Investing in whale watching shares offers exposure to a niche eco-tourism market with steady growth driven by increasing environmental awareness and travel demand. Cryptocurrency investment provides high volatility and potential for rapid gains, appealing to risk-tolerant investors seeking diversification beyond traditional assets. Explore the benefits and risks of whale watching shares versus cryptocurrency to determine the best fit for your portfolio.

Why it is important

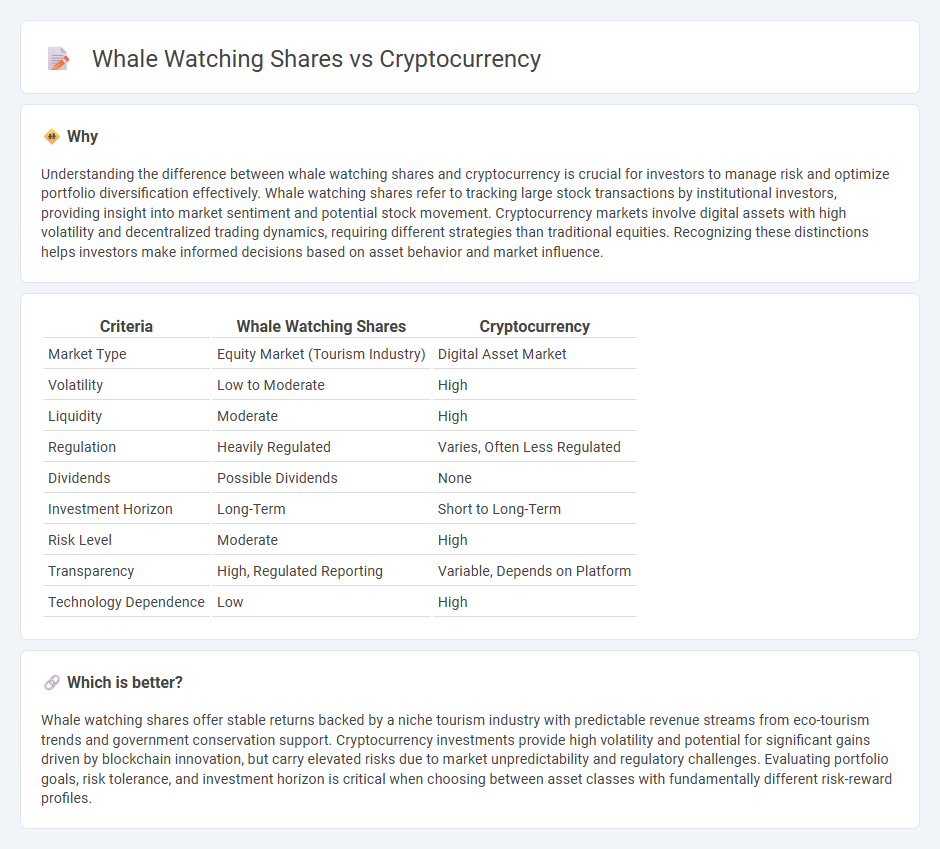

Understanding the difference between whale watching shares and cryptocurrency is crucial for investors to manage risk and optimize portfolio diversification effectively. Whale watching shares refer to tracking large stock transactions by institutional investors, providing insight into market sentiment and potential stock movement. Cryptocurrency markets involve digital assets with high volatility and decentralized trading dynamics, requiring different strategies than traditional equities. Recognizing these distinctions helps investors make informed decisions based on asset behavior and market influence.

Comparison Table

| Criteria | Whale Watching Shares | Cryptocurrency |

|---|---|---|

| Market Type | Equity Market (Tourism Industry) | Digital Asset Market |

| Volatility | Low to Moderate | High |

| Liquidity | Moderate | High |

| Regulation | Heavily Regulated | Varies, Often Less Regulated |

| Dividends | Possible Dividends | None |

| Investment Horizon | Long-Term | Short to Long-Term |

| Risk Level | Moderate | High |

| Transparency | High, Regulated Reporting | Variable, Depends on Platform |

| Technology Dependence | Low | High |

Which is better?

Whale watching shares offer stable returns backed by a niche tourism industry with predictable revenue streams from eco-tourism trends and government conservation support. Cryptocurrency investments provide high volatility and potential for significant gains driven by blockchain innovation, but carry elevated risks due to market unpredictability and regulatory challenges. Evaluating portfolio goals, risk tolerance, and investment horizon is critical when choosing between asset classes with fundamentally different risk-reward profiles.

Connection

Whale watching shares often refer to large shareholders or investors in cryptocurrency markets known as "whales," whose massive transactions can significantly impact crypto prices. Monitoring whale activities provides crucial insights for investors seeking to predict market movements and optimize portfolio strategies. Cryptocurrency exchanges and blockchain analytics firms track these whales to offer data-driven investment opportunities based on buying or selling patterns.

Key Terms

Volatility

Cryptocurrency markets exhibit extreme volatility, often influenced by rapid shifts in investor sentiment and regulatory news, leading to significant price fluctuations within short periods. Whale watching shares tend to show lower volatility, reflecting more stable demand patterns and seasonal tourism trends rather than speculative trading. Explore further to understand how volatility impacts investment strategies in these contrasting sectors.

Liquidity

Cryptocurrency markets offer high liquidity with 24/7 trading and rapid execution of transactions, enabling investors to enter and exit positions swiftly. Whale watching shares, often part of niche tourism or conservation sectors, tend to have lower liquidity due to limited market presence and trading volumes. Discover how liquidity impacts investment decisions in emerging financial assets and specialized shares.

Market Manipulation

Cryptocurrency markets often face significant risks of market manipulation due to their decentralized nature and lack of stringent regulations, where large holders--called whales--can influence prices by executing large trades. Whale watching shares, on the other hand, relate to tracking large investors' stock movements in regulated equity markets, offering clearer transparency and regulatory oversight, which reduces the likelihood of manipulation but does not eliminate it. Explore more to understand the nuanced dynamics of market manipulation across these investment types.

Source and External Links

What is Cryptocurrency and How Does it Work? - Kaspersky - Cryptocurrency is a digital payment system that operates without central banks, using cryptography and a decentralized blockchain ledger to secure transactions and issue currency units, with Bitcoin as the first and most well-known example.

Cryptocurrency - Wikipedia - Cryptocurrencies are digital currencies that function on decentralized computer networks and blockchain technology, with ownership records secured via consensus mechanisms like proof of work or proof of stake, and as of 2025, the market capitalization is estimated at $2.76 trillion.

Digital Currencies | Explainer | Education - Reserve Bank of Australia - Cryptocurrencies are digital tokens used for peer-to-peer payments without intrinsic or legal tender value, characterized by high market volatility and significant computing power used for securing transactions, with skepticism about their ability to replace traditional currencies.

dowidth.com

dowidth.com