Music royalties investment offers investors a unique asset class generating income from song rights and royalties, often providing stable, long-term cash flow independent of market volatility. Peer-to-peer lending involves directly funding loans to individuals or businesses through online platforms, potentially yielding higher interest rates but carrying increased credit risk. Explore the benefits and risks of music royalties versus peer-to-peer lending to optimize your investment portfolio.

Why it is important

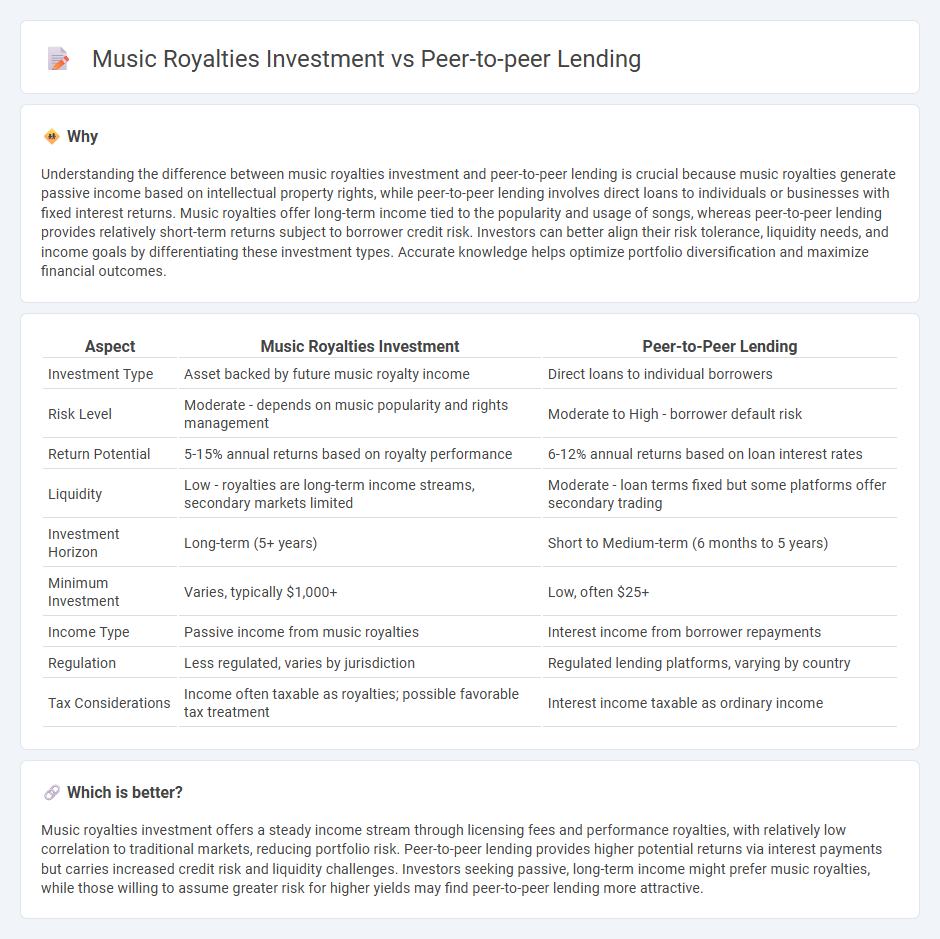

Understanding the difference between music royalties investment and peer-to-peer lending is crucial because music royalties generate passive income based on intellectual property rights, while peer-to-peer lending involves direct loans to individuals or businesses with fixed interest returns. Music royalties offer long-term income tied to the popularity and usage of songs, whereas peer-to-peer lending provides relatively short-term returns subject to borrower credit risk. Investors can better align their risk tolerance, liquidity needs, and income goals by differentiating these investment types. Accurate knowledge helps optimize portfolio diversification and maximize financial outcomes.

Comparison Table

| Aspect | Music Royalties Investment | Peer-to-Peer Lending |

|---|---|---|

| Investment Type | Asset backed by future music royalty income | Direct loans to individual borrowers |

| Risk Level | Moderate - depends on music popularity and rights management | Moderate to High - borrower default risk |

| Return Potential | 5-15% annual returns based on royalty performance | 6-12% annual returns based on loan interest rates |

| Liquidity | Low - royalties are long-term income streams, secondary markets limited | Moderate - loan terms fixed but some platforms offer secondary trading |

| Investment Horizon | Long-term (5+ years) | Short to Medium-term (6 months to 5 years) |

| Minimum Investment | Varies, typically $1,000+ | Low, often $25+ |

| Income Type | Passive income from music royalties | Interest income from borrower repayments |

| Regulation | Less regulated, varies by jurisdiction | Regulated lending platforms, varying by country |

| Tax Considerations | Income often taxable as royalties; possible favorable tax treatment | Interest income taxable as ordinary income |

Which is better?

Music royalties investment offers a steady income stream through licensing fees and performance royalties, with relatively low correlation to traditional markets, reducing portfolio risk. Peer-to-peer lending provides higher potential returns via interest payments but carries increased credit risk and liquidity challenges. Investors seeking passive, long-term income might prefer music royalties, while those willing to assume greater risk for higher yields may find peer-to-peer lending more attractive.

Connection

Music royalties investment and peer-to-peer lending are connected through their role as alternative investment opportunities that provide diversified income streams outside traditional markets. Investors in music royalties receive passive income from rights to intellectual property, similar to how lenders in peer-to-peer platforms earn interest by funding individual or business loans. Both markets leverage technology platforms to facilitate direct investment, increase access, and offer scalable financial returns with varying risk profiles.

Key Terms

Platform Risk

Peer-to-peer lending platforms face platform risk through borrower defaults and possible platform insolvency, impacting investor returns directly. Music royalties investments carry platform risk related to rights management efficiency and transparency in royalty distribution. Explore further to understand how platform risk varies between these alternative investment options.

Default Rate

Peer-to-peer lending typically exhibits default rates ranging from 2% to 10%, heavily influenced by borrower creditworthiness and platform risk management. In contrast, music royalties investment shows lower default risk due to consistent revenue streams from copyrights and licensing agreements, though market volatility can impact returns. Explore detailed comparisons to better understand risk profiles and optimize your investment strategy.

Royalty Income

Peer-to-peer lending offers investors steady interest income through loans made directly to individuals or businesses, while music royalties investment generates royalty income based on the performance and usage of music tracks. Royalty income from music investments can provide passive, long-term cash flow that correlates with music consumption trends and licensing agreements. Explore how diversifying your portfolio with royalty income can enhance financial stability and growth potential.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work | Equifax - Peer-to-peer lending (P2P) is a method where individuals can borrow and lend money directly without a bank, using specialized websites that connect borrowers with individual investors, often offering lower eligibility requirements and flexible terms for borrowers, while providing lenders an investment opportunity by charging interest.

Peer-to-peer lending - Wikipedia - Peer-to-peer lending is an online financial service where money is lent directly to individuals or businesses via platforms that operate intermediary services including credit checks, loan servicing, and payment processing, typically without government insurance and sometimes allowing lenders to select specific borrowers.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending connects lenders and borrowers through online marketplaces where lenders earn interest, but it carries higher risk than traditional savings, often featuring higher interest rates with some platforms allowing lenders to distribute funds across many borrowers or choose them individually.

dowidth.com

dowidth.com