Whale watching shares offer niche market exposure with moderate volatility and steady dividend potential, appealing to investors seeking sustainable tourism investments. Growth stocks, characterized by higher risk and rapid capital appreciation, attract those aiming for significant long-term gains in dynamic industries like technology and healthcare. Explore the comparative advantages of whale watching shares versus growth stocks to optimize your investment strategy.

Why it is important

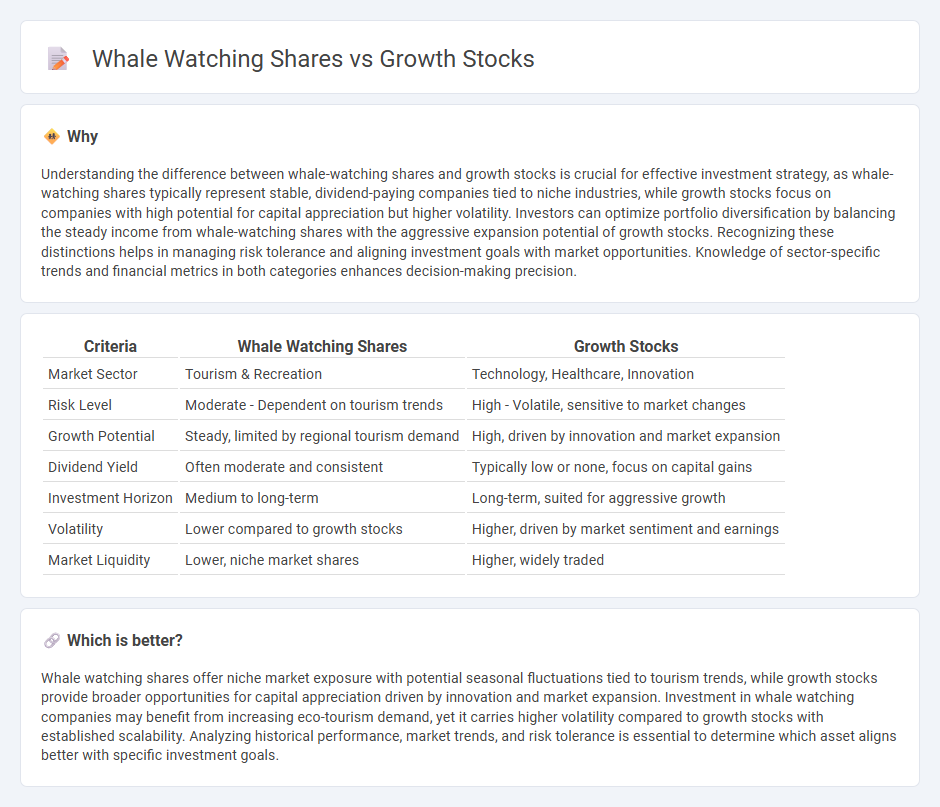

Understanding the difference between whale-watching shares and growth stocks is crucial for effective investment strategy, as whale-watching shares typically represent stable, dividend-paying companies tied to niche industries, while growth stocks focus on companies with high potential for capital appreciation but higher volatility. Investors can optimize portfolio diversification by balancing the steady income from whale-watching shares with the aggressive expansion potential of growth stocks. Recognizing these distinctions helps in managing risk tolerance and aligning investment goals with market opportunities. Knowledge of sector-specific trends and financial metrics in both categories enhances decision-making precision.

Comparison Table

| Criteria | Whale Watching Shares | Growth Stocks |

|---|---|---|

| Market Sector | Tourism & Recreation | Technology, Healthcare, Innovation |

| Risk Level | Moderate - Dependent on tourism trends | High - Volatile, sensitive to market changes |

| Growth Potential | Steady, limited by regional tourism demand | High, driven by innovation and market expansion |

| Dividend Yield | Often moderate and consistent | Typically low or none, focus on capital gains |

| Investment Horizon | Medium to long-term | Long-term, suited for aggressive growth |

| Volatility | Lower compared to growth stocks | Higher, driven by market sentiment and earnings |

| Market Liquidity | Lower, niche market shares | Higher, widely traded |

Which is better?

Whale watching shares offer niche market exposure with potential seasonal fluctuations tied to tourism trends, while growth stocks provide broader opportunities for capital appreciation driven by innovation and market expansion. Investment in whale watching companies may benefit from increasing eco-tourism demand, yet it carries higher volatility compared to growth stocks with established scalability. Analyzing historical performance, market trends, and risk tolerance is essential to determine which asset aligns better with specific investment goals.

Connection

Whale watching shares and growth stocks intersect through investor behavior focused on high potential returns and market momentum. Whale watching, a practice of tracking large institutional investors' trades, reveals significant increases in growth stock acquisitions reflecting confidence in future expansion. This insight enables retail investors to align their portfolios strategically with influential market movers driving growth sectors.

Key Terms

Capital Appreciation

Growth stocks prioritize capital appreciation by reinvesting earnings to fuel expansion, often trading at higher price-to-earnings ratios reflecting future earnings potential. Whale watching shares offer a niche investment with potential seasonal gains driven by tourism trends and environmental factors affecting marine wildlife visibility. Explore detailed comparisons to understand which option aligns with your capital appreciation goals.

Institutional Ownership

Growth stocks exhibit high institutional ownership, often surpassing 70%, as large investors seek companies with strong revenue and earnings potential. Whale watching shares typically have lower institutional ownership, reflecting niche market interest and regional appeal with less trading volume. Explore detailed ownership patterns and investment implications to better understand these contrasting market segments.

Market Influence

Growth stocks often represent companies with rapid revenue and earnings expansion, attracting investors aiming for significant capital gains. Whale watching shares, typically tied to eco-tourism and niche travel markets, may offer steadier returns with exposure to environmental sustainability trends but less volatility. Explore the comparative market influence and investment potential of these sectors to make informed financial decisions.

Source and External Links

Growth stocks: what they are and why you should care - Saxo Bank - Growth stocks are shares of companies expected to grow significantly faster than their industry peers, commonly found in sectors like technology, healthcare, FMCG, semiconductors, and digital entertainment.

20 Best-Performing Growth Stocks for July 2025 - NerdWallet - Growth stocks are companies whose revenues grow faster than average, typically reinvesting profits instead of paying dividends, with prominent examples including tech giants like Apple, Microsoft, Amazon, Tesla, and Alphabet.

Growth stock - Wikipedia - A growth stock is a company's stock characterized by substantial and sustainable positive cash flow, with expectations for increasing revenues and earnings over time.

dowidth.com

dowidth.com