Farmland funds allocate capital to agricultural land, generating returns through crop production and land appreciation, often offering stability and inflation protection. Impact investment funds focus on projects delivering measurable social and environmental benefits alongside financial returns, targeting sectors such as renewable energy, education, and healthcare. Explore the distinct advantages and risks associated with farmland and impact investment funds to make informed portfolio decisions.

Why it is important

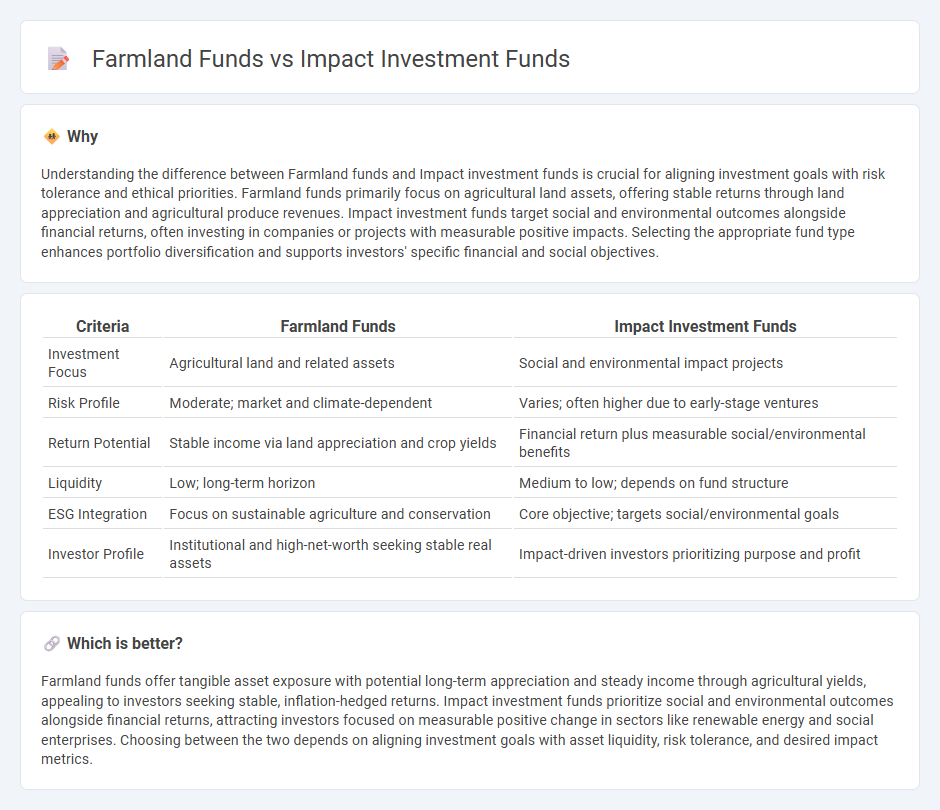

Understanding the difference between Farmland funds and Impact investment funds is crucial for aligning investment goals with risk tolerance and ethical priorities. Farmland funds primarily focus on agricultural land assets, offering stable returns through land appreciation and agricultural produce revenues. Impact investment funds target social and environmental outcomes alongside financial returns, often investing in companies or projects with measurable positive impacts. Selecting the appropriate fund type enhances portfolio diversification and supports investors' specific financial and social objectives.

Comparison Table

| Criteria | Farmland Funds | Impact Investment Funds |

|---|---|---|

| Investment Focus | Agricultural land and related assets | Social and environmental impact projects |

| Risk Profile | Moderate; market and climate-dependent | Varies; often higher due to early-stage ventures |

| Return Potential | Stable income via land appreciation and crop yields | Financial return plus measurable social/environmental benefits |

| Liquidity | Low; long-term horizon | Medium to low; depends on fund structure |

| ESG Integration | Focus on sustainable agriculture and conservation | Core objective; targets social/environmental goals |

| Investor Profile | Institutional and high-net-worth seeking stable real assets | Impact-driven investors prioritizing purpose and profit |

Which is better?

Farmland funds offer tangible asset exposure with potential long-term appreciation and steady income through agricultural yields, appealing to investors seeking stable, inflation-hedged returns. Impact investment funds prioritize social and environmental outcomes alongside financial returns, attracting investors focused on measurable positive change in sectors like renewable energy and social enterprises. Choosing between the two depends on aligning investment goals with asset liquidity, risk tolerance, and desired impact metrics.

Connection

Farmland funds and impact investment funds are connected through their shared goal of generating financial returns alongside positive environmental and social outcomes. Farmland funds invest in agricultural land, promoting sustainable farming practices that enhance soil health, biodiversity, and rural livelihoods, aligning with impact investing's focus on measurable, beneficial impacts. Both fund types attract investors seeking to address climate change, food security, and ethical resource management while achieving portfolio diversification and long-term value appreciation.

Key Terms

Social/Environmental Return

Impact investment funds prioritize generating measurable social and environmental benefits alongside financial returns, targeting projects that promote sustainability, renewable energy, and community development. Farmland funds invest specifically in agricultural land, leveraging natural resource stewardship and sustainable farming practices to enhance environmental outcomes such as soil health and biodiversity, while providing stable financial returns. Explore the unique social and environmental advantages of these fund types to align your investment with your values.

Agricultural Asset

Impact investment funds prioritize social and environmental outcomes alongside financial returns, often targeting sustainable agriculture projects that improve livelihoods and conserve resources. Farmland funds concentrate on acquiring and managing agricultural land to generate stable income through crop production and land value appreciation. Explore how these fund types compare in aligning financial goals with sustainable agricultural assets.

Performance Metrics

Impact investment funds prioritize measuring social and environmental returns alongside financial gains, using metrics such as the Global Impact Investing Network's (GIIN) IRIS+ framework for standardized impact performance. Farmland funds emphasize land appreciation, crop yields, commodity prices, and sustainable farming practices as key performance indicators to assess long-term asset value and operational efficiency. Explore detailed comparisons to understand which fund type aligns best with your investment goals.

Source and External Links

Impact Investments by Social Finance - Impact investment funds serve philanthropic capital investors by providing a cost-effective way to pursue impact-first investments that generate measurable positive social and environmental outcomes, complementing philanthropy and government efforts to scale solutions for complex societal problems.

Impact Investments Program Strategy by MacArthur Foundation - Impact investment funds deploy catalytic capital in the form of loans, equity, and guarantees to support underfunded social enterprises and nonprofits, focusing on additionality, capital mobilization, and systemic impact to address social and environmental challenges globally.

What You Need to Know About Impact Investing by GIIN - Impact investment funds are designed to intentionally generate measurable social or environmental benefits alongside financial returns, investing across sectors like energy, healthcare, and sustainable agriculture with the goal of addressing pressing global challenges through diverse financial returns.

dowidth.com

dowidth.com