Sneaker flipping capitalizes on high-demand, limited-edition releases that rapidly appreciate in value due to trends and scarcity, offering quick turnover potential. Jewelry investing focuses on tangible assets like gold, diamonds, and designer pieces that provide long-term value stability and hedge against inflation. Explore how each investment strategy aligns with your financial goals and risk tolerance.

Why it is important

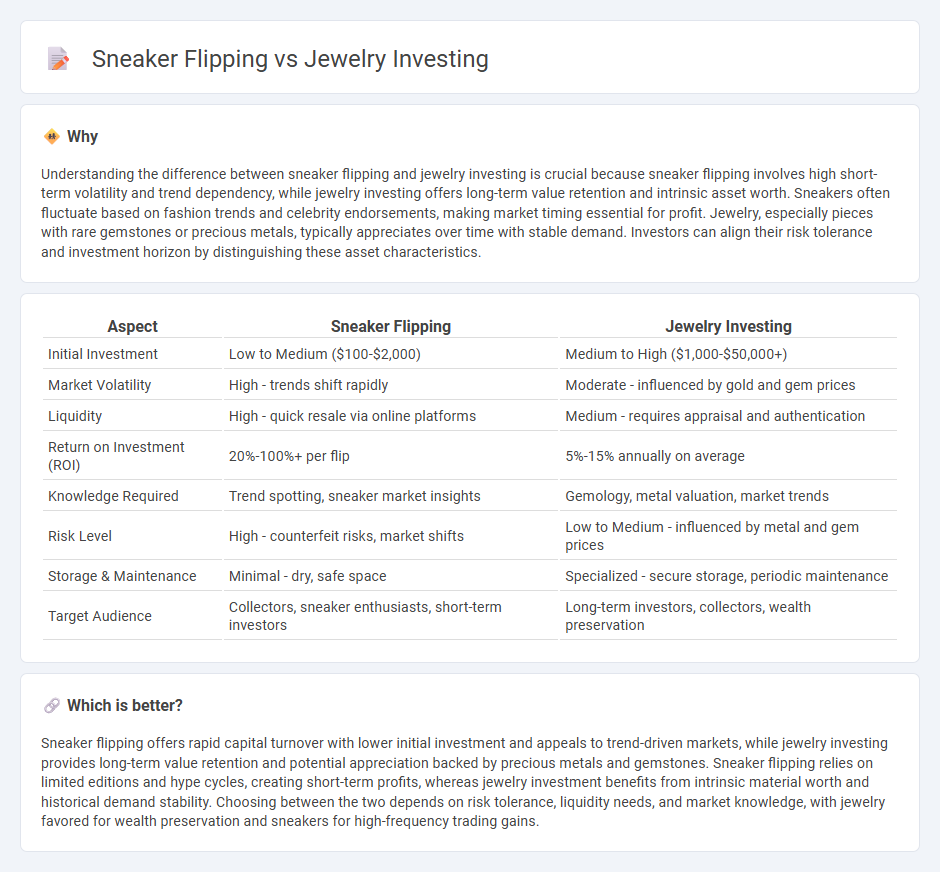

Understanding the difference between sneaker flipping and jewelry investing is crucial because sneaker flipping involves high short-term volatility and trend dependency, while jewelry investing offers long-term value retention and intrinsic asset worth. Sneakers often fluctuate based on fashion trends and celebrity endorsements, making market timing essential for profit. Jewelry, especially pieces with rare gemstones or precious metals, typically appreciates over time with stable demand. Investors can align their risk tolerance and investment horizon by distinguishing these asset characteristics.

Comparison Table

| Aspect | Sneaker Flipping | Jewelry Investing |

|---|---|---|

| Initial Investment | Low to Medium ($100-$2,000) | Medium to High ($1,000-$50,000+) |

| Market Volatility | High - trends shift rapidly | Moderate - influenced by gold and gem prices |

| Liquidity | High - quick resale via online platforms | Medium - requires appraisal and authentication |

| Return on Investment (ROI) | 20%-100%+ per flip | 5%-15% annually on average |

| Knowledge Required | Trend spotting, sneaker market insights | Gemology, metal valuation, market trends |

| Risk Level | High - counterfeit risks, market shifts | Low to Medium - influenced by metal and gem prices |

| Storage & Maintenance | Minimal - dry, safe space | Specialized - secure storage, periodic maintenance |

| Target Audience | Collectors, sneaker enthusiasts, short-term investors | Long-term investors, collectors, wealth preservation |

Which is better?

Sneaker flipping offers rapid capital turnover with lower initial investment and appeals to trend-driven markets, while jewelry investing provides long-term value retention and potential appreciation backed by precious metals and gemstones. Sneaker flipping relies on limited editions and hype cycles, creating short-term profits, whereas jewelry investment benefits from intrinsic material worth and historical demand stability. Choosing between the two depends on risk tolerance, liquidity needs, and market knowledge, with jewelry favored for wealth preservation and sneakers for high-frequency trading gains.

Connection

Sneaker flipping and jewelry investing both involve acquiring rare or limited-edition items with the potential for value appreciation over time. Both markets rely heavily on trends, brand reputation, and authenticity verification to determine resale value and investment potential. Investors in these sectors often utilize online platforms and communities to track demand, price fluctuations, and authenticate products for profitable transactions.

Key Terms

**Jewelry investing:**

Jewelry investing offers a stable asset class with intrinsic value derived from precious metals and gemstones, often appreciating over time due to rarity and craftsmanship. Unlike sneaker flipping, which depends heavily on trends and limited editions, jewelry provides long-term wealth preservation and potential for portfolio diversification. Explore the benefits and strategies of jewelry investing to enhance your financial growth.

Provenance

Jewelry investing offers a secure asset with verifiable provenance through certifications like GIA and authenticated ownership history, ensuring lasting value appreciation. Sneaker flipping relies heavily on limited editions and cultural significance, where provenance is proven by retail receipts, collaboration authenticity, and condition rarity, impacting resale premiums. Explore more about how provenance drives value in both markets for smarter investment decisions.

Appraisal

Jewelry investing relies heavily on expert appraisal to determine the intrinsic value of gemstones and precious metals, ensuring accurate market pricing and authenticity verification. Sneaker flipping primarily depends on market demand and limited-edition releases, with appraisal less formal and often driven by condition and rarity assessments from collectors. Discover more about how specialized appraisal impacts profitability in these unique investment markets.

Source and External Links

Is gold jewelry considered an investment? Experts weigh in - Gold jewelry can be a viable investment if purchased strategically, offering value beyond its metal content through design and craftsmanship.

The Best Jewelry Investment Pieces: What to Buy for Long-Term Value - High-quality, timeless pieces such as diamond engagement rings and rare gemstones are considered strong investment options due to their durability and potential for value appreciation.

Should You Buy Jewelry as an Investment? Pros and Cons to Consider - Jewelry can serve as a tangible asset for diversification, but it carries risks; understanding the value of precious metals and gemstones is crucial for making informed investment decisions.

dowidth.com

dowidth.com