Psychedelic stocks, representing companies involved in psychedelic medicine and mental health therapies, offer high growth potential driven by increasing legalization and scientific research. Tech stocks, encompassing giants in software, hardware, and digital services, remain a cornerstone of innovation with widespread market adoption and substantial revenue streams. Explore the distinct dynamics and investment opportunities in psychedelic and tech stocks to make informed portfolio decisions.

Why it is important

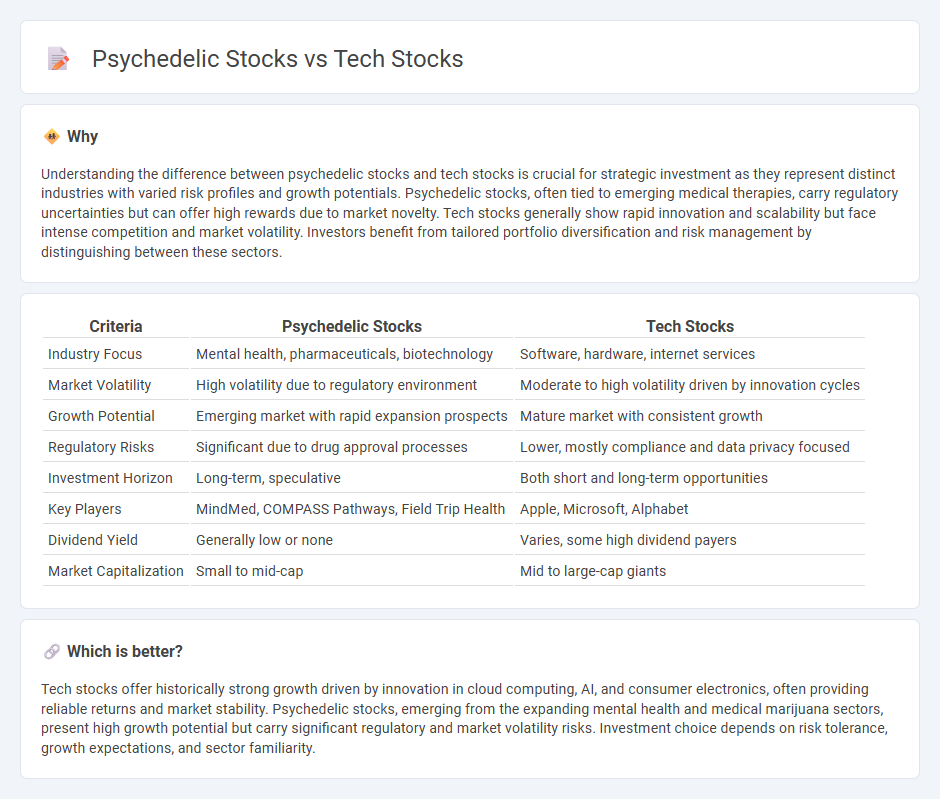

Understanding the difference between psychedelic stocks and tech stocks is crucial for strategic investment as they represent distinct industries with varied risk profiles and growth potentials. Psychedelic stocks, often tied to emerging medical therapies, carry regulatory uncertainties but can offer high rewards due to market novelty. Tech stocks generally show rapid innovation and scalability but face intense competition and market volatility. Investors benefit from tailored portfolio diversification and risk management by distinguishing between these sectors.

Comparison Table

| Criteria | Psychedelic Stocks | Tech Stocks |

|---|---|---|

| Industry Focus | Mental health, pharmaceuticals, biotechnology | Software, hardware, internet services |

| Market Volatility | High volatility due to regulatory environment | Moderate to high volatility driven by innovation cycles |

| Growth Potential | Emerging market with rapid expansion prospects | Mature market with consistent growth |

| Regulatory Risks | Significant due to drug approval processes | Lower, mostly compliance and data privacy focused |

| Investment Horizon | Long-term, speculative | Both short and long-term opportunities |

| Key Players | MindMed, COMPASS Pathways, Field Trip Health | Apple, Microsoft, Alphabet |

| Dividend Yield | Generally low or none | Varies, some high dividend payers |

| Market Capitalization | Small to mid-cap | Mid to large-cap giants |

Which is better?

Tech stocks offer historically strong growth driven by innovation in cloud computing, AI, and consumer electronics, often providing reliable returns and market stability. Psychedelic stocks, emerging from the expanding mental health and medical marijuana sectors, present high growth potential but carry significant regulatory and market volatility risks. Investment choice depends on risk tolerance, growth expectations, and sector familiarity.

Connection

Psychedelic stocks and tech stocks are connected through the shared reliance on cutting-edge research and innovation to disrupt traditional markets. Both sectors attract significant venture capital aiming to develop transformative products: psychedelics focus on novel mental health treatments, while tech stocks drive advancements in software, AI, and hardware. Investor interest in high-growth potential and regulatory shifts further align these industries within emerging investment portfolios.

Key Terms

Volatility

Tech stocks exhibit high volatility driven by rapid innovation cycles, regulatory shifts, and market sentiment, often resulting in significant price swings. Psychedelic stocks, although newer and less established, show pronounced volatility due to evolving legal frameworks, clinical trial results, and investor speculation in the emerging mental health sector. Explore detailed volatility comparisons and market trends to better understand investment dynamics in these sectors.

Market capitalization

Tech stocks like Apple and Microsoft often boast market capitalizations exceeding $2 trillion, reflecting their dominant positions in the global economy. Psychedelic stocks, such as MindMed and Compass Pathways, typically have significantly smaller market caps, usually below $1 billion, indicating a nascent and emerging industry. Explore detailed market capitalization comparisons to understand growth potential and investment opportunities in these distinct sectors.

Regulatory environment

Tech stocks benefit from a relatively mature regulatory environment with clear guidelines that support innovation and data privacy compliance, driven by bodies like the SEC and FCC. Psychedelic stocks face evolving and complex regulations due to ongoing research and shifting legal statuses across regions, with agencies such as the FDA and DEA playing pivotal roles in clinical trial approvals and substance classification. Explore more about how regulatory landscapes impact investment strategies in these dynamic sectors.

Source and External Links

The Best Tech Stocks to Buy - Morningstar lists 12 of the best undervalued tech stocks to buy now in 2025, including Endava, Sensata Technologies, Akamai, Adobe, and Teradyne, selected based on fair value metrics and economic moat ratings.

7 Best-Performing Tech Stocks for July 2025 - The top performing tech stocks by one-year return include Palantir (511%), MicroStrategy (152%), and Zscaler (68%), reflecting strong growth despite economic concerns.

A List of Stocks in the Technology Sector - The technology sector encompasses 762 stocks with a combined market cap of $23.8 trillion and an average PE ratio of 45.53, illustrating its massive scale and valuation.

dowidth.com

dowidth.com