Farmland funds provide investors with exposure to agricultural land assets, generating returns through land appreciation and agricultural production income, while commodity funds focus on physical commodities like metals, energy, and crops, offering liquidity and diversification benefits. Farmland investments tend to have lower volatility and potential inflation hedging compared to the often more price-sensitive and speculative commodity markets. Explore the distinct risk profiles and performance drivers of these asset classes to determine which aligns best with your investment goals.

Why it is important

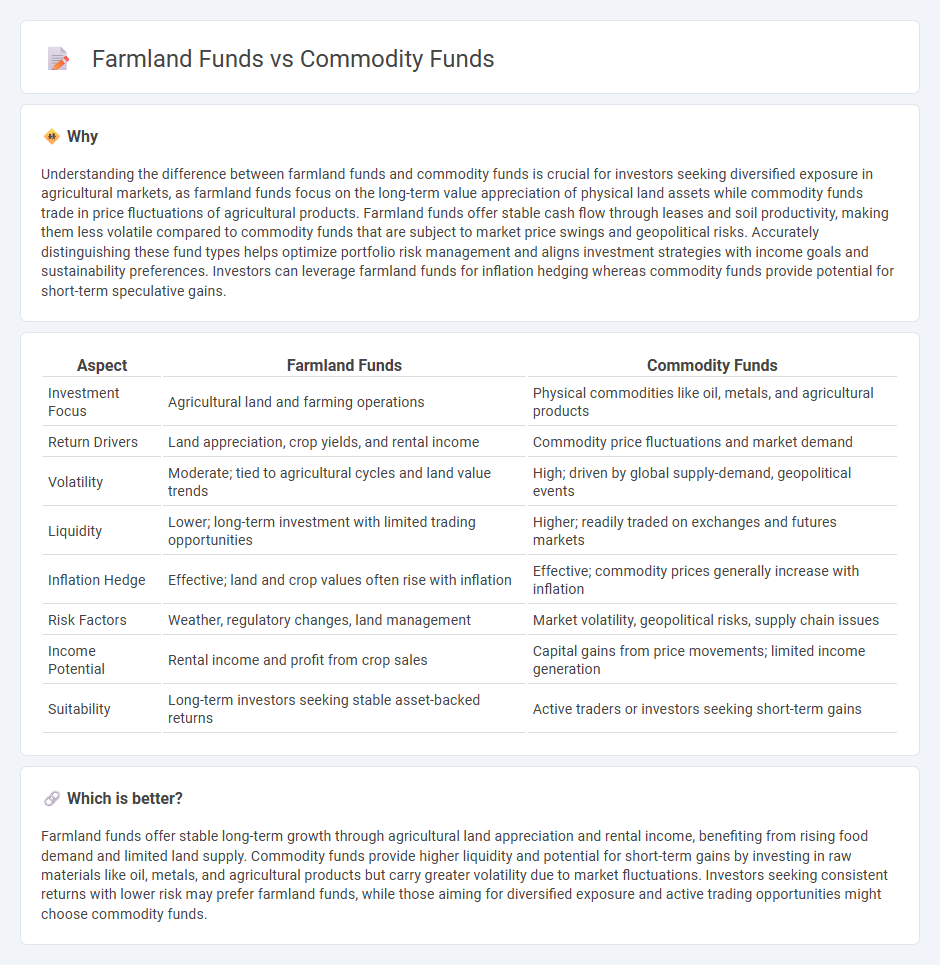

Understanding the difference between farmland funds and commodity funds is crucial for investors seeking diversified exposure in agricultural markets, as farmland funds focus on the long-term value appreciation of physical land assets while commodity funds trade in price fluctuations of agricultural products. Farmland funds offer stable cash flow through leases and soil productivity, making them less volatile compared to commodity funds that are subject to market price swings and geopolitical risks. Accurately distinguishing these fund types helps optimize portfolio risk management and aligns investment strategies with income goals and sustainability preferences. Investors can leverage farmland funds for inflation hedging whereas commodity funds provide potential for short-term speculative gains.

