Fractional ownership real estate allows investors to purchase a specific percentage of a property, providing direct asset control and potential rental income. Real estate ETFs offer diversified exposure to property markets through exchange-traded funds, facilitating liquidity and ease of trading. Explore the advantages and risks of each investment to determine the best fit for your portfolio.

Why it is important

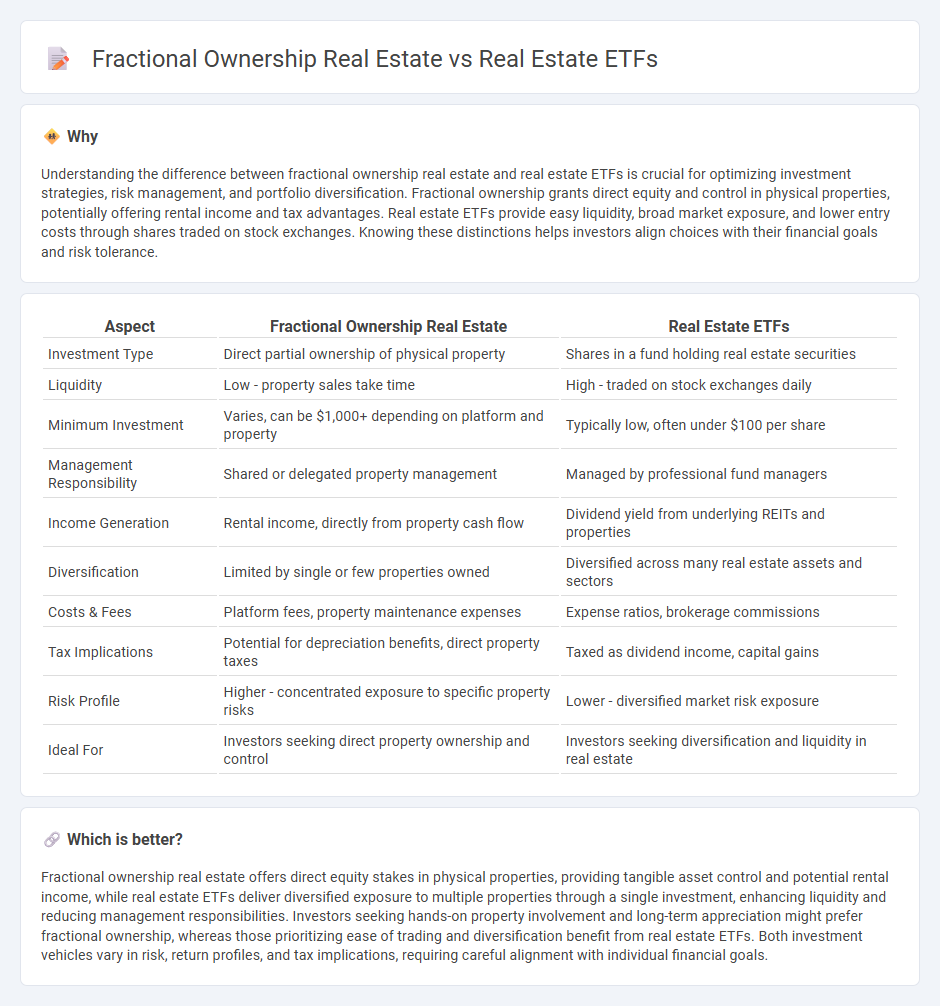

Understanding the difference between fractional ownership real estate and real estate ETFs is crucial for optimizing investment strategies, risk management, and portfolio diversification. Fractional ownership grants direct equity and control in physical properties, potentially offering rental income and tax advantages. Real estate ETFs provide easy liquidity, broad market exposure, and lower entry costs through shares traded on stock exchanges. Knowing these distinctions helps investors align choices with their financial goals and risk tolerance.

Comparison Table

| Aspect | Fractional Ownership Real Estate | Real Estate ETFs |

|---|---|---|

| Investment Type | Direct partial ownership of physical property | Shares in a fund holding real estate securities |

| Liquidity | Low - property sales take time | High - traded on stock exchanges daily |

| Minimum Investment | Varies, can be $1,000+ depending on platform and property | Typically low, often under $100 per share |

| Management Responsibility | Shared or delegated property management | Managed by professional fund managers |

| Income Generation | Rental income, directly from property cash flow | Dividend yield from underlying REITs and properties |

| Diversification | Limited by single or few properties owned | Diversified across many real estate assets and sectors |

| Costs & Fees | Platform fees, property maintenance expenses | Expense ratios, brokerage commissions |

| Tax Implications | Potential for depreciation benefits, direct property taxes | Taxed as dividend income, capital gains |

| Risk Profile | Higher - concentrated exposure to specific property risks | Lower - diversified market risk exposure |

| Ideal For | Investors seeking direct property ownership and control | Investors seeking diversification and liquidity in real estate |

Which is better?

Fractional ownership real estate offers direct equity stakes in physical properties, providing tangible asset control and potential rental income, while real estate ETFs deliver diversified exposure to multiple properties through a single investment, enhancing liquidity and reducing management responsibilities. Investors seeking hands-on property involvement and long-term appreciation might prefer fractional ownership, whereas those prioritizing ease of trading and diversification benefit from real estate ETFs. Both investment vehicles vary in risk, return profiles, and tax implications, requiring careful alignment with individual financial goals.

Connection

Fractional ownership in real estate allows investors to buy shares of a property, making high-value assets accessible with lower capital, while real estate ETFs pool funds to invest in diversified portfolios of real estate securities. Both investment methods enhance liquidity compared to direct property ownership and offer diversified exposure to the real estate market. These options democratize real estate investment, enabling participation without the complexities of property management.

Key Terms

Liquidity

Real estate ETFs provide high liquidity, allowing investors to buy and sell shares quickly on stock exchanges with minimal transaction costs, making them ideal for those seeking flexible investment options. Fractional ownership real estate offers less liquidity as it involves direct stakes in physical properties, often requiring longer holding periods and more complex transfer processes. Explore comprehensive comparisons to determine which investment suits your liquidity needs best.

Diversification

Real estate ETFs provide investors with broad market exposure by holding diversified portfolios of real estate investment trusts (REITs) and property-related stocks, minimizing risk through asset variety. Fractional ownership real estate offers direct stakes in specific properties, allowing targeted asset control but with less inherent diversification. Explore more about how these investment options balance risk and returns with different diversification strategies.

Ownership structure

Real estate ETFs offer indirect ownership through shares in diversified real estate portfolios managed by professionals, providing liquidity and ease of trading on stock exchanges. Fractional ownership real estate involves direct, proportional ownership of specific properties, granting investors more control and potential income from rents and appreciation. Discover the key differences and benefits of each ownership structure to determine which investment aligns with your goals.

Source and External Links

5 Best-Performing Real Estate ETFs for July 2025 - NerdWallet - Real estate ETFs offer diversification, liquidity, passive income potential, and inflation hedging by investing in a basket of real estate securities, with top performers including Janus Henderson U.S. Real Estate ETF (JRE) and Pacer Data & Infrastructure Real Estate ETF (SRVR).

The Best REIT ETFs to Buy | Morningstar - Vanguard Real Estate ETF is highlighted as a popular, low-fee REIT option with diversified holdings primarily invested in income-producing equity real estate trusts, serving as a proxy for the U.S. real estate market.

Cohen & Steers Real Estate Active ETF - This actively managed real estate ETF offers enhanced portfolio diversification, access to attractive valuations, growth catalysts, and aims for high total and risk-adjusted returns through active management in a sector with significant return dispersion.

dowidth.com

dowidth.com