royalty rights can provide a strategic hedge against commodity price volatility and enhance portfolio stability.

Source and External Links

Commodity investing and its role in a portfolio - Vanguard - Commodity investing provides diversification benefits and inflation protection, and can be systematically integrated into strategic portfolios to enhance investment outcomes.

Futures and Commodities | FINRA.org - Investors gain exposure to commodities via physical holdings, futures contracts, mutual funds, and exchange-traded products, with futures allowing more flexible speculative or hedging strategies.

Why and How to Invest in Commodities | U.S. Bank - Commodity investing carries special risks including price volatility and regulatory changes, and is typically suited for investors with high risk tolerance and a strategic asset allocation approach.

dowidth.com

dowidth.com