Music royalties provide investors with a steady income stream derived from intellectual property rights, offering diversification beyond traditional asset classes. Commodities, such as gold and oil, present opportunities tied to physical goods with prices influenced by global supply and demand factors. Explore the unique benefits and risks of both investments to enhance your portfolio strategy.

Why it is important

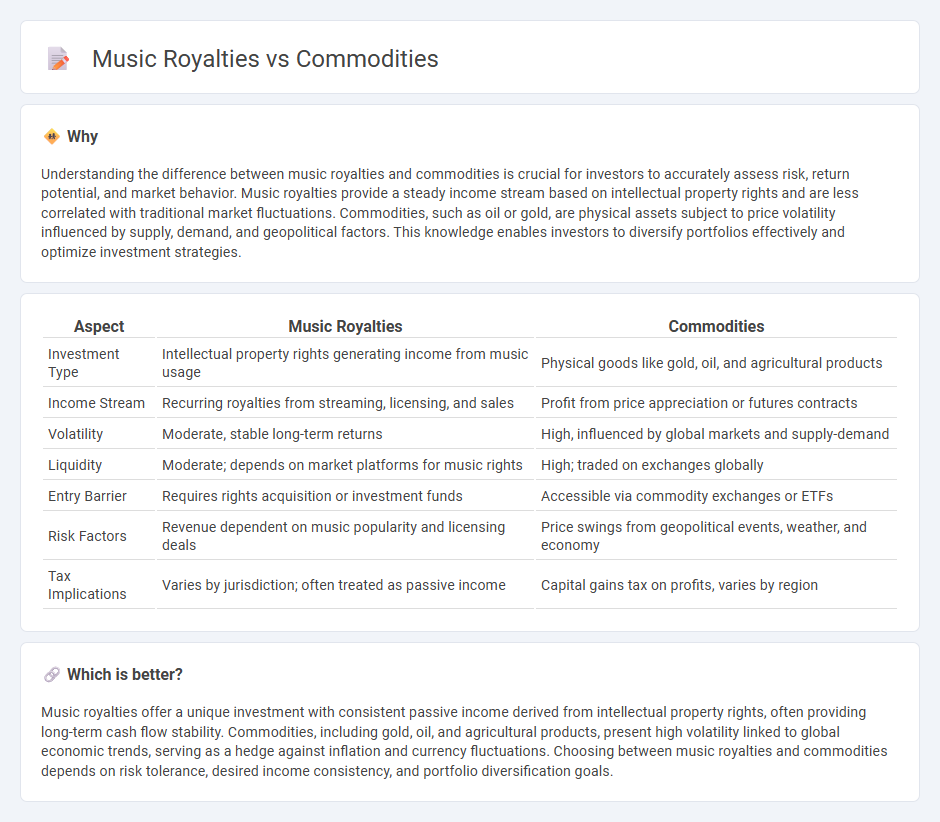

Understanding the difference between music royalties and commodities is crucial for investors to accurately assess risk, return potential, and market behavior. Music royalties provide a steady income stream based on intellectual property rights and are less correlated with traditional market fluctuations. Commodities, such as oil or gold, are physical assets subject to price volatility influenced by supply, demand, and geopolitical factors. This knowledge enables investors to diversify portfolios effectively and optimize investment strategies.

Comparison Table

| Aspect | Music Royalties | Commodities |

|---|---|---|

| Investment Type | Intellectual property rights generating income from music usage | Physical goods like gold, oil, and agricultural products |

| Income Stream | Recurring royalties from streaming, licensing, and sales | Profit from price appreciation or futures contracts |

| Volatility | Moderate, stable long-term returns | High, influenced by global markets and supply-demand |

| Liquidity | Moderate; depends on market platforms for music rights | High; traded on exchanges globally |

| Entry Barrier | Requires rights acquisition or investment funds | Accessible via commodity exchanges or ETFs |

| Risk Factors | Revenue dependent on music popularity and licensing deals | Price swings from geopolitical events, weather, and economy |

| Tax Implications | Varies by jurisdiction; often treated as passive income | Capital gains tax on profits, varies by region |

Which is better?

Music royalties offer a unique investment with consistent passive income derived from intellectual property rights, often providing long-term cash flow stability. Commodities, including gold, oil, and agricultural products, present high volatility linked to global economic trends, serving as a hedge against inflation and currency fluctuations. Choosing between music royalties and commodities depends on risk tolerance, desired income consistency, and portfolio diversification goals.

Connection

Music royalties represent a form of intellectual property investment that generates passive income through licensing and streaming revenues, similar to how commodities provide tangible asset value influenced by market demand. Both assets are subject to market fluctuations, with music royalties offering predictable cash flows from royalties, while commodities respond to supply chain and geopolitical factors. Diversifying investment portfolios with music royalties and commodities can mitigate risk by balancing intangible income streams with physical asset exposure.

Key Terms

Asset Class

Commodities offer tangible assets like oil, gold, and agricultural products, providing diversification and inflation hedging in investment portfolios. Music royalties represent an alternative asset class with income derived from intellectual property rights, often yielding steady cash flows and long-term value appreciation through streaming and licensing. Explore this evolving asset landscape to understand the unique benefits and risks of commodities versus music royalties.

Market Liquidity

Commodity markets offer high liquidity due to standardized contracts and active trading on exchanges like the CME and NYMEX, enabling investors to enter and exit positions quickly. Music royalties, as alternative assets, typically exhibit lower liquidity since transactions depend on private deals and niche marketplaces such as Royalty Exchange. Explore the differences in market liquidity and investment potential between these asset classes to make informed portfolio decisions.

Revenue Stream

Commodities trading generates revenue through price fluctuations in physical goods like oil, gold, and agricultural products, relying on market demand and supply dynamics. Music royalties offer a steady income stream derived from copyright ownership, streaming platforms, licensing deals, and public performances, providing consistent cash flow based on intellectual property rights. Explore the nuances of these revenue streams to understand their distinct financial potentials and investment strategies.

Source and External Links

Understanding Commodities - PIMCO - This webpage provides an overview of commodities, including their definition, types, and how they are traded through futures and options contracts.

Commodities Versus Differentiated Products | Ag Decision Maker - This article discusses the distinction between commodities and differentiated products, highlighting that commodities are fungible and identical across producers.

Commodities - Investor.gov - This webpage explains commodity futures contracts and the regulations surrounding their trading, emphasizing the role of the Commodity Futures Trading Commission.

dowidth.com

dowidth.com