Hedge fund replication strategies aim to mimic the risk-return profile of hedge funds by using liquid, transparent instruments, often at a lower cost compared to traditional hedge funds. Long-only funds focus solely on buying stocks with the expectation of capital appreciation, offering simplicity and regulatory clarity but potentially limited downside protection. Explore deeper insights into how these investment approaches compare and which may align with your portfolio goals.

Why it is important

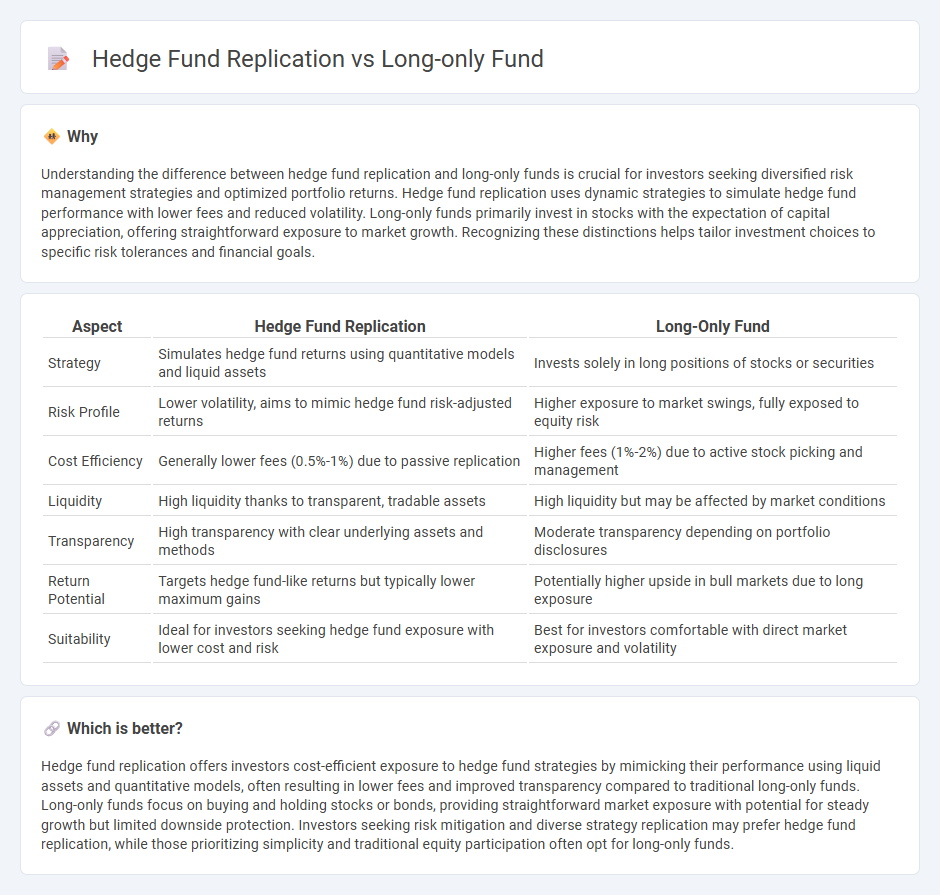

Understanding the difference between hedge fund replication and long-only funds is crucial for investors seeking diversified risk management strategies and optimized portfolio returns. Hedge fund replication uses dynamic strategies to simulate hedge fund performance with lower fees and reduced volatility. Long-only funds primarily invest in stocks with the expectation of capital appreciation, offering straightforward exposure to market growth. Recognizing these distinctions helps tailor investment choices to specific risk tolerances and financial goals.

Comparison Table

| Aspect | Hedge Fund Replication | Long-Only Fund |

|---|---|---|

| Strategy | Simulates hedge fund returns using quantitative models and liquid assets | Invests solely in long positions of stocks or securities |

| Risk Profile | Lower volatility, aims to mimic hedge fund risk-adjusted returns | Higher exposure to market swings, fully exposed to equity risk |

| Cost Efficiency | Generally lower fees (0.5%-1%) due to passive replication | Higher fees (1%-2%) due to active stock picking and management |

| Liquidity | High liquidity thanks to transparent, tradable assets | High liquidity but may be affected by market conditions |

| Transparency | High transparency with clear underlying assets and methods | Moderate transparency depending on portfolio disclosures |

| Return Potential | Targets hedge fund-like returns but typically lower maximum gains | Potentially higher upside in bull markets due to long exposure |

| Suitability | Ideal for investors seeking hedge fund exposure with lower cost and risk | Best for investors comfortable with direct market exposure and volatility |

Which is better?

Hedge fund replication offers investors cost-efficient exposure to hedge fund strategies by mimicking their performance using liquid assets and quantitative models, often resulting in lower fees and improved transparency compared to traditional long-only funds. Long-only funds focus on buying and holding stocks or bonds, providing straightforward market exposure with potential for steady growth but limited downside protection. Investors seeking risk mitigation and diverse strategy replication may prefer hedge fund replication, while those prioritizing simplicity and traditional equity participation often opt for long-only funds.

Connection

Hedge fund replication strategies aim to mimic the risk-return profile of hedge funds by using long-only funds and liquid assets, offering investors similar alpha exposure with lower fees and enhanced transparency. Long-only funds provide the foundational building blocks, such as equity and fixed income securities, enabling replication models to construct portfolios that approximate hedge fund strategies without engaging in complex derivatives or short selling. This connection allows investors to access diversified hedge fund-like returns while benefiting from the regulatory clarity and cost efficiency typical of long-only fund structures.

Key Terms

Beta Exposure

Long-only funds primarily seek to generate returns through exposure to broad market Beta, capturing systematic risk factors via direct equity investments. Hedge fund replication strategies aim to mimic hedge fund returns by constructing portfolios that replicate the Beta exposures of various hedge fund styles using liquid, transparent assets. Explore detailed methodologies and performance comparisons to understand how Beta replication can align with your portfolio objectives.

Leverage

Long-only funds typically employ minimal or no leverage, focusing on buying assets to achieve growth over time. Hedge fund replication strategies often incorporate leverage to mimic hedge fund returns while managing risk through diversified, liquid instruments. Explore how leverage influences risk and return profiles in these investment approaches to deepen your understanding.

Alpha Generation

Long-only funds primarily generate alpha through strategic security selection and market timing within bullish or neutral market environments, focusing on capturing systematic equity risk premiums. Hedge fund replication seeks to mimic hedge fund alpha by employing quantitative strategies such as factor models, alternative beta, and derivatives, aiming to achieve similar risk-adjusted returns with lower fees and higher liquidity. Explore advanced methodologies and comparative performance data to deepen your understanding of alpha generation in fund management.

Source and External Links

Top 5 Long-Only asset management funds that focus on fundamental investment - Long-only funds buy and hold equities without short-selling, focusing on companies with strong fundamentals to deliver long-term growth through detailed company analysis rather than market timing.

Long-Only Hedge Funds: Careers, Recruiting, and Top Names - A long-only hedge fund invests to profit from price increases without short-selling, often using derivatives to hedge risks, and differs from traditional long/short funds by only holding 'long' positions.

What do long-only funds look for in a trading system? - Long-only funds prioritize trading systems that support multi-asset execution, advanced trading strategies, and efficient management of trades to minimize market impact and transaction costs for long-term capital growth.

dowidth.com

dowidth.com