Spice trading, a centuries-old commodity exchange, involves the buying and selling of valuable spices like pepper, cinnamon, and cloves, often generating steady returns through physical assets and global demand. Venture capital focuses on funding innovative startups and high-growth companies, providing equity in exchange for potential exponential returns amid higher risks. Explore the distinct advantages and strategies of spice trading versus venture capital to diversify your investment portfolio.

Why it is important

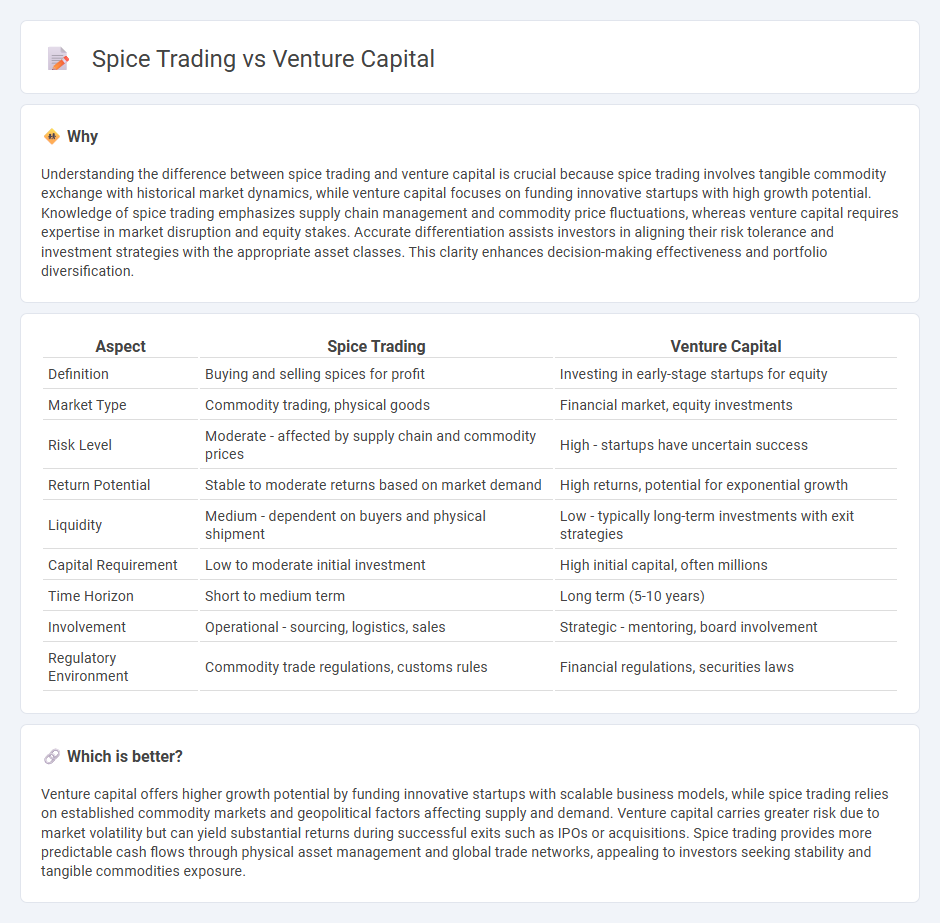

Understanding the difference between spice trading and venture capital is crucial because spice trading involves tangible commodity exchange with historical market dynamics, while venture capital focuses on funding innovative startups with high growth potential. Knowledge of spice trading emphasizes supply chain management and commodity price fluctuations, whereas venture capital requires expertise in market disruption and equity stakes. Accurate differentiation assists investors in aligning their risk tolerance and investment strategies with the appropriate asset classes. This clarity enhances decision-making effectiveness and portfolio diversification.

Comparison Table

| Aspect | Spice Trading | Venture Capital |

|---|---|---|

| Definition | Buying and selling spices for profit | Investing in early-stage startups for equity |

| Market Type | Commodity trading, physical goods | Financial market, equity investments |

| Risk Level | Moderate - affected by supply chain and commodity prices | High - startups have uncertain success |

| Return Potential | Stable to moderate returns based on market demand | High returns, potential for exponential growth |

| Liquidity | Medium - dependent on buyers and physical shipment | Low - typically long-term investments with exit strategies |

| Capital Requirement | Low to moderate initial investment | High initial capital, often millions |

| Time Horizon | Short to medium term | Long term (5-10 years) |

| Involvement | Operational - sourcing, logistics, sales | Strategic - mentoring, board involvement |

| Regulatory Environment | Commodity trade regulations, customs rules | Financial regulations, securities laws |

Which is better?

Venture capital offers higher growth potential by funding innovative startups with scalable business models, while spice trading relies on established commodity markets and geopolitical factors affecting supply and demand. Venture capital carries greater risk due to market volatility but can yield substantial returns during successful exits such as IPOs or acquisitions. Spice trading provides more predictable cash flows through physical asset management and global trade networks, appealing to investors seeking stability and tangible commodities exposure.

Connection

Spice trading historically involved high-risk ventures requiring significant capital investment, similar to modern venture capital's role in funding innovative startups with uncertain outcomes. Both practices focus on identifying high-potential opportunities that promise substantial returns despite inherent risks. The evolution from tangible commodity trading to financial investment reflects how venture capital principles are rooted in strategic resource allocation and risk management established by spice traders.

Key Terms

Equity (Venture Capital)

Venture capital investments focus on acquiring equity stakes in high-growth startups, enabling investors to gain partial ownership and potentially significant returns. Unlike commodity-based spice trading, venture capital emphasizes funding innovation and scalable business models through equity participation. Discover the strategic advantages and risk profiles of equity-focused venture capital to deepen your understanding of investment opportunities.

Risk Management (Spice Trading)

Spice trading carries inherent risks such as price volatility, supply chain disruptions, and geopolitical uncertainties that demand robust risk management strategies including diversification and hedging. Unlike venture capital, which primarily involves financial risk assessment and market potential evaluation, spice trading requires a focus on real-world factors like weather impact and regulatory compliance. Explore further to understand the intricate risk management techniques that safeguard spice trading investments.

Exit Strategy (Venture Capital)

Venture capital exit strategies primarily include initial public offerings (IPOs), mergers and acquisitions (M&A), and secondary sales, enabling investors to realize returns on their investments. Exit planning in venture capital is crucial for maximizing returns, ensuring liquidity, and strategically positioning the startup in the market. Explore detailed methods and best practices to optimize exit strategies in venture capital investments.

Source and External Links

What is Venture Capital? - Venture capital (VC) is a form of financing that turns ideas and basic research into products and services by investing long-term equity into high-growth companies, typically supporting startups that cannot get traditional loans and requiring years to mature; VCs also provide strategic guidance and operational expertise to entrepreneurs while taking high risks for potential high returns.

Fund your business | U.S. Small Business Administration - Venture capital provides funding to startups in exchange for equity ownership and usually a board seat, focusing on high-growth companies with a longer investment horizon and higher risks, involving a process of finding investors, due diligence, negotiating terms, and multiple financing rounds.

What is venture capital? - Venture capital is a type of private equity used to invest in early-stage companies with rapid growth potential, supplying not only capital but also technical support and managerial help, usually in exchange for ownership stakes, and is crucial since early startups often cannot access loans or capital markets directly.

dowidth.com

dowidth.com