Wine cask aging offers a tangible asset investment with potential appreciation influenced by vintage quality and market demand, providing diversification beyond traditional portfolios. Private debt investments deliver steady income through negotiated interest payments and lower volatility compared to public markets, often backed by collateral or contractual agreements. Explore the nuances of wine cask aging and private debt to optimize your investment strategy.

Why it is important

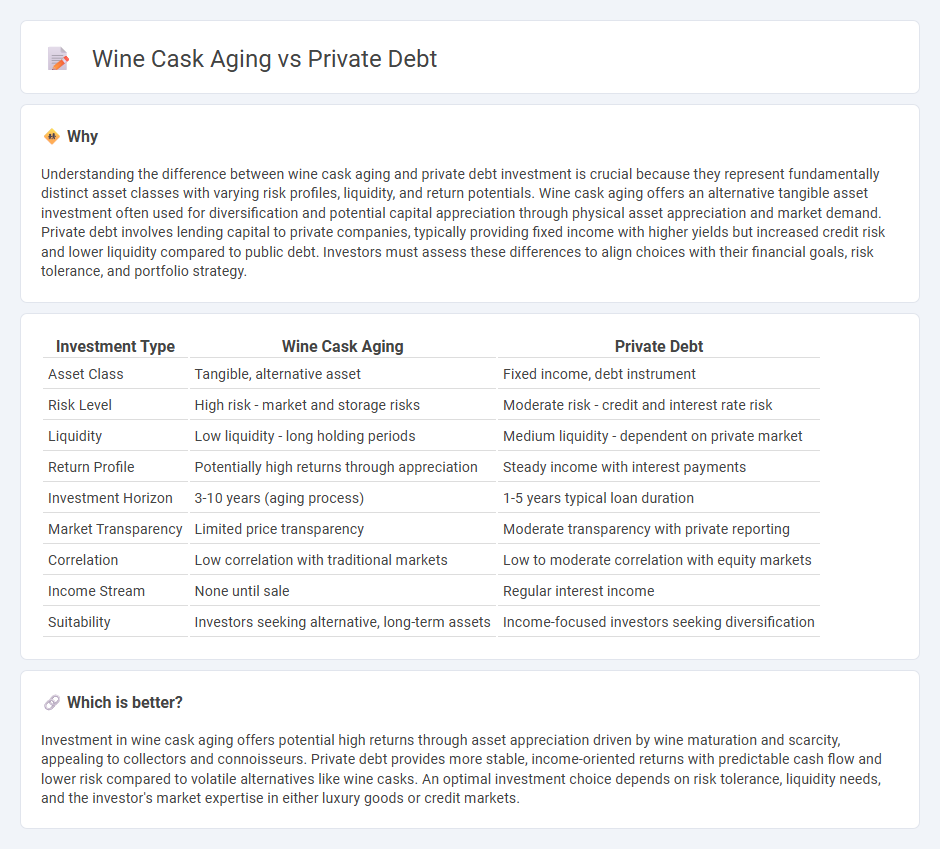

Understanding the difference between wine cask aging and private debt investment is crucial because they represent fundamentally distinct asset classes with varying risk profiles, liquidity, and return potentials. Wine cask aging offers an alternative tangible asset investment often used for diversification and potential capital appreciation through physical asset appreciation and market demand. Private debt involves lending capital to private companies, typically providing fixed income with higher yields but increased credit risk and lower liquidity compared to public debt. Investors must assess these differences to align choices with their financial goals, risk tolerance, and portfolio strategy.

Comparison Table

| Investment Type | Wine Cask Aging | Private Debt |

|---|---|---|

| Asset Class | Tangible, alternative asset | Fixed income, debt instrument |

| Risk Level | High risk - market and storage risks | Moderate risk - credit and interest rate risk |

| Liquidity | Low liquidity - long holding periods | Medium liquidity - dependent on private market |

| Return Profile | Potentially high returns through appreciation | Steady income with interest payments |

| Investment Horizon | 3-10 years (aging process) | 1-5 years typical loan duration |

| Market Transparency | Limited price transparency | Moderate transparency with private reporting |

| Correlation | Low correlation with traditional markets | Low to moderate correlation with equity markets |

| Income Stream | None until sale | Regular interest income |

| Suitability | Investors seeking alternative, long-term assets | Income-focused investors seeking diversification |

Which is better?

Investment in wine cask aging offers potential high returns through asset appreciation driven by wine maturation and scarcity, appealing to collectors and connoisseurs. Private debt provides more stable, income-oriented returns with predictable cash flow and lower risk compared to volatile alternatives like wine casks. An optimal investment choice depends on risk tolerance, liquidity needs, and the investor's market expertise in either luxury goods or credit markets.

Connection

Wine cask aging and private debt intersect through alternative investment strategies that appeal to portfolio diversification and risk management. Both wine cask investments and private debt offer tangible or structured assets with potential for stable, non-correlated returns compared to traditional equities and bonds. Institutional investors increasingly allocate capital to these asset classes seeking enhanced yield performance and inflation hedging benefits.

Key Terms

Yield

Private debt investments typically offer stable and predictable yields ranging from 6% to 12% annually, reflecting consistent income streams through interest payments. Wine cask aging can significantly enhance the value of wine, with yields potentially exceeding 20% over several years as the wine matures and market demand increases. Explore how combining these asset classes can diversify your portfolio and optimize overall yield potential.

Liquidity

Private debt typically offers limited liquidity due to longer lock-up periods and fewer secondary market opportunities, making capital access slower but potentially yielding steady returns. Wine cask aging involves illiquid assets locked in extended maturation periods, with value depending on wine quality and market demand, often requiring specialized storage and expertise. Explore deeper insights on balancing liquidity and investment horizons in private debt and wine cask portfolios.

Risk

Private debt investments typically carry credit risk, liquidity risk, and default risk, as borrowers may fail to repay loans or market conditions may shift. Wine cask aging involves risks related to storage conditions, market demand fluctuations, and potential spoilage, which can impact the cask's value and resale potential. Explore further to understand how these distinct risk profiles influence investment strategies and returns.

Source and External Links

Private debt - Natixis Investment Managers - Private debt, also called private credit, is debt financing provided to companies by non-bank funds, growing rapidly since the Global Financial Crisis as banks retreated from riskier loans and offering investors higher yields and diverse risk profiles.

What Is Private Debt? | Allvue Systems - Private debt is a private capital strategy involving non-bank loans to companies, gaining popularity post-2008 when banks tightened lending, forming a distinct asset class that attracts institutional investors by offering alternatives to traditional bank lending.

Investing in Private Debt - Guggenheim Investments - Private debt delivers potential for higher income and returns than some fixed income alternatives, consisting mainly of directly originated, cash flow-based loans held by fewer lenders, with growth driven by investor demand for enhanced risk-adjusted returns.

dowidth.com

dowidth.com