Virtual land real estate offers investors the chance to purchase, develop, and monetize plots within digital environments using blockchain technology and NFTs, providing a novel asset class with potential for high returns. Angel investing involves providing early-stage capital to startups in exchange for equity, supporting innovation while bearing substantial risk and the possibility of significant financial rewards. Explore the unique benefits and considerations of virtual land real estate versus angel investing to make informed investment decisions.

Why it is important

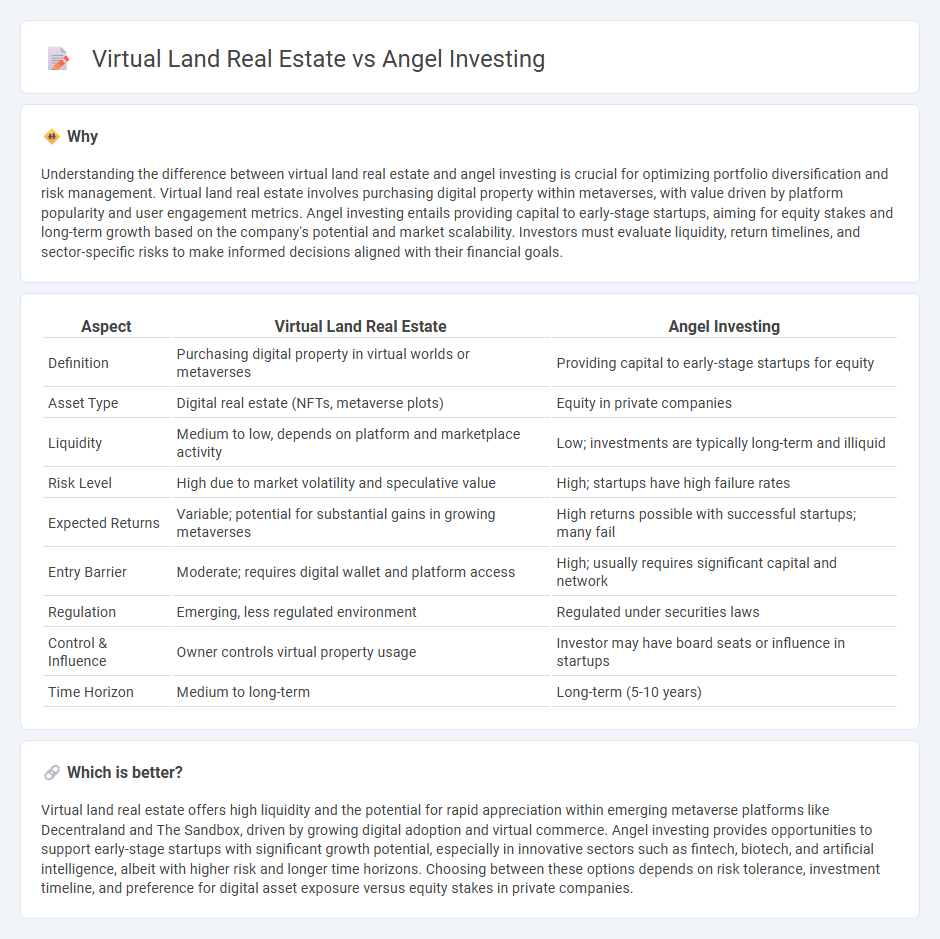

Understanding the difference between virtual land real estate and angel investing is crucial for optimizing portfolio diversification and risk management. Virtual land real estate involves purchasing digital property within metaverses, with value driven by platform popularity and user engagement metrics. Angel investing entails providing capital to early-stage startups, aiming for equity stakes and long-term growth based on the company's potential and market scalability. Investors must evaluate liquidity, return timelines, and sector-specific risks to make informed decisions aligned with their financial goals.

Comparison Table

| Aspect | Virtual Land Real Estate | Angel Investing |

|---|---|---|

| Definition | Purchasing digital property in virtual worlds or metaverses | Providing capital to early-stage startups for equity |

| Asset Type | Digital real estate (NFTs, metaverse plots) | Equity in private companies |

| Liquidity | Medium to low, depends on platform and marketplace activity | Low; investments are typically long-term and illiquid |

| Risk Level | High due to market volatility and speculative value | High; startups have high failure rates |

| Expected Returns | Variable; potential for substantial gains in growing metaverses | High returns possible with successful startups; many fail |

| Entry Barrier | Moderate; requires digital wallet and platform access | High; usually requires significant capital and network |

| Regulation | Emerging, less regulated environment | Regulated under securities laws |

| Control & Influence | Owner controls virtual property usage | Investor may have board seats or influence in startups |

| Time Horizon | Medium to long-term | Long-term (5-10 years) |

Which is better?

Virtual land real estate offers high liquidity and the potential for rapid appreciation within emerging metaverse platforms like Decentraland and The Sandbox, driven by growing digital adoption and virtual commerce. Angel investing provides opportunities to support early-stage startups with significant growth potential, especially in innovative sectors such as fintech, biotech, and artificial intelligence, albeit with higher risk and longer time horizons. Choosing between these options depends on risk tolerance, investment timeline, and preference for digital asset exposure versus equity stakes in private companies.

Connection

Virtual land real estate and angel investing intersect through their shared focus on emerging digital economies and innovative startup ecosystems. Angel investors often provide early-stage capital to companies developing virtual land platforms, blockchain technology, or metaverse infrastructure, driving growth in digital asset markets. Both investment types emphasize high-risk, high-reward opportunities within technology-driven sectors poised for significant expansion.

Key Terms

**Angel Investing:**

Angel investing involves providing early-stage capital to startups in exchange for equity, often contributing strategic guidance and industry connections. This form of investment carries high risk but offers potential for substantial returns when startups succeed, particularly in tech-driven sectors. Discover more about how angel investing can diversify your portfolio and support innovation.

Equity

Angel investing involves providing capital to early-stage startups in exchange for equity stakes, offering potential high returns tied to company growth. Virtual land real estate allows investors to acquire digital plots within metaverse platforms, with ownership represented as non-fungible tokens (NFTs) that can appreciate based on platform popularity and utility. Explore the detailed equity implications of both investment types to maximize portfolio gains.

Seed Funding

Angel investing in seed funding offers early-stage startups crucial capital and mentorship, enabling rapid growth and innovation. Virtual land real estate in seed funding presents a new frontier, where investors acquire digital plots in metaverse platforms, expecting long-term value appreciation and ecosystem development. Explore the nuances of seed funding strategies to maximize returns in both angel investing and virtual real estate sectors.

Source and External Links

Understanding angel financing and investing - J.P. Morgan - Angel investors provide early-stage funding to startups beyond family and friends, investing money in exchange for equity or convertible debt and offering mentorship, industry experience, and networking to help startups reach their first professional financing round.

Angel Investors - The Hartford Insurance - Angel investors are wealthy individuals who invest their own money in small businesses for equity, often providing patient capital and mentoring, aiming for returns usually through a public offering or acquisition.

Angel investor - Wikipedia - Angel investors, also called business angels or seed investors, are private individuals providing capital at early stages, with UK data showing an average investment size and returns, noting a growing market and increased impact investments between 2009 and 2015.

dowidth.com

dowidth.com