Whiskey cask investment involves purchasing aging barrels of whiskey, capitalizing on the appreciation of rare spirits over time, while venture capital investment entails funding startups or early-stage companies with high growth potential in exchange for equity. Whiskey casks offer a tangible, alternative asset with historical value and market demand, whereas venture capital provides exposure to innovative industries and potential high returns accompanied by higher risk. Explore detailed comparisons of risk, liquidity, and returns in whiskey cask versus venture capital investments to make an informed decision.

Why it is important

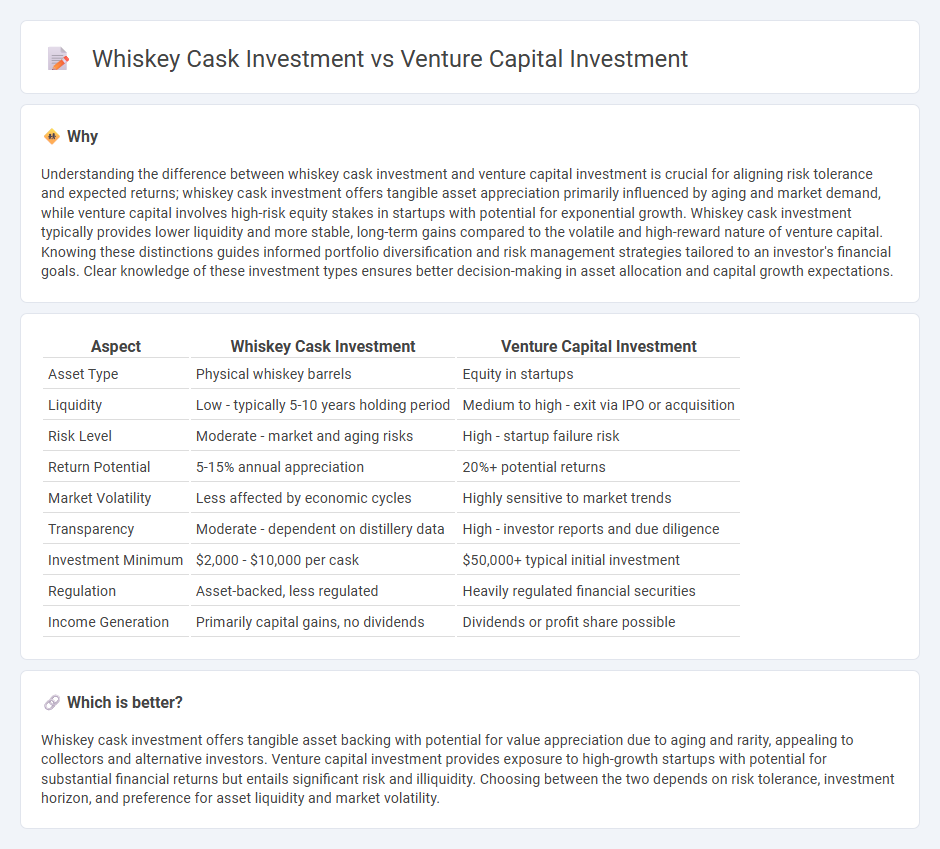

Understanding the difference between whiskey cask investment and venture capital investment is crucial for aligning risk tolerance and expected returns; whiskey cask investment offers tangible asset appreciation primarily influenced by aging and market demand, while venture capital involves high-risk equity stakes in startups with potential for exponential growth. Whiskey cask investment typically provides lower liquidity and more stable, long-term gains compared to the volatile and high-reward nature of venture capital. Knowing these distinctions guides informed portfolio diversification and risk management strategies tailored to an investor's financial goals. Clear knowledge of these investment types ensures better decision-making in asset allocation and capital growth expectations.

Comparison Table

| Aspect | Whiskey Cask Investment | Venture Capital Investment |

|---|---|---|

| Asset Type | Physical whiskey barrels | Equity in startups |

| Liquidity | Low - typically 5-10 years holding period | Medium to high - exit via IPO or acquisition |

| Risk Level | Moderate - market and aging risks | High - startup failure risk |

| Return Potential | 5-15% annual appreciation | 20%+ potential returns |

| Market Volatility | Less affected by economic cycles | Highly sensitive to market trends |

| Transparency | Moderate - dependent on distillery data | High - investor reports and due diligence |

| Investment Minimum | $2,000 - $10,000 per cask | $50,000+ typical initial investment |

| Regulation | Asset-backed, less regulated | Heavily regulated financial securities |

| Income Generation | Primarily capital gains, no dividends | Dividends or profit share possible |

Which is better?

Whiskey cask investment offers tangible asset backing with potential for value appreciation due to aging and rarity, appealing to collectors and alternative investors. Venture capital investment provides exposure to high-growth startups with potential for substantial financial returns but entails significant risk and illiquidity. Choosing between the two depends on risk tolerance, investment horizon, and preference for asset liquidity and market volatility.

Connection

Whiskey cask investment and venture capital investment both provide alternative asset opportunities that diversify traditional portfolios and offer potential high returns. Whiskey cask investment involves acquiring rare or aged casks that appreciate as the spirit matures, while venture capital focuses on funding high-growth startups with scalable business models. Both require market expertise and risk assessment to maximize value appreciation over time.

Key Terms

Venture capital investment:

Venture capital investment involves funding early-stage, high-growth startups with the potential for significant returns, often in technology, biotech, and innovative sectors. It requires thorough due diligence, an understanding of market trends, and a higher risk tolerance compared to traditional investments. Explore the advantages and strategies of venture capital investment to maximize your portfolio growth.

Equity

Venture capital investment offers equity stakes in high-growth startups, providing potential for significant returns through company valuation appreciation and exit events like IPOs or acquisitions. Whiskey cask investment entails purchasing physical barrels or shares in casks, with value driven by aging process, rarity, and market demand, but it lacks traditional equity ownership in a company. Explore the nuances of equity in these distinct asset classes to make informed investment decisions.

Startup

Venture capital investment in startups offers high growth potential by funding innovative companies with scalable business models, often resulting in equity stakes and liquidity events like IPOs or acquisitions. Whiskey cask investment, while providing tangible asset-backed portfolios and potential appreciation related to aging and rarity, lacks the immediate growth trajectory and market liquidity of startups. Explore detailed comparisons and risk profiles to choose the ideal investment strategy tailored to your financial goals.

Source and External Links

What is Venture Capital? - This webpage describes venture capital as a means to turn ideas into high-growth companies, providing funding and strategic guidance to entrepreneurs.

Venture Capital investing - Venture capital provides funds in exchange for equity, focusing on high-growth start-ups that struggle to access conventional finance.

Venture capital - This article explains how venture capital works, supporting early-stage companies with strong growth potential through multiple investment rounds.

dowidth.com

dowidth.com