Eco-friendly cryptocurrencies leverage blockchain technology to minimize environmental impact by using energy-efficient consensus mechanisms and supporting green initiatives. Socially responsible mutual funds invest in companies with strong environmental, social, and governance (ESG) criteria, aligning portfolios with ethical and sustainable business practices. Explore the benefits and differences of these investment options to make informed decisions aligned with your values.

Why it is important

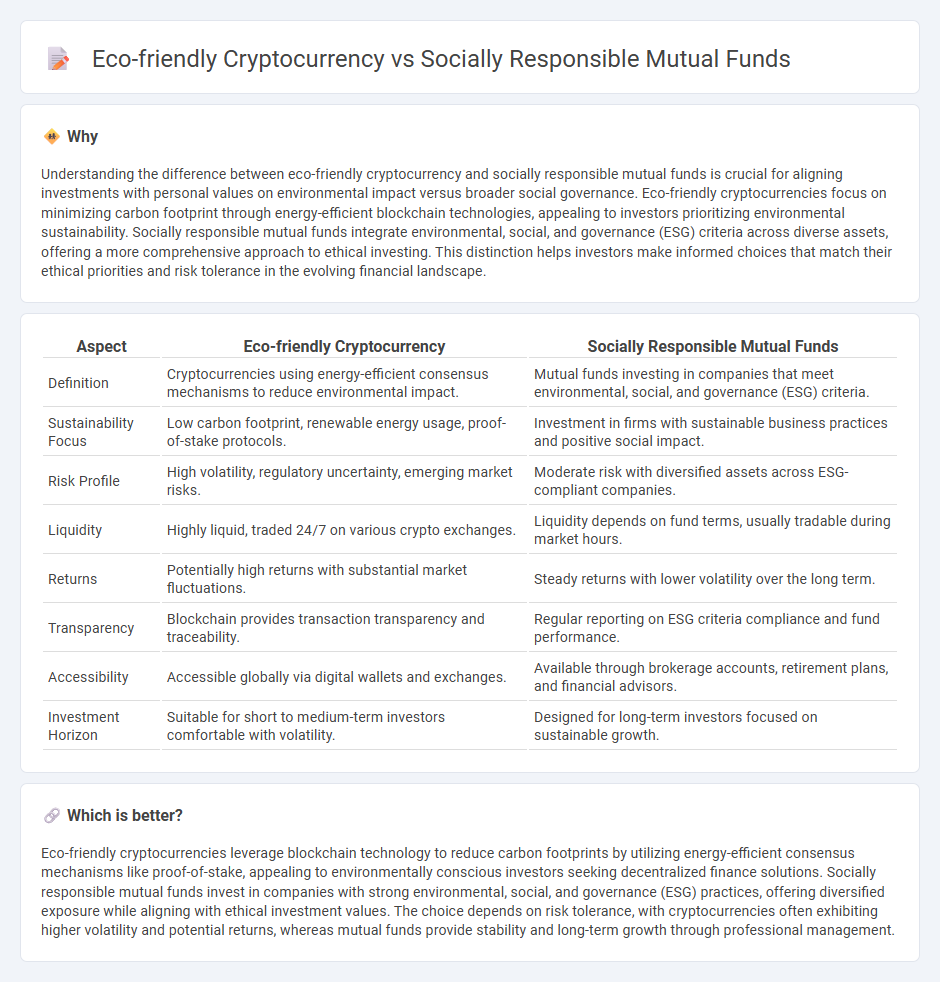

Understanding the difference between eco-friendly cryptocurrency and socially responsible mutual funds is crucial for aligning investments with personal values on environmental impact versus broader social governance. Eco-friendly cryptocurrencies focus on minimizing carbon footprint through energy-efficient blockchain technologies, appealing to investors prioritizing environmental sustainability. Socially responsible mutual funds integrate environmental, social, and governance (ESG) criteria across diverse assets, offering a more comprehensive approach to ethical investing. This distinction helps investors make informed choices that match their ethical priorities and risk tolerance in the evolving financial landscape.

