Fine art micro-shares allow investors to purchase fractional ownership in valuable artworks, providing access to an asset class traditionally reserved for high-net-worth individuals. Music royalties platforms enable users to invest in future earnings of songs and albums, generating passive income from streaming and licensing revenues. Explore detailed comparisons to understand which investment aligns best with your financial goals.

Why it is important

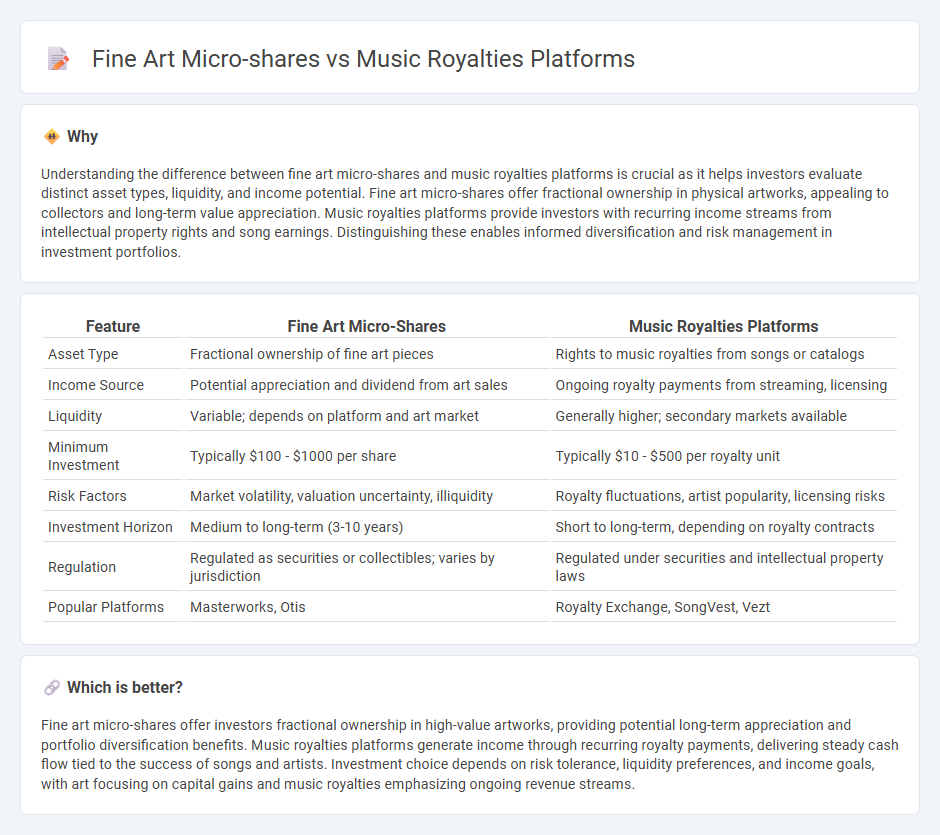

Understanding the difference between fine art micro-shares and music royalties platforms is crucial as it helps investors evaluate distinct asset types, liquidity, and income potential. Fine art micro-shares offer fractional ownership in physical artworks, appealing to collectors and long-term value appreciation. Music royalties platforms provide investors with recurring income streams from intellectual property rights and song earnings. Distinguishing these enables informed diversification and risk management in investment portfolios.

Comparison Table

| Feature | Fine Art Micro-Shares | Music Royalties Platforms |

|---|---|---|

| Asset Type | Fractional ownership of fine art pieces | Rights to music royalties from songs or catalogs |

| Income Source | Potential appreciation and dividend from art sales | Ongoing royalty payments from streaming, licensing |

| Liquidity | Variable; depends on platform and art market | Generally higher; secondary markets available |

| Minimum Investment | Typically $100 - $1000 per share | Typically $10 - $500 per royalty unit |

| Risk Factors | Market volatility, valuation uncertainty, illiquidity | Royalty fluctuations, artist popularity, licensing risks |

| Investment Horizon | Medium to long-term (3-10 years) | Short to long-term, depending on royalty contracts |

| Regulation | Regulated as securities or collectibles; varies by jurisdiction | Regulated under securities and intellectual property laws |

| Popular Platforms | Masterworks, Otis | Royalty Exchange, SongVest, Vezt |

Which is better?

Fine art micro-shares offer investors fractional ownership in high-value artworks, providing potential long-term appreciation and portfolio diversification benefits. Music royalties platforms generate income through recurring royalty payments, delivering steady cash flow tied to the success of songs and artists. Investment choice depends on risk tolerance, liquidity preferences, and income goals, with art focusing on capital gains and music royalties emphasizing ongoing revenue streams.

Connection

Fine art micro-shares and music royalties platforms both democratize investment by allowing fractional ownership in creative assets, enabling investors to gain exposure to alternative income streams. These platforms utilize blockchain technology and smart contracts to ensure transparent royalty distribution and secure trading of shares. By fragmenting high-value art pieces and music rights, they lower barriers to entry and diversify portfolios through culturally enriched assets.

Key Terms

Revenue Distribution

Music royalties platforms enable artists and rights holders to monetize their work through streaming, licensing, and sales, ensuring ongoing revenue distribution proportional to usage and ownership shares. Fine art micro-shares distribute income from art sales, exhibitions, or licensing based on fractional ownership, often challenging traditional art market inefficiencies and providing liquidity to investors. Explore how each model optimizes revenue distribution and empowers stakeholders in creative industries.

Asset Liquidity

Music royalties platforms offer enhanced asset liquidity by enabling investors to buy and sell fractional rights to music earnings through digital marketplaces, providing frequent transaction opportunities. Fine art micro-shares represent fractional ownership of physical artworks, but their liquidity is often limited by niche market demand and longer transaction times. Explore how these asset classes compare in liquidity dynamics and investment potential.

Ownership Fractionalization

Music royalties platforms enable artists and investors to buy ownership fractions of song rights, generating income from streaming, licensing, and performance royalties. Fine art micro-shares allow collectors to own proportional stakes in high-value artworks, benefiting from potential appreciation and exhibition revenues without possessing the physical piece. Explore how ownership fractionalization transforms asset access and investment opportunities in music and fine art.

Source and External Links

Ditto Music Distribution - Offers musicians the ability to upload music to major platforms while keeping 100% of their royalties.

ANote Music - Allows users to invest in music royalties, providing a unique asset for passive income through music catalogues.

TuneCore - Provides digital music distribution services, enabling artists to reach global audiences while maintaining ownership and control of their work.

dowidth.com

dowidth.com