Fractional farmland ownership offers investors the opportunity to buy shares of agricultural land, benefiting from crop yields and land appreciation without managing the property directly. Timberland investment provides exposure to forest assets, generating returns through both timber sales and land value growth, often with lower volatility. Discover the comparative advantages and potential returns of these unique asset classes.

Why it is important

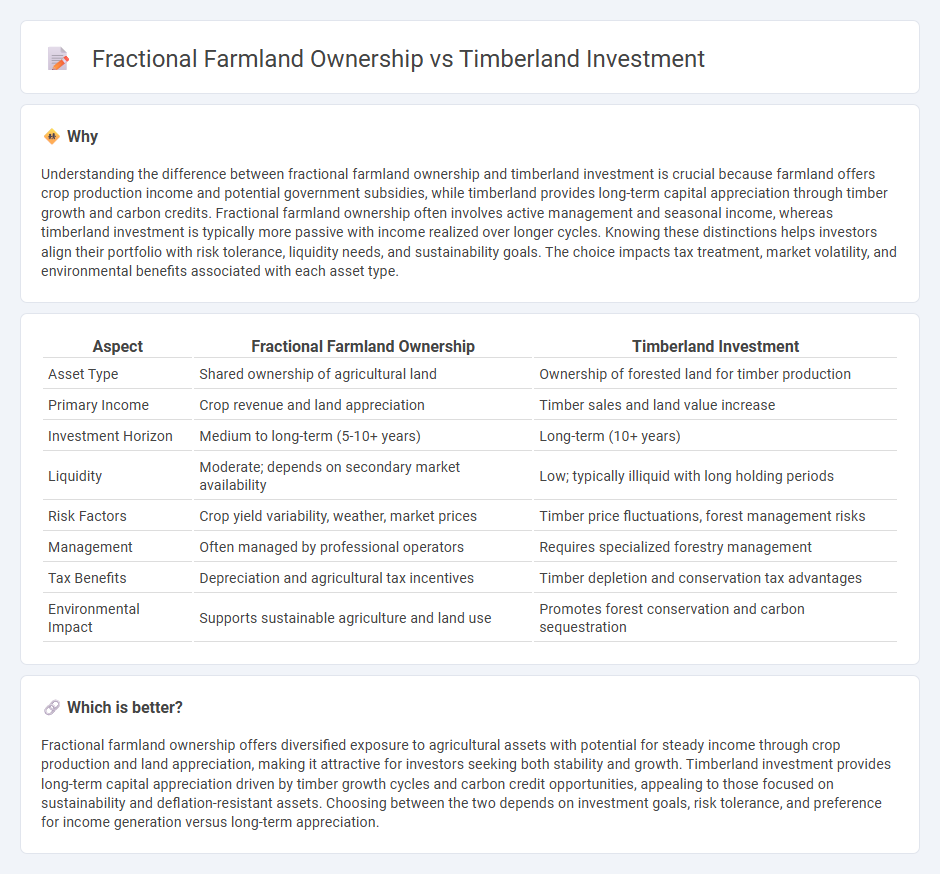

Understanding the difference between fractional farmland ownership and timberland investment is crucial because farmland offers crop production income and potential government subsidies, while timberland provides long-term capital appreciation through timber growth and carbon credits. Fractional farmland ownership often involves active management and seasonal income, whereas timberland investment is typically more passive with income realized over longer cycles. Knowing these distinctions helps investors align their portfolio with risk tolerance, liquidity needs, and sustainability goals. The choice impacts tax treatment, market volatility, and environmental benefits associated with each asset type.

Comparison Table

| Aspect | Fractional Farmland Ownership | Timberland Investment |

|---|---|---|

| Asset Type | Shared ownership of agricultural land | Ownership of forested land for timber production |

| Primary Income | Crop revenue and land appreciation | Timber sales and land value increase |

| Investment Horizon | Medium to long-term (5-10+ years) | Long-term (10+ years) |

| Liquidity | Moderate; depends on secondary market availability | Low; typically illiquid with long holding periods |

| Risk Factors | Crop yield variability, weather, market prices | Timber price fluctuations, forest management risks |

| Management | Often managed by professional operators | Requires specialized forestry management |

| Tax Benefits | Depreciation and agricultural tax incentives | Timber depletion and conservation tax advantages |

| Environmental Impact | Supports sustainable agriculture and land use | Promotes forest conservation and carbon sequestration |

Which is better?

Fractional farmland ownership offers diversified exposure to agricultural assets with potential for steady income through crop production and land appreciation, making it attractive for investors seeking both stability and growth. Timberland investment provides long-term capital appreciation driven by timber growth cycles and carbon credit opportunities, appealing to those focused on sustainability and deflation-resistant assets. Choosing between the two depends on investment goals, risk tolerance, and preference for income generation versus long-term appreciation.

Connection

Fractional farmland ownership and timberland investment are connected through their shared appeal as alternative asset classes that offer diversification, inflation hedging, and stable long-term returns. Both investment types enable fractional ownership models, allowing investors to gain exposure to physical land assets without the burden of full acquisition costs or direct management responsibilities. This fractional structure facilitates access to agricultural and forestry markets, leveraging the regenerative nature of these natural resources to generate sustainable income streams and potential capital appreciation.

Key Terms

Asset Diversification

Timberland investment provides a unique opportunity for asset diversification by offering stable cash flow through timber sales and potential land appreciation, often less correlated with traditional financial markets. Fractional farmland ownership allows investors to gain exposure to agricultural assets, benefiting from both rental income and crop price inflation with relatively low entry costs. Explore the detailed benefits and risk profiles of both to enhance your diversified investment portfolio.

Liquidity

Timberland investment offers moderate liquidity through timber harvesting cycles and potential land sales, but typically requires longer holding periods compared to traditional assets. Fractional farmland ownership provides enhanced liquidity by enabling investors to buy and sell shares more freely on specialized platforms, reducing entry barriers and allowing flexible portfolio management. Explore detailed comparisons on liquidity aspects to make informed investment decisions between timberland and fractional farmland ownership.

Yield Potential

Timberland investments offer steady long-term yield potential through the appreciation of timber prices and sustainable harvesting cycles, while fractional farmland ownership provides income from crop production and land value increases, often influenced by commodity markets and weather conditions. Timberland yield is measured by board feet growth and market demand for lumber, whereas farmland yield depends on crop yields per acre and rental income from tenant farmers. Explore the comparative benefits and risks of these asset classes to determine which aligns best with your investment goals.

Source and External Links

Timberland | Institutional - Manulife Investment Management - Timberland investment offers portfolio diversification, potential inflation protection, and positive environmental and social impacts through sustainable forest management and carbon credit opportunities.

Timberland - Overview, How to Diversify, Benefits of Investing - Timberland investments involve buying managed tree plantations or natural forests, providing predictable biological growth and portfolio diversification favored by large institutional investors.

Timberland | J.P. Morgan Asset Management - Investing in timberland can hedge inflation risk, provide flexible income from timber sales, diversify portfolios with low correlation to traditional assets, and promote sustainability through well-managed forests.

dowidth.com

dowidth.com