Tax lien certificates offer investors a secured interest in property tax payments, often providing high returns with relatively low risk by acquiring the government's claim on delinquent taxes. Mortgage notes represent promissory notes secured by real estate, granting investors steady income through borrower repayments and potential property ownership upon default. Discover the key differences between tax lien certificates and mortgage notes to optimize your investment strategy.

Why it is important

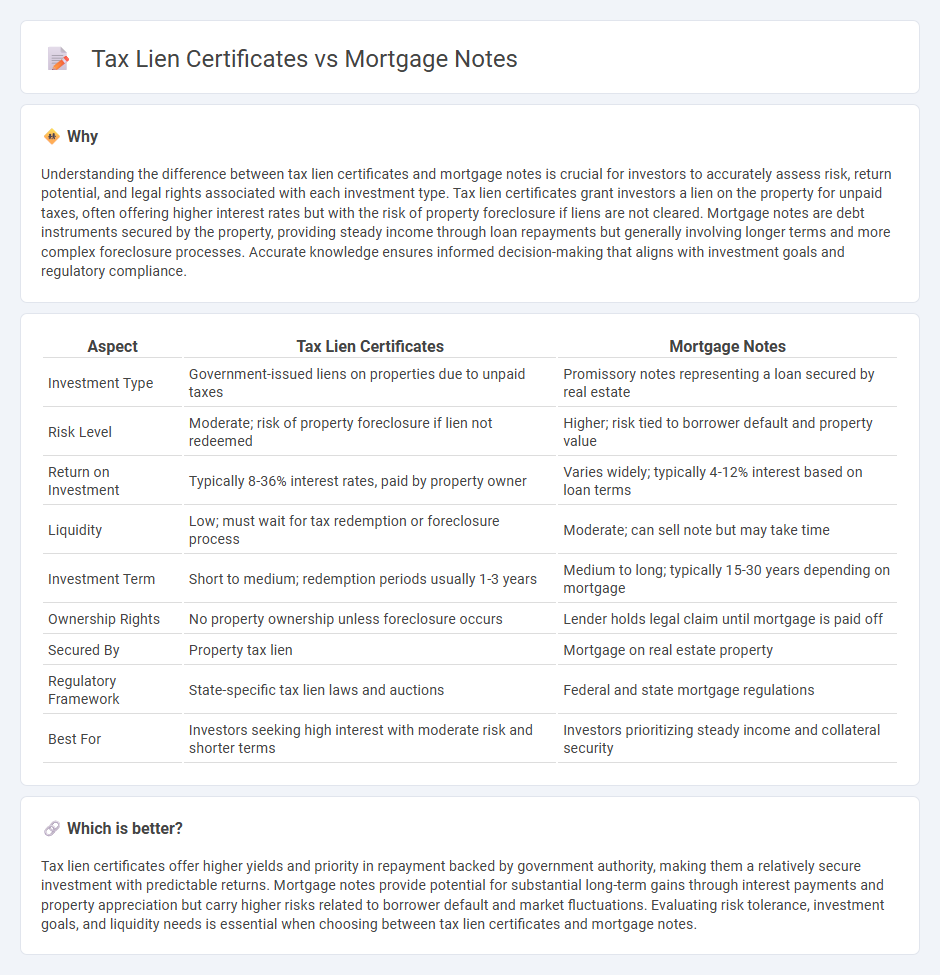

Understanding the difference between tax lien certificates and mortgage notes is crucial for investors to accurately assess risk, return potential, and legal rights associated with each investment type. Tax lien certificates grant investors a lien on the property for unpaid taxes, often offering higher interest rates but with the risk of property foreclosure if liens are not cleared. Mortgage notes are debt instruments secured by the property, providing steady income through loan repayments but generally involving longer terms and more complex foreclosure processes. Accurate knowledge ensures informed decision-making that aligns with investment goals and regulatory compliance.

Comparison Table

| Aspect | Tax Lien Certificates | Mortgage Notes |

|---|---|---|

| Investment Type | Government-issued liens on properties due to unpaid taxes | Promissory notes representing a loan secured by real estate |

| Risk Level | Moderate; risk of property foreclosure if lien not redeemed | Higher; risk tied to borrower default and property value |

| Return on Investment | Typically 8-36% interest rates, paid by property owner | Varies widely; typically 4-12% interest based on loan terms |

| Liquidity | Low; must wait for tax redemption or foreclosure process | Moderate; can sell note but may take time |

| Investment Term | Short to medium; redemption periods usually 1-3 years | Medium to long; typically 15-30 years depending on mortgage |

| Ownership Rights | No property ownership unless foreclosure occurs | Lender holds legal claim until mortgage is paid off |

| Secured By | Property tax lien | Mortgage on real estate property |

| Regulatory Framework | State-specific tax lien laws and auctions | Federal and state mortgage regulations |

| Best For | Investors seeking high interest with moderate risk and shorter terms | Investors prioritizing steady income and collateral security |

Which is better?

Tax lien certificates offer higher yields and priority in repayment backed by government authority, making them a relatively secure investment with predictable returns. Mortgage notes provide potential for substantial long-term gains through interest payments and property appreciation but carry higher risks related to borrower default and market fluctuations. Evaluating risk tolerance, investment goals, and liquidity needs is essential when choosing between tax lien certificates and mortgage notes.

Connection

Tax lien certificates and mortgage notes are both financial instruments tied to real estate debt, providing investors with potential income through interest or property ownership. Tax lien certificates represent claims on property for unpaid taxes, allowing investors to collect fees or foreclose if obligations remain unmet, while mortgage notes are promissory documents securing loans with property as collateral. Both involve risks related to property value and borrower repayment, making them interconnected tools in real estate investment strategies.

Key Terms

Collateral

Mortgage notes are secured by real property, providing lenders with a lien on the borrower's home or land as collateral, ensuring repayment through the property's value. Tax lien certificates represent claims against a property for unpaid property taxes, giving investors a lien priority that often surpasses other debts but does not transfer ownership unless the lien is not resolved. Explore further differences in risk, return, and legal processes to make informed investment decisions.

Yield

Mortgage notes typically offer yields ranging from 4% to 12%, depending on credit risk and loan terms, providing steady interest income over the loan duration. Tax lien certificates can deliver higher yields, often between 8% to 36%, as governments impose penalties and interest to recover unpaid property taxes. Explore our in-depth analysis to compare the yield potential and risk profiles of mortgage notes versus tax lien certificates.

Foreclosure

Mortgage notes represent a borrower's promise to repay a loan secured by real estate, with foreclosure as a lender's recourse if payments default, allowing sale of the property to recover the debt. Tax lien certificates arise when a government places a claim on a property due to unpaid taxes, often leading to foreclosure if the lienholder enforces the obligation after redemption periods expire. Explore how foreclosure processes differ between mortgage notes and tax lien certificates to understand investment risks and recovery methods more deeply.

Source and External Links

Mortgage Note: What Is It And How Does It Work? - A mortgage note is a legal closing document representing a home loan that includes a promissory note where the borrower promises to repay the loan under specified terms such as amount, interest rate, and payment schedule.

What is a mortgage note? - It is a legal document between the lender and borrower outlining the mortgage terms, including loan amount, payment schedule, interest rate type, and penalties, and once signed, becomes legally binding.

Mortgage Note: What It Is, How It Works, How to Sell One - Mortgage notes come in types like secured loans, private loans, and institutional loans, each with specific terms impacted by loan type, collateral, regulation, and borrower risk profile.

dowidth.com

dowidth.com