Comparison Table

| Aspect | Eco-friendly Cryptocurrency | Socially Responsible Mutual Funds |

|---|---|---|

| Definition | Cryptocurrencies using energy-efficient consensus mechanisms to reduce environmental impact. | Mutual funds investing in companies that meet environmental, social, and governance (ESG) criteria. |

| Sustainability Focus | Low carbon footprint, renewable energy usage, proof-of-stake protocols. | Investment in firms with sustainable business practices and positive social impact. |

| Risk Profile | High volatility, regulatory uncertainty, emerging market risks. | Moderate risk with diversified assets across ESG-compliant companies. |

| Liquidity | Highly liquid, traded 24/7 on various crypto exchanges. | Liquidity depends on fund terms, usually tradable during market hours. |

| Returns | Potentially high returns with substantial market fluctuations. | Steady returns with lower volatility over the long term. |

| Transparency | Blockchain provides transaction transparency and traceability. | Regular reporting on ESG criteria compliance and fund performance. |

| Accessibility | Accessible globally via digital wallets and exchanges. | Available through brokerage accounts, retirement plans, and financial advisors. |

| Investment Horizon | Suitable for short to medium-term investors comfortable with volatility. | Designed for long-term investors focused on sustainable growth. |

Which is better?

Eco-friendly cryptocurrencies leverage blockchain technology to reduce carbon footprints by utilizing energy-efficient consensus mechanisms like proof-of-stake, appealing to environmentally conscious investors seeking decentralized finance solutions. Socially responsible mutual funds invest in companies with strong environmental, social, and governance (ESG) practices, offering diversified exposure while aligning with ethical investment values. The choice depends on risk tolerance, with cryptocurrencies often exhibiting higher volatility and potential returns, whereas mutual funds provide stability and long-term growth through professional management.

Connection

Eco-friendly cryptocurrencies utilize energy-efficient blockchain technologies that reduce carbon footprints, aligning closely with the environmental values prioritized by socially responsible mutual funds. These funds invest specifically in companies and assets committed to sustainability, often including green digital currencies as part of their diversified portfolios. The connection lies in their shared goal to promote sustainable investment practices that balance financial returns with positive environmental impact.

Key Terms

ESG (Environmental, Social, and Governance)

Socially responsible mutual funds selectively invest in companies excelling in Environmental, Social, and Governance (ESG) criteria, aiming to generate sustainable returns while promoting positive societal impact. Eco-friendly cryptocurrencies prioritize reduced carbon footprints through energy-efficient consensus mechanisms like proof-of-stake compared to traditional proof-of-work systems, aligning digital asset investments with environmental sustainability. Explore the evolving landscape of ESG-focused investment options to make informed financial decisions aligned with your values.

Carbon Footprint

Socially responsible mutual funds invest in companies committed to reducing their carbon footprint through sustainable practices and renewable energy adoption. Eco-friendly cryptocurrencies utilize energy-efficient consensus mechanisms, such as proof-of-stake, significantly lowering emissions compared to traditional proof-of-work chains. Explore detailed comparisons and benefits to understand which investment aligns best with your environmental values.

Impact Investing

Socially responsible mutual funds channel investments into companies demonstrating strong environmental, social, and governance (ESG) practices, offering diversified portfolios aligned with sustainable values. Eco-friendly cryptocurrencies utilize blockchain technology with low energy consumption protocols, promoting green innovation while addressing climate concerns within digital finance. Explore the evolving landscape of impact investing to discover how your capital can drive meaningful change.

Source and External Links

Socially Responsible Investing | Green America - Socially responsible mutual funds (SRI, impact, or ESG funds) allow investors to align their portfolios with companies demonstrating strong environmental, social, and governance (ESG) practices, positive community impact, and transparency, while avoiding those lacking in these areas.

5 Top-Performing ESG Funds in 2024 | Morningstar - Leading ESG funds such as Putnam Sustainable Leaders and Alger Responsible Investing focus on companies with low carbon risk, sustainable business models, and minimal exposure to controversies, often outperforming peers in environmental and social metrics.

Investing in ESG Funds: Reflect What Matters Most | Vanguard - Vanguard offers a range of ESG mutual funds and ETFs, including indexed options that exclude companies failing to meet ESG criteria and actively managed funds targeting firms with leading or improving ESG practices, all while maintaining diversification and low costs.

dowidth.com

dowidth.com