Royalty rights investing involves purchasing rights to a percentage of revenue generated by a company's product or intellectual property, offering steady passive income without ownership dilution. Angel investing requires providing early-stage capital to startups in exchange for equity, carrying higher risk but potential for significant returns and involvement in company growth. Discover the key differences and benefits of each investment strategy to align with your financial goals.

Why it is important

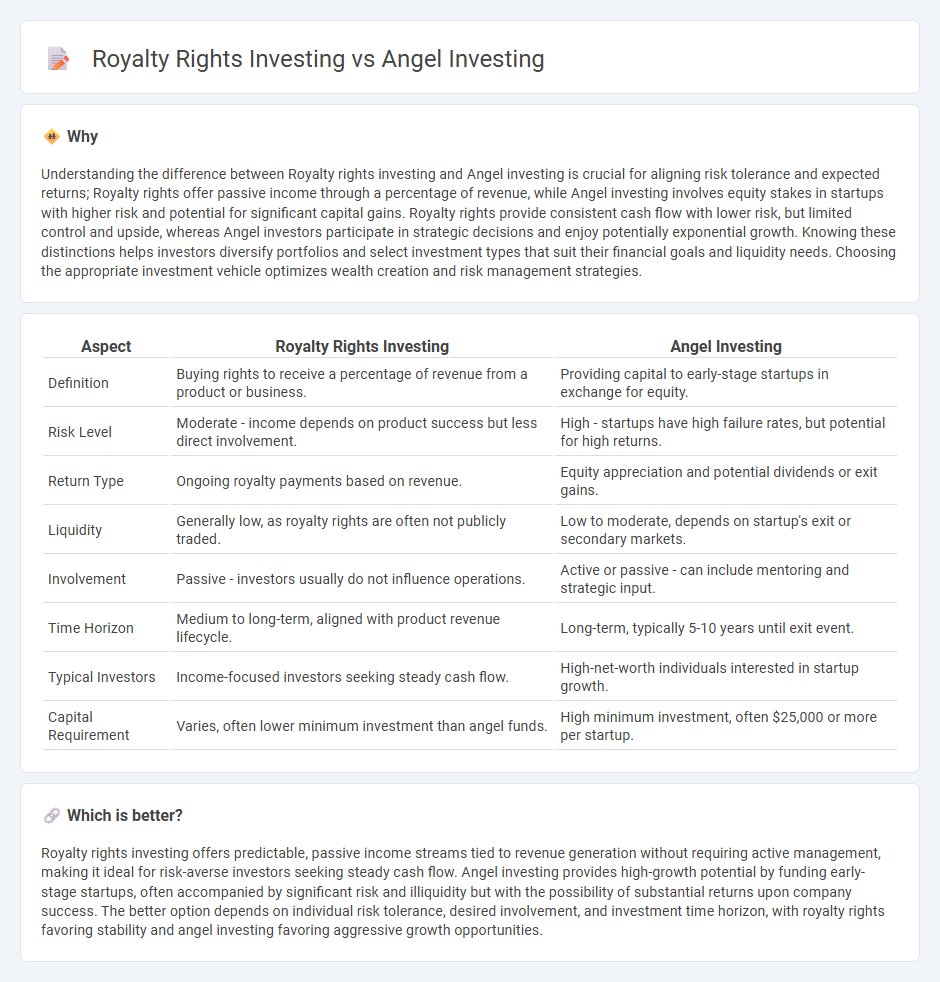

Understanding the difference between Royalty rights investing and Angel investing is crucial for aligning risk tolerance and expected returns; Royalty rights offer passive income through a percentage of revenue, while Angel investing involves equity stakes in startups with higher risk and potential for significant capital gains. Royalty rights provide consistent cash flow with lower risk, but limited control and upside, whereas Angel investors participate in strategic decisions and enjoy potentially exponential growth. Knowing these distinctions helps investors diversify portfolios and select investment types that suit their financial goals and liquidity needs. Choosing the appropriate investment vehicle optimizes wealth creation and risk management strategies.

