Investment communities foster diverse member interactions, pooling resources and insights to leverage market opportunities effectively. Family offices manage substantial private wealth, prioritizing long-term asset preservation and tailored investment strategies aligned with family values. Explore how both approaches offer unique advantages in wealth growth and management.

Why it is important

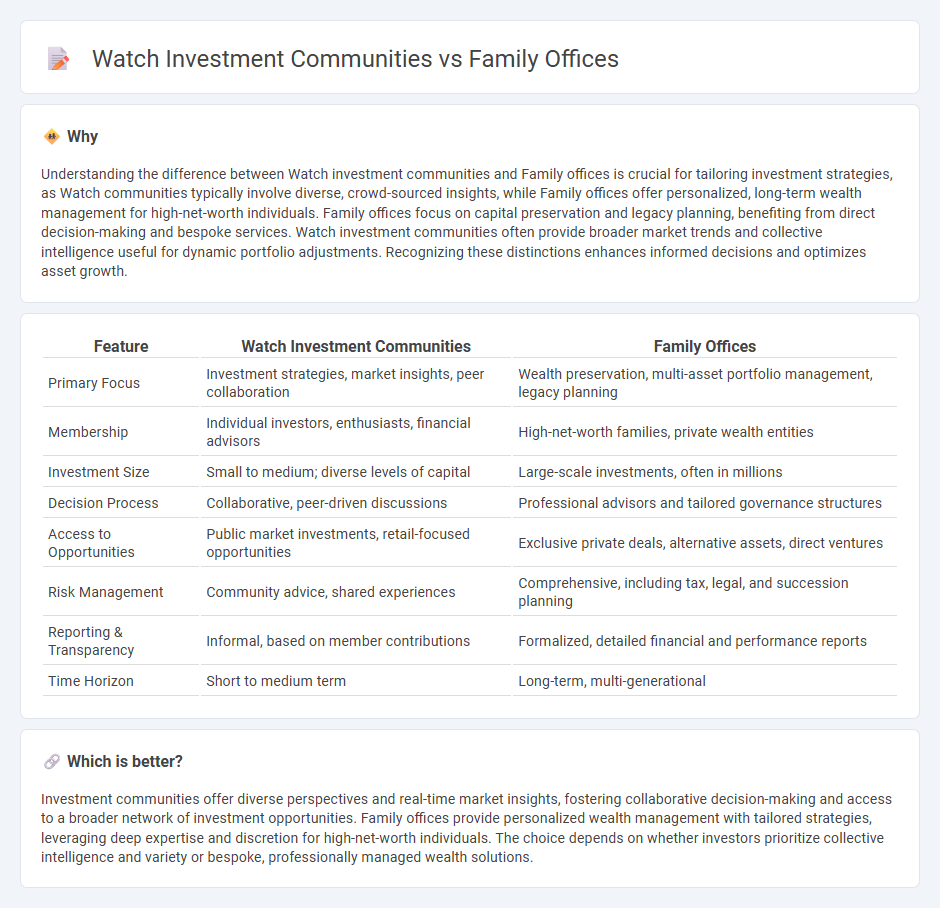

Understanding the difference between Watch investment communities and Family offices is crucial for tailoring investment strategies, as Watch communities typically involve diverse, crowd-sourced insights, while Family offices offer personalized, long-term wealth management for high-net-worth individuals. Family offices focus on capital preservation and legacy planning, benefiting from direct decision-making and bespoke services. Watch investment communities often provide broader market trends and collective intelligence useful for dynamic portfolio adjustments. Recognizing these distinctions enhances informed decisions and optimizes asset growth.

Comparison Table

| Feature | Watch Investment Communities | Family Offices |

|---|---|---|

| Primary Focus | Investment strategies, market insights, peer collaboration | Wealth preservation, multi-asset portfolio management, legacy planning |

| Membership | Individual investors, enthusiasts, financial advisors | High-net-worth families, private wealth entities |

| Investment Size | Small to medium; diverse levels of capital | Large-scale investments, often in millions |

| Decision Process | Collaborative, peer-driven discussions | Professional advisors and tailored governance structures |

| Access to Opportunities | Public market investments, retail-focused opportunities | Exclusive private deals, alternative assets, direct ventures |

| Risk Management | Community advice, shared experiences | Comprehensive, including tax, legal, and succession planning |

| Reporting & Transparency | Informal, based on member contributions | Formalized, detailed financial and performance reports |

| Time Horizon | Short to medium term | Long-term, multi-generational |

Which is better?

Investment communities offer diverse perspectives and real-time market insights, fostering collaborative decision-making and access to a broader network of investment opportunities. Family offices provide personalized wealth management with tailored strategies, leveraging deep expertise and discretion for high-net-worth individuals. The choice depends on whether investors prioritize collective intelligence and variety or bespoke, professionally managed wealth solutions.

Connection

Watch investment communities and family offices share a strategic connection through their focus on asset diversification and wealth preservation. Family offices often leverage watch investment communities for expert insights and market trends, enhancing their portfolio's value with rare and luxury timepieces as alternative investments. The collaboration fosters a niche market where trust, exclusivity, and long-term value appreciation drive both groups' investment decisions.

Key Terms

Family Offices:

Family offices manage ultra-high-net-worth individuals' wealth through diversified asset portfolios, including private equity, real estate, and fine art like luxury watches, emphasizing long-term preservation and growth. Watch investment communities, however, primarily focus on trading, valuing, and collecting timepieces, often driven by passion and market speculation rather than comprehensive financial planning. Explore deeper insights into how family offices strategically integrate watch investments within broader wealth management frameworks.

Wealth Management

Family offices prioritize comprehensive wealth management by offering tailored financial planning, estate planning, tax optimization, and investment strategies tailored to high-net-worth families, ensuring asset preservation across generations. Watch investment communities concentrate on collective expertise in luxury timepieces, leveraging market trends, rarity, and brand value to maximize returns within a niche investment class. Explore deeper insights into how these distinct approaches can align with your wealth management goals.

Succession Planning

Family offices prioritize long-term wealth preservation and succession planning by integrating legal, financial, and estate strategies to ensure smooth generational wealth transfer. Watch investment communities, while passionate about asset appreciation, often lack structured succession frameworks, focusing more on market trends and collectible valuation. Explore comprehensive succession strategies tailored for luxury watch investments to safeguard your collection's legacy.

Source and External Links

Family office - A family office is a private company managing investment and wealth for very wealthy families, typically with $50-100 million or more in assets, handling investments, legal affairs, property, household management, and succession planning to grow and preserve family wealth across generations.

A Simple guide to family offices - Family offices come in three main types: single family offices (for very wealthy families needing customized services), multi-family offices (cost-effective shared services for affluent families), and virtual family offices (remote, technology-based services for geographically spread families).

The Family Office: What Is It, Purpose, Strategies - A family office helps affluent families manage their complex wealth, focusing on legacy, multi-generational wealth sustainability, philanthropy, investment, estate planning, and family governance with a team of specialized professionals.

dowidth.com

dowidth.com