Sneaker flipping and music royalties represent two distinct investment strategies with different risk profiles and revenue potentials. Sneaker flipping involves buying limited-edition sneakers at retail prices to resell at a premium, capitalizing on market demand and scarcity. Explore these avenues further to understand which investment aligns best with your financial goals.

Why it is important

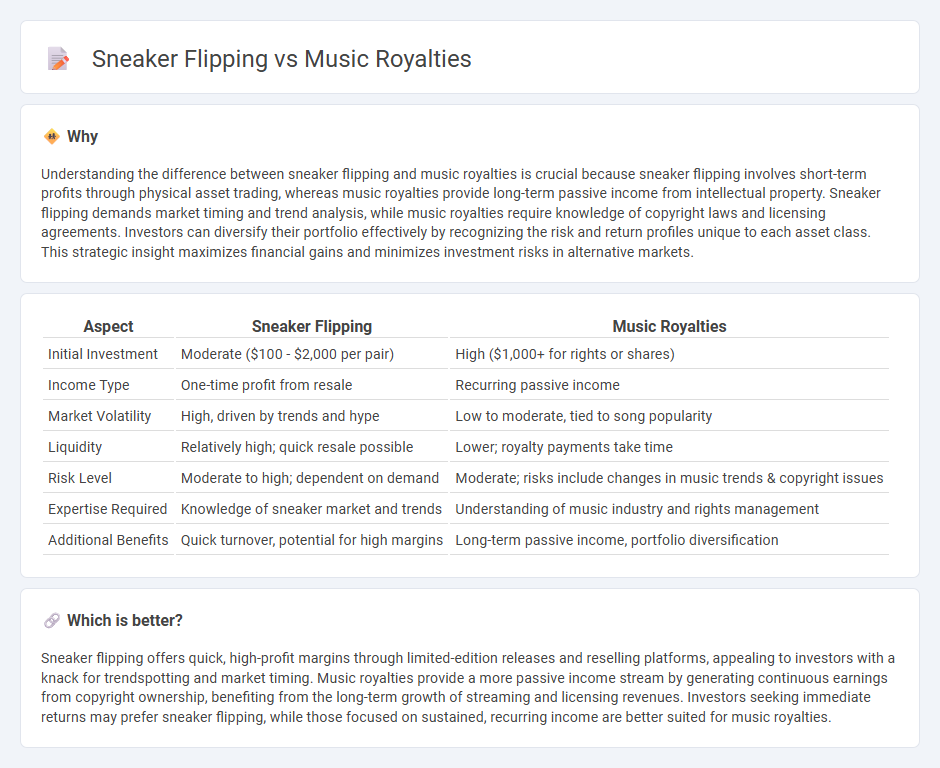

Understanding the difference between sneaker flipping and music royalties is crucial because sneaker flipping involves short-term profits through physical asset trading, whereas music royalties provide long-term passive income from intellectual property. Sneaker flipping demands market timing and trend analysis, while music royalties require knowledge of copyright laws and licensing agreements. Investors can diversify their portfolio effectively by recognizing the risk and return profiles unique to each asset class. This strategic insight maximizes financial gains and minimizes investment risks in alternative markets.

Comparison Table

| Aspect | Sneaker Flipping | Music Royalties |

|---|---|---|

| Initial Investment | Moderate ($100 - $2,000 per pair) | High ($1,000+ for rights or shares) |

| Income Type | One-time profit from resale | Recurring passive income |

| Market Volatility | High, driven by trends and hype | Low to moderate, tied to song popularity |

| Liquidity | Relatively high; quick resale possible | Lower; royalty payments take time |

| Risk Level | Moderate to high; dependent on demand | Moderate; risks include changes in music trends & copyright issues |

| Expertise Required | Knowledge of sneaker market and trends | Understanding of music industry and rights management |

| Additional Benefits | Quick turnover, potential for high margins | Long-term passive income, portfolio diversification |

Which is better?

Sneaker flipping offers quick, high-profit margins through limited-edition releases and reselling platforms, appealing to investors with a knack for trendspotting and market timing. Music royalties provide a more passive income stream by generating continuous earnings from copyright ownership, benefiting from the long-term growth of streaming and licensing revenues. Investors seeking immediate returns may prefer sneaker flipping, while those focused on sustained, recurring income are better suited for music royalties.

Connection

Sneaker flipping and music royalties both serve as alternative investment strategies that generate passive income through asset appreciation and intellectual property rights, respectively. Sneaker flipping capitalizes on limited-edition releases and market demand, while music royalties provide ongoing revenue from licensed songs and streaming platforms. Investors leverage market trends and digital platforms in both domains to maximize returns and diversify portfolios beyond traditional stocks and real estate.

Key Terms

Music royalties:

Music royalties generate passive income by compensating creators for the ongoing use of their compositions, recorded sound rights, and performances across multiple platforms such as streaming services, radio broadcasts, and public performances. Unlike sneaker flipping, which relies on short-term market trends and reselling limited-edition shoes for profit, music royalties provide a long-term revenue stream linked to the popularity and licensing of music catalogs. Discover how investing in music royalties can secure sustainable earnings and diversify your income portfolio.

Licensing

Music royalties generate income through licensing agreements where artists, songwriters, and producers earn payments whenever their music is used commercially, including streaming, broadcasting, and commercials. Sneaker flipping involves acquiring limited-edition releases and reselling them at a higher value, but licensing plays a minimal role compared to music royalties. Explore how licensing strategies shape revenue streams in both industries for a deeper understanding.

Mechanical Rights

Mechanical rights generate income every time a song is reproduced, including physical copies and digital downloads, making music royalties a consistent revenue stream for songwriters and publishers. Sneaker flipping relies on buying limited-edition sneakers at retail and reselling them at a higher price, with profits dependent on market demand and rarity but offering less recurring income. Explore how mechanical rights in music provide long-term earning potential compared to the variable returns from sneaker flipping.

Source and External Links

Music Royalties Inc. | Invest in the Top Artists - Music Royalties Inc. allows investors to gain exposure to music revenue streams by acquiring song royalties from top artists, paying dividends based on royalties collected from streaming and other uses of music copyrights.

Music Royalties Explained: The Ultimate Guide for 2024 - Music royalties come in various types including artist royalties, producer points, and session musician royalties, with collection often managed through unions or agreements depending on the contributor's role and contract.

Explained: How Music Royalties Work in the Music Industry - Music royalties are payments to rights holders such as songwriters, publishers, and record labels, with different royalties like mechanical, performance, and sync royalties distributed according to agreements and copyright ownership.

dowidth.com

dowidth.com