Comparison Table

| Aspect | Royalty Rights Investing | Angel Investing |

|---|---|---|

| Definition | Buying rights to receive a percentage of revenue from a product or business. | Providing capital to early-stage startups in exchange for equity. |

| Risk Level | Moderate - income depends on product success but less direct involvement. | High - startups have high failure rates, but potential for high returns. |

| Return Type | Ongoing royalty payments based on revenue. | Equity appreciation and potential dividends or exit gains. |

| Liquidity | Generally low, as royalty rights are often not publicly traded. | Low to moderate, depends on startup's exit or secondary markets. |

| Involvement | Passive - investors usually do not influence operations. | Active or passive - can include mentoring and strategic input. |

| Time Horizon | Medium to long-term, aligned with product revenue lifecycle. | Long-term, typically 5-10 years until exit event. |

| Typical Investors | Income-focused investors seeking steady cash flow. | High-net-worth individuals interested in startup growth. |

| Capital Requirement | Varies, often lower minimum investment than angel funds. | High minimum investment, often $25,000 or more per startup. |

Which is better?

Royalty rights investing offers predictable, passive income streams tied to revenue generation without requiring active management, making it ideal for risk-averse investors seeking steady cash flow. Angel investing provides high-growth potential by funding early-stage startups, often accompanied by significant risk and illiquidity but with the possibility of substantial returns upon company success. The better option depends on individual risk tolerance, desired involvement, and investment time horizon, with royalty rights favoring stability and angel investing favoring aggressive growth opportunities.

Connection

Royalty rights investing and angel investing are connected through their focus on early-stage revenue generation and equity growth, providing alternative funding options for startups and small businesses. Both investment types offer investors potential recurring income streams--royalty rights through a percentage of sales and angel investing through equity appreciation as the company scales. These strategies attract investors seeking diversification beyond traditional stocks and bonds by leveraging intellectual property and innovative business ventures.

Key Terms

Equity Ownership (Angel Investing)

Angel investing involves acquiring equity ownership in early-stage companies, granting investors partial control and potential dividends based on company performance. Equity ownership aligns investor interests with company growth, offering capital appreciation alongside voting rights and influence in strategic decisions. Discover how angel investing compares to royalty rights investing and its impact on your investment portfolio.

Intellectual Property Royalties (Royalty Rights Investing)

Angel investing provides equity capital to early-stage startups, offering potential high returns through company growth and eventual exits, while royalty rights investing centers on acquiring intellectual property royalties for steady income streams based on IP usage. Intellectual property royalties involve licensing patents, trademarks, or copyrights where investors receive payments tied to product sales or usage, presenting lower risk compared to equity but with more predictable cash flows. Explore the benefits and dynamics of intellectual property royalty rights investing to diversify your portfolio with IP-backed income opportunities.

Risk Profile

Angel investing involves high risk due to startup uncertainties, equity dilution, and potential total loss of capital, while royalty rights investing offers more predictable income streams with lower risk since earnings are based on revenue percentage rather than company equity. Angel investors face illiquidity and longer exit horizons, whereas royalty rights provide ongoing royalty payments with quicker returns and less exposure to operational failures. Explore detailed risk comparisons and strategic benefits to optimize your investment decisions in these asset classes.

Source and External Links

Understanding angel financing and investing - Angel investing involves individuals providing capital to startups in exchange for equity or convertible debt, often bridging the gap between personal/family funding and institutional investment rounds, while offering mentorship and access to valuable networks.

Angel Investors - Angel investors are wealthy individuals who invest their own money in early-stage businesses for an ownership stake, typically seeking eventual profit through exits like acquisitions or IPOs, and often provide hands-on support beyond just funding.

Angel investor - An angel investor is a private individual who supplies capital to startups, usually in exchange for equity, with investments often ranging from tens of thousands to hundreds of thousands of dollars, and historically achieving average gross returns of about 22% over 3.6 years in the UK.

dowidth.com

dowidth.com