Litigation funding involves providing capital to cover legal costs in exchange for a portion of the settlement or judgment, offering high-risk, potentially high-return investment opportunities. Art investment focuses on acquiring valuable artworks that appreciate over time, blending cultural value with financial growth in a less liquid market. Explore these distinct investment avenues to understand risk profiles and potential returns.

Why it is important

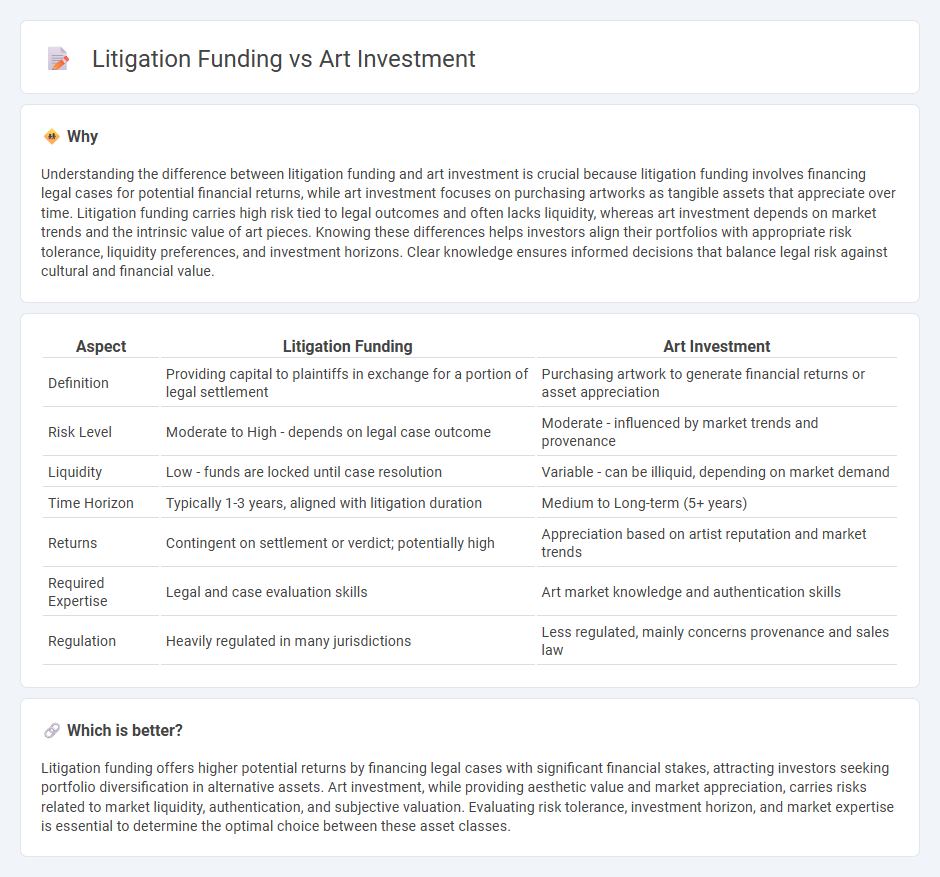

Understanding the difference between litigation funding and art investment is crucial because litigation funding involves financing legal cases for potential financial returns, while art investment focuses on purchasing artworks as tangible assets that appreciate over time. Litigation funding carries high risk tied to legal outcomes and often lacks liquidity, whereas art investment depends on market trends and the intrinsic value of art pieces. Knowing these differences helps investors align their portfolios with appropriate risk tolerance, liquidity preferences, and investment horizons. Clear knowledge ensures informed decisions that balance legal risk against cultural and financial value.

Comparison Table

| Aspect | Litigation Funding | Art Investment |

|---|---|---|

| Definition | Providing capital to plaintiffs in exchange for a portion of legal settlement | Purchasing artwork to generate financial returns or asset appreciation |

| Risk Level | Moderate to High - depends on legal case outcome | Moderate - influenced by market trends and provenance |

| Liquidity | Low - funds are locked until case resolution | Variable - can be illiquid, depending on market demand |

| Time Horizon | Typically 1-3 years, aligned with litigation duration | Medium to Long-term (5+ years) |

| Returns | Contingent on settlement or verdict; potentially high | Appreciation based on artist reputation and market trends |

| Required Expertise | Legal and case evaluation skills | Art market knowledge and authentication skills |

| Regulation | Heavily regulated in many jurisdictions | Less regulated, mainly concerns provenance and sales law |

Which is better?

Litigation funding offers higher potential returns by financing legal cases with significant financial stakes, attracting investors seeking portfolio diversification in alternative assets. Art investment, while providing aesthetic value and market appreciation, carries risks related to market liquidity, authentication, and subjective valuation. Evaluating risk tolerance, investment horizon, and market expertise is essential to determine the optimal choice between these asset classes.

Connection

Litigation funding and art investment intersect through the use of alternative assets to diversify portfolios and manage risk. Litigation funding provides capital for legal claims with potential high returns, similar to how art investment involves acquiring valuable artworks that appreciate over time. Both serve as non-traditional investment strategies appealing to investors seeking uncorrelated assets beyond stocks and bonds.

Key Terms

**Art Investment:**

Art investment offers a unique opportunity to diversify portfolios through tangible assets with potential for significant appreciation, driven by market trends and artist reputation. Unlike litigation funding, which depends on the outcome of legal cases, art investments benefit from historical performance and cultural value, appealing to collectors and investors seeking long-term growth. Explore further to understand how art investment can enhance your financial strategy.

Provenance

Art investment relies heavily on provenance to authenticate the artwork's history and value, ensuring investors acquire genuine and valuable pieces. Litigation funding, by contrast, uses provenance to verify the legal history and ownership chain of assets involved in disputes, reducing risks related to fraudulent claims. Explore further how provenance plays a critical role in assessing risks and securing investments in both sectors.

Liquidity

Art investment offers limited liquidity due to the niche market and variable demand, often requiring extended holding periods before profitable sales. Litigation funding provides more structured liquidity as cases progress, with returns tied to legal outcomes, though timelines remain uncertain. Explore the nuances of liquidity in both sectors to better align your investment strategy.

Source and External Links

Basics of Art Funds and their Managers , The Art Fund Association - Art funds are investment vehicles focusing on acquiring and selling artworks, employing strategies like buy-and-hold, geographic arbitrage, and investing in emerging artists, offering benefits such as portfolio diversification and inflation hedging.

Investing in art: What to know about turning a passion into a ... - Art investment carries risks like lack of liquidity and value fluctuations based on trends but provides benefits including portfolio diversification, inflation protection, potential tax advantages, and can add cultural worth to a collection.

How to Invest in Art: A Seven-Point Guide to Help You Understand ... - Compared to other passion assets like cars or wine, art has delivered superior returns as a tangible, culturally significant asset that requires minimal upkeep and does not devalue through use, making it a preferred choice for wealthy investors.

dowidth.com

dowidth.com