Comparison Table

| Aspect | Farmland Funds | Commodity Funds |

|---|---|---|

| Investment Focus | Agricultural land and farming operations | Physical commodities like oil, metals, and agricultural products |

| Return Drivers | Land appreciation, crop yields, and rental income | Commodity price fluctuations and market demand |

| Volatility | Moderate; tied to agricultural cycles and land value trends | High; driven by global supply-demand, geopolitical events |

| Liquidity | Lower; long-term investment with limited trading opportunities | Higher; readily traded on exchanges and futures markets |

| Inflation Hedge | Effective; land and crop values often rise with inflation | Effective; commodity prices generally increase with inflation |

| Risk Factors | Weather, regulatory changes, land management | Market volatility, geopolitical risks, supply chain issues |

| Income Potential | Rental income and profit from crop sales | Capital gains from price movements; limited income generation |

| Suitability | Long-term investors seeking stable asset-backed returns | Active traders or investors seeking short-term gains |

Which is better?

Farmland funds offer stable long-term growth through agricultural land appreciation and rental income, benefiting from rising food demand and limited land supply. Commodity funds provide higher liquidity and potential for short-term gains by investing in raw materials like oil, metals, and agricultural products but carry greater volatility due to market fluctuations. Investors seeking consistent returns with lower risk may prefer farmland funds, while those aiming for diversified exposure and active trading opportunities might choose commodity funds.

Connection

Farmland funds invest in agricultural land, generating income through crop production and land appreciation, while commodity funds focus on raw materials like grains, metals, and energy products traded in markets. Both fund types are linked by their exposure to agricultural commodities, as farmland funds' asset values often correlate with commodity price fluctuations. This interconnection allows investors to diversify risk while capitalizing on the agricultural sector's growth and commodity market trends.

Key Terms

Asset Class

Commodity funds primarily invest in physical goods such as metals, energy, and agricultural products, offering exposure to price fluctuations in global markets. Farmland funds focus on acquiring and managing agricultural land, generating returns through crop production, land appreciation, and leasing income. Discover detailed insights on how asset class characteristics influence investment strategies by exploring our in-depth analysis.

Liquidity

Commodity funds offer higher liquidity due to active trading on established exchanges, enabling investors to quickly buy or sell shares. Farmland funds, while providing stable long-term returns through agricultural land investments, typically have lower liquidity as they involve physical assets with longer investment horizons. Explore how liquidity impacts your investment strategy between commodity and farmland funds for informed decision-making.

Return Drivers

Commodity funds primarily generate returns through price fluctuations driven by supply-demand imbalances, global economic trends, and geopolitical factors affecting raw materials like oil, metal, and agricultural products. Farmland funds derive returns mainly from land appreciation, crop yields, and rental income, benefiting from factors such as soil quality, crop diversification, and long-term agricultural productivity. Explore detailed analyses to understand how these distinct return drivers impact investment performance and risk profiles.

Source and External Links

7 Best-Performing Commodity ETFs for April 2025 - Commodity ETFs like FGDL (Franklin Responsibly Sourced Gold ETF) and USG (USCF Gold Strategy Plus Income Fund) track baskets of physical commodities such as gold, oil, and agricultural products, with the top funds delivering strong one-year returns and acting as potential hedges against inflation and global instability.

Commodities ETFs - Commodities ETFs invest in a range of underlying assets, including precious metals, energy, livestock, and agricultural products, with funds like HGER (Harbor Commodity All-Weather Strategy ETF) and CMDT (PIMCO Commodity Strategy Active ETF) offering diversified or actively managed exposure to the commodities market.

Commodity investing and its role in a portfolio - Adding commodity funds to a portfolio can provide diversification and inflation protection, with strategies ranging from static allocations to dynamic approaches that adapt to changing economic and inflation conditions.

dowidth.com

dowidth.com