Sports memorabilia funds specialize in investing in rare collectibles such as autographed items, game-used equipment, and limited-edition memorabilia, offering high growth potential tied to market demand and athlete popularity. Infrastructure funds focus on long-term investments in public assets like roads, bridges, and utilities, providing steady cash flows and lower risk through government-backed projects. Explore the distinct benefits and risk profiles of sports memorabilia versus infrastructure funds to tailor your investment strategy.

Why it is important

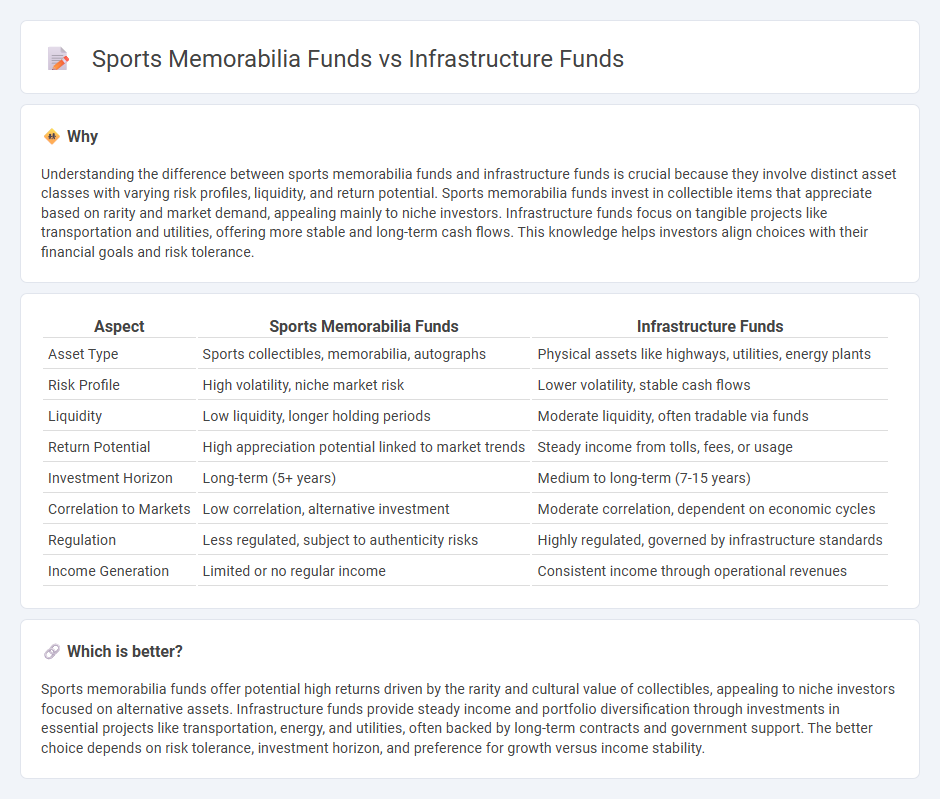

Understanding the difference between sports memorabilia funds and infrastructure funds is crucial because they involve distinct asset classes with varying risk profiles, liquidity, and return potential. Sports memorabilia funds invest in collectible items that appreciate based on rarity and market demand, appealing mainly to niche investors. Infrastructure funds focus on tangible projects like transportation and utilities, offering more stable and long-term cash flows. This knowledge helps investors align choices with their financial goals and risk tolerance.

Comparison Table

| Aspect | Sports Memorabilia Funds | Infrastructure Funds |

|---|---|---|

| Asset Type | Sports collectibles, memorabilia, autographs | Physical assets like highways, utilities, energy plants |

| Risk Profile | High volatility, niche market risk | Lower volatility, stable cash flows |

| Liquidity | Low liquidity, longer holding periods | Moderate liquidity, often tradable via funds |

| Return Potential | High appreciation potential linked to market trends | Steady income from tolls, fees, or usage |

| Investment Horizon | Long-term (5+ years) | Medium to long-term (7-15 years) |

| Correlation to Markets | Low correlation, alternative investment | Moderate correlation, dependent on economic cycles |

| Regulation | Less regulated, subject to authenticity risks | Highly regulated, governed by infrastructure standards |

| Income Generation | Limited or no regular income | Consistent income through operational revenues |

Which is better?

Sports memorabilia funds offer potential high returns driven by the rarity and cultural value of collectibles, appealing to niche investors focused on alternative assets. Infrastructure funds provide steady income and portfolio diversification through investments in essential projects like transportation, energy, and utilities, often backed by long-term contracts and government support. The better choice depends on risk tolerance, investment horizon, and preference for growth versus income stability.

Connection

Sports memorabilia funds and infrastructure funds intersect through their shared focus on alternative investment strategies that diversify portfolios beyond traditional assets. Sports memorabilia funds capitalize on the growing market demand for collectible physical assets, while infrastructure funds invest in long-term physical projects like stadiums and sports facilities. Both fund types leverage the sports industry's economic potential, offering investors exposure to non-correlated assets tied to sports-related physical wealth and development.

Key Terms

**Infrastructure Funds:**

Infrastructure funds invest in physical assets such as transportation networks, utilities, and energy projects, offering stable cash flows and long-term growth potential. These funds typically appeal to investors seeking lower volatility and inflation-protected income through asset-backed securities. Explore how infrastructure funds compare with sports memorabilia funds in risk, return, and diversification to make informed investment decisions.

Core Assets

Infrastructure funds primarily invest in core assets such as transportation networks, utilities, and energy facilities that offer stable, long-term cash flows and inflation protection. Sports memorabilia funds focus on rare, collectible items with high appreciation potential but carry higher liquidity risks and market volatility. Discover how core asset strategies differentiate infrastructure funds from sports memorabilia funds by exploring their risk profiles and return characteristics.

Public-Private Partnerships (PPP)

Infrastructure funds primarily invest in Public-Private Partnerships (PPP) to finance large-scale projects like highways, hospitals, and utilities, generating stable, long-term returns through government-backed contracts. Sports memorabilia funds, in contrast, focus on acquiring, managing, and trading collectible items with appreciation potential but lack the consistent cash flow and contract guarantees typical of PPP investments. Explore how these contrasting asset classes balance risk and return in diversified investment portfolios.

Source and External Links

Infrastructure fund - An infrastructure fund is a private or public investment vehicle that invests directly or indirectly in infrastructure assets like power plants, transportation, and communications systems, but returns can vary due to economic cycles and compensation structures.

The top 100 infrastructure fund managers - This ranking lists the largest global infrastructure fund managers by capital raised, with Brookfield Asset Management leading, followed by Global Infrastructure Partners and KKR.

Infrastructure Fund - A fund focused on total return with an emphasis on income through investing in securities issued by infrastructure companies, offering broad diversification and potentially lower volatility than global equities.

dowidth.com

dowidth.com