Forestry investment focuses on sustainable management and conservation of forest ecosystems, aiming to generate long-term ecological and financial returns through activities like carbon sequestration and biodiversity preservation. Timberland investment centers on the acquisition and management of land specifically for timber production, emphasizing the growth and harvesting of trees for commercial sale and profit. Explore detailed differences and insights between forestry and timberland investments to make informed financial decisions.

Why it is important

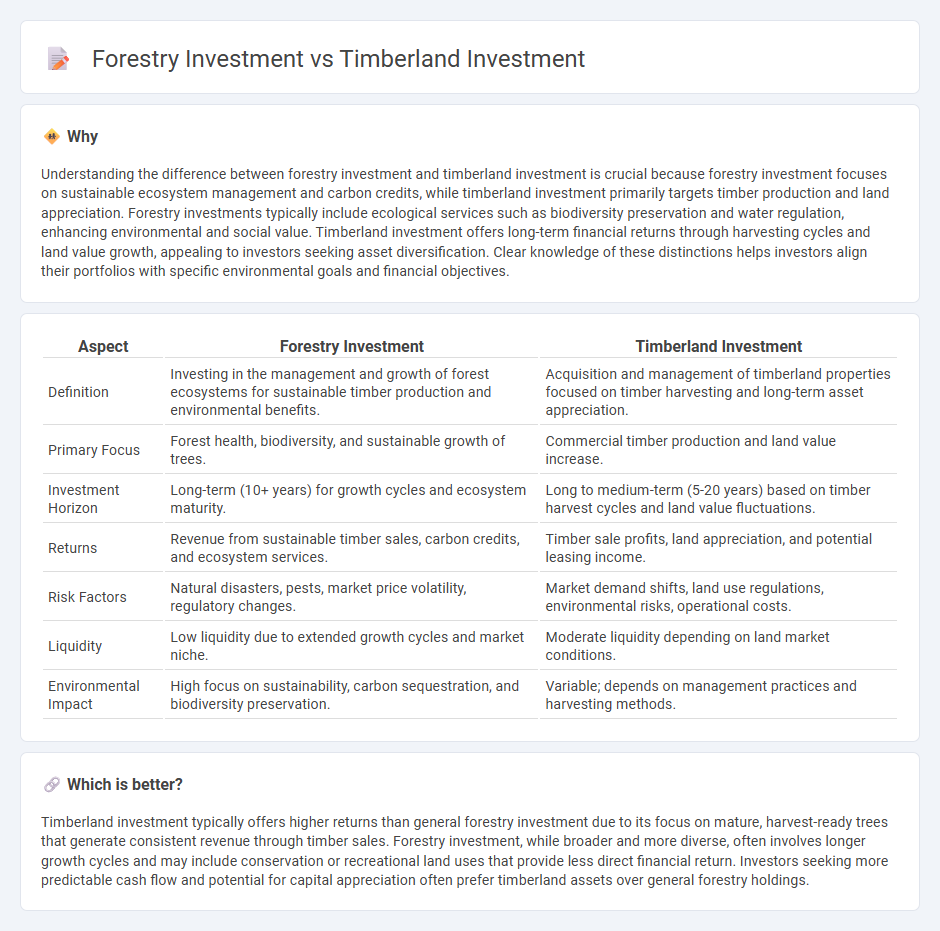

Understanding the difference between forestry investment and timberland investment is crucial because forestry investment focuses on sustainable ecosystem management and carbon credits, while timberland investment primarily targets timber production and land appreciation. Forestry investments typically include ecological services such as biodiversity preservation and water regulation, enhancing environmental and social value. Timberland investment offers long-term financial returns through harvesting cycles and land value growth, appealing to investors seeking asset diversification. Clear knowledge of these distinctions helps investors align their portfolios with specific environmental goals and financial objectives.

Comparison Table

| Aspect | Forestry Investment | Timberland Investment |

|---|---|---|

| Definition | Investing in the management and growth of forest ecosystems for sustainable timber production and environmental benefits. | Acquisition and management of timberland properties focused on timber harvesting and long-term asset appreciation. |

| Primary Focus | Forest health, biodiversity, and sustainable growth of trees. | Commercial timber production and land value increase. |

| Investment Horizon | Long-term (10+ years) for growth cycles and ecosystem maturity. | Long to medium-term (5-20 years) based on timber harvest cycles and land value fluctuations. |

| Returns | Revenue from sustainable timber sales, carbon credits, and ecosystem services. | Timber sale profits, land appreciation, and potential leasing income. |

| Risk Factors | Natural disasters, pests, market price volatility, regulatory changes. | Market demand shifts, land use regulations, environmental risks, operational costs. |

| Liquidity | Low liquidity due to extended growth cycles and market niche. | Moderate liquidity depending on land market conditions. |

| Environmental Impact | High focus on sustainability, carbon sequestration, and biodiversity preservation. | Variable; depends on management practices and harvesting methods. |

Which is better?

Timberland investment typically offers higher returns than general forestry investment due to its focus on mature, harvest-ready trees that generate consistent revenue through timber sales. Forestry investment, while broader and more diverse, often involves longer growth cycles and may include conservation or recreational land uses that provide less direct financial return. Investors seeking more predictable cash flow and potential for capital appreciation often prefer timberland assets over general forestry holdings.

Connection

Forestry investment and timberland investment are intrinsically connected as both involve allocating capital into forested land to generate financial returns through the sustainable management of timber resources. Timberland investment specifically focuses on acquiring and managing forested properties for timber production, carbon credits, and land appreciation, making it a subset of broader forestry investment strategies. The growing demand for renewable raw materials and environmental sustainability increases the value and appeal of timberland investment within the forestry sector.

Key Terms

Asset Diversification

Timberland investment offers asset diversification by providing consistent cash flow through timber harvesting alongside potential land appreciation, making it a hybrid of real estate and commodity investment. Forestry investment, while similar, often emphasizes sustainable management and ecosystem services, contributing to environmental benefits and carbon credit opportunities. Explore our comprehensive guide to understand how these investment types can enhance your portfolio diversification and risk management.

Biological Growth Yield

Timberland investment centers on acquiring land rich in mature trees for immediate timber production, emphasizing commercial harvest cycles, while forestry investment focuses more broadly on sustainable forest management practices that optimize biological growth yield through reforestation and ecosystem restoration. Biological growth yield measures the rate at which forest biomass increases, directly impacting the long-term profitability and ecological value of forestry assets. Discover more about maximizing returns by understanding the critical differences in managing timberland and forestry investments.

Land Ownership Rights

Timberland investment emphasizes long-term land ownership rights, providing investors with tangible assets and stable revenue streams from sustainable timber harvesting. Forestry investment often includes broader ecosystem services and conservation easements, which may restrict land use but enhance environmental benefits and biodiversity. Explore the nuances of land ownership rights and their impact on investment returns and sustainability.

Source and External Links

Timberland | Institutional - Manulife Investment Management - Timberland investment offers portfolio diversification, inflation protection, and environmental benefits through sustainable management and carbon credit generation, leveraging nearly 40 years of experience in the sector.

Timberland - Overview, How to Diversify, Benefits of Investing - Timberland investing involves managed tree plantations or natural forests, providing steady biological growth and portfolio diversification, commonly held by large institutional investors like pension funds and endowments.

Timberland | J.P. Morgan Asset Management - Timberland offers benefits such as inflation risk management, diversified income sources, low correlation to traditional assets, and sustainability through carbon sequestration and biodiversity support, delivered via expert management strategies.

dowidth.com

dowidth.com