Farmland funds and timberland funds offer unique investment opportunities by leveraging natural resources with distinct growth and income potential; farmland funds focus on agricultural land generating revenue from crop production, while timberland funds invest in forested areas providing returns through timber sales and land appreciation. Both asset classes offer diversification benefits and inflation hedging but differ in liquidity, management requirements, and market drivers. Explore the comparative advantages and risks of farmland versus timberland funds to make informed investment decisions.

Why it is important

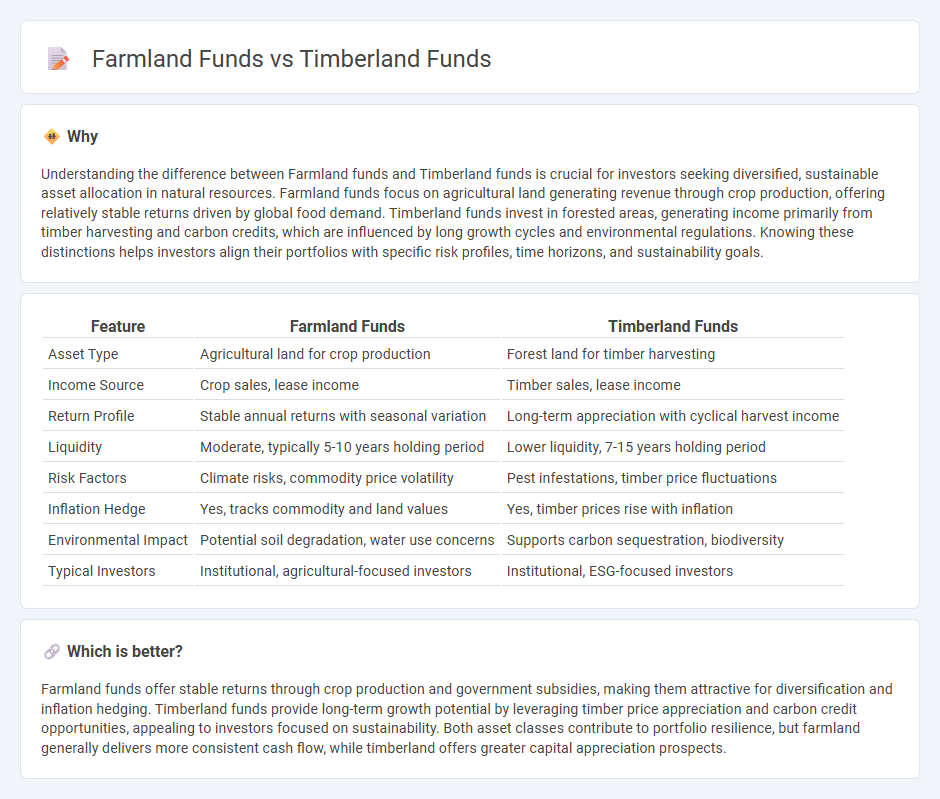

Understanding the difference between Farmland funds and Timberland funds is crucial for investors seeking diversified, sustainable asset allocation in natural resources. Farmland funds focus on agricultural land generating revenue through crop production, offering relatively stable returns driven by global food demand. Timberland funds invest in forested areas, generating income primarily from timber harvesting and carbon credits, which are influenced by long growth cycles and environmental regulations. Knowing these distinctions helps investors align their portfolios with specific risk profiles, time horizons, and sustainability goals.

Comparison Table

| Feature | Farmland Funds | Timberland Funds |

|---|---|---|

| Asset Type | Agricultural land for crop production | Forest land for timber harvesting |

| Income Source | Crop sales, lease income | Timber sales, lease income |

| Return Profile | Stable annual returns with seasonal variation | Long-term appreciation with cyclical harvest income |

| Liquidity | Moderate, typically 5-10 years holding period | Lower liquidity, 7-15 years holding period |

| Risk Factors | Climate risks, commodity price volatility | Pest infestations, timber price fluctuations |

| Inflation Hedge | Yes, tracks commodity and land values | Yes, timber prices rise with inflation |

| Environmental Impact | Potential soil degradation, water use concerns | Supports carbon sequestration, biodiversity |

| Typical Investors | Institutional, agricultural-focused investors | Institutional, ESG-focused investors |

Which is better?

Farmland funds offer stable returns through crop production and government subsidies, making them attractive for diversification and inflation hedging. Timberland funds provide long-term growth potential by leveraging timber price appreciation and carbon credit opportunities, appealing to investors focused on sustainability. Both asset classes contribute to portfolio resilience, but farmland generally delivers more consistent cash flow, while timberland offers greater capital appreciation prospects.

Connection

Farmland funds and timberland funds are connected through their classification as alternative real asset investments that generate returns from natural resource management. Both fund types leverage the increasing global demand for agricultural products and sustainable timber, providing portfolio diversification and inflation hedging. Investors benefit from stable income streams derived from lease payments, crop yields, and timber sales while contributing to environmental stewardship and land value appreciation.

Key Terms

Asset Type

Timberland funds invest primarily in forested land for timber production and carbon sequestration, offering returns through sustainable harvesting and environmental services. Farmland funds focus on agricultural land used for crop cultivation and livestock, generating income from crop sales and land appreciation. Explore the distinct benefits and risks of timberland versus farmland investments to make an informed decision.

Revenue Source

Timberland funds primarily generate revenue through sustainable timber harvesting, land appreciation, and ancillary eco-tourism activities, while farmland funds rely on crop yields, lease income from farmers, and agri-based subsidies for income generation. Timberland investments benefit from long-term growth and stable cash flow due to the cyclical nature of timber markets, whereas farmland funds are more sensitive to seasonal agricultural productivity and commodity price fluctuations. Explore the nuances of these unique asset classes to understand their revenue dynamics in-depth.

Biological Risk

Timberland funds face biological risks including pests, diseases, and wildfires that can significantly impact tree growth and timber yields, whereas farmland funds primarily contend with risks like soil degradation, crop pests, and climate variability affecting crop production. Both asset classes require proactive management strategies and investment in sustainable practices to mitigate these biological threats and maintain long-term value. Explore detailed analyses on managing biological risk in Timberland and Farmland funds to enhance your investment decisions.

Source and External Links

Timberland - Meketa Investment Group - The timberland investment industry raised a record $3.7 billion across 10 funds in 2008, but fundraising slowed after the financial crisis, with timberland funds accounting for just 2% of capital raised in natural resources between 2015-2019.

Timberland | Institutional - Manulife Investment Management - Manulife offers global, sustainable timberland investment solutions through commingled funds and individual accounts tailored for institutional investors, highlighting the benefits of long-term timberland investment and carbon market integration.

Timberland - Stafford Capital Partners - Stafford Capital Partners manages global timberland funds and provides advisory services, offering pooled funds, co-investment opportunities, and carbon timberland investments focused on sustainable forest management and verified carbon offsets.

dowidth.com

dowidth.com