Sneakers flipping involves buying limited-edition sneakers at retail prices and reselling them at a higher value, capitalizing on trends and brand exclusivity, while stock trading focuses on buying and selling shares of publicly traded companies to profit from market fluctuations and dividends. Sneakers flipping often requires niche knowledge of sneaker culture, release schedules, and market demand, whereas stock trading demands understanding of financial indicators, market analysis, and economic trends. Explore the key differences and strategies to determine which investment approach aligns with your goals.

Why it is important

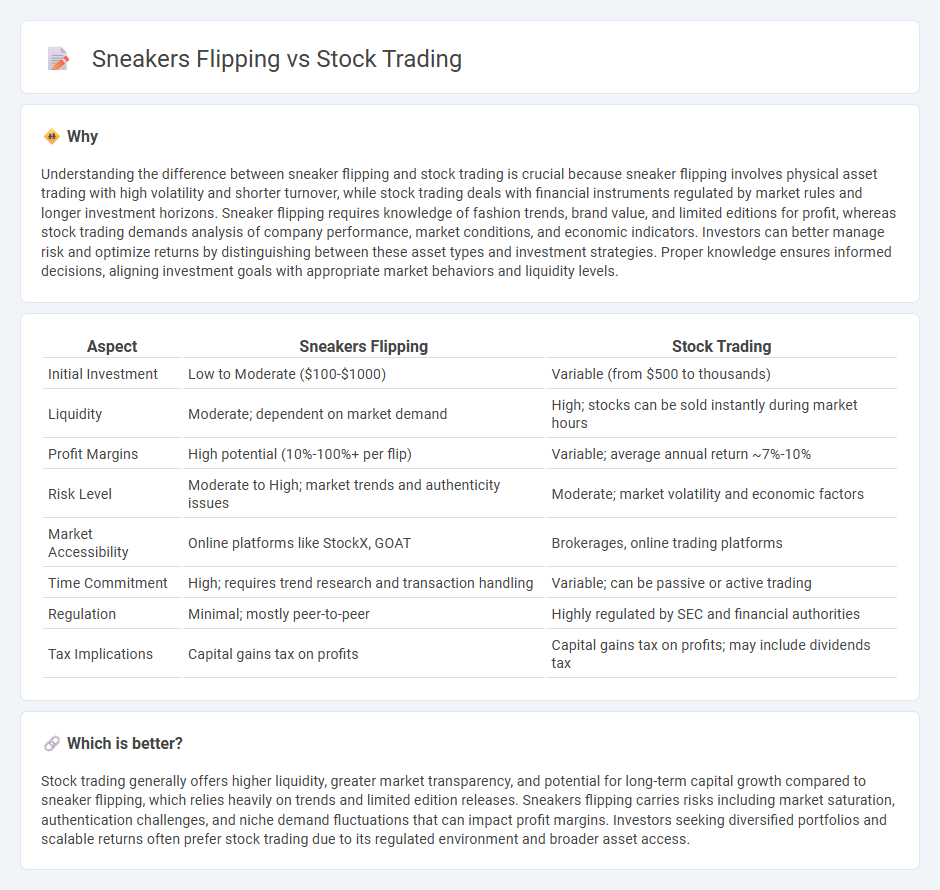

Understanding the difference between sneaker flipping and stock trading is crucial because sneaker flipping involves physical asset trading with high volatility and shorter turnover, while stock trading deals with financial instruments regulated by market rules and longer investment horizons. Sneaker flipping requires knowledge of fashion trends, brand value, and limited editions for profit, whereas stock trading demands analysis of company performance, market conditions, and economic indicators. Investors can better manage risk and optimize returns by distinguishing between these asset types and investment strategies. Proper knowledge ensures informed decisions, aligning investment goals with appropriate market behaviors and liquidity levels.

Comparison Table

| Aspect | Sneakers Flipping | Stock Trading |

|---|---|---|

| Initial Investment | Low to Moderate ($100-$1000) | Variable (from $500 to thousands) |

| Liquidity | Moderate; dependent on market demand | High; stocks can be sold instantly during market hours |

| Profit Margins | High potential (10%-100%+ per flip) | Variable; average annual return ~7%-10% |

| Risk Level | Moderate to High; market trends and authenticity issues | Moderate; market volatility and economic factors |

| Market Accessibility | Online platforms like StockX, GOAT | Brokerages, online trading platforms |

| Time Commitment | High; requires trend research and transaction handling | Variable; can be passive or active trading |

| Regulation | Minimal; mostly peer-to-peer | Highly regulated by SEC and financial authorities |

| Tax Implications | Capital gains tax on profits | Capital gains tax on profits; may include dividends tax |

Which is better?

Stock trading generally offers higher liquidity, greater market transparency, and potential for long-term capital growth compared to sneaker flipping, which relies heavily on trends and limited edition releases. Sneakers flipping carries risks including market saturation, authentication challenges, and niche demand fluctuations that can impact profit margins. Investors seeking diversified portfolios and scalable returns often prefer stock trading due to its regulated environment and broader asset access.

Connection

Sneakers flipping and stock trading both rely on market demand, timing, and price volatility to generate profits. Investors analyze trends, limited releases, and resale values in sneakers, similar to how traders study market indicators and company performance in stocks. Both practices require strategic buying low and selling high to maximize returns.

Key Terms

**Stock trading:**

Stock trading involves buying and selling shares in publicly traded companies on stock exchanges like the NYSE and NASDAQ, aiming for profit through market value fluctuations and dividends. Key strategies include day trading, swing trading, and long-term investing, each requiring analysis of market trends, financial statements, and economic indicators. Explore in-depth methods and tips to maximize returns in stock trading.

Dividend

Stock trading offers the potential for dividends, providing investors with a steady income stream based on company profits, which sneakers flipping lacks since it relies solely on capital gains from resale. Dividend-paying stocks like those in the S&P 500 often deliver consistent returns and long-term wealth accumulation through reinvestment. Explore the advantages of dividend investing versus asset flipping to optimize your financial strategies.

Portfolio

Stock trading involves diversifying assets across various sectors like technology, healthcare, and finance to optimize returns and mitigate risks in an investment portfolio. Sneakers flipping requires careful selection of limited-edition releases and trending brands to build a collection that appreciates rapidly in resale value. Explore how portfolio strategies differ in these two markets for maximizing profit and managing risk.

Source and External Links

Stock Trading: What It Is and How It Works - This article provides an introduction to stock trading, explaining how it involves buying and selling shares to make a profit.

How Online Stock Trading Works: Understanding the Online Trade Lifecycle - This resource outlines the process of online stock trading, detailing the steps from placing an order to executing a trade.

Stock Trading at Charles Schwab - This site offers tools and insights for stock trading, including commission-free online trades and diversified investment options.

dowidth.com

dowidth.com