The secondaries market offers investors liquidity and portfolio diversification by enabling the purchase of pre-existing private equity stakes, while co-investment allows direct participation alongside lead investors in new deals, often with reduced fees and enhanced control. Both strategies optimize capital deployment and risk management but differ in timing, access, and investment dynamics. Explore in-depth insights on how secondaries and co-investments can strategically enhance your investment portfolio.

Why it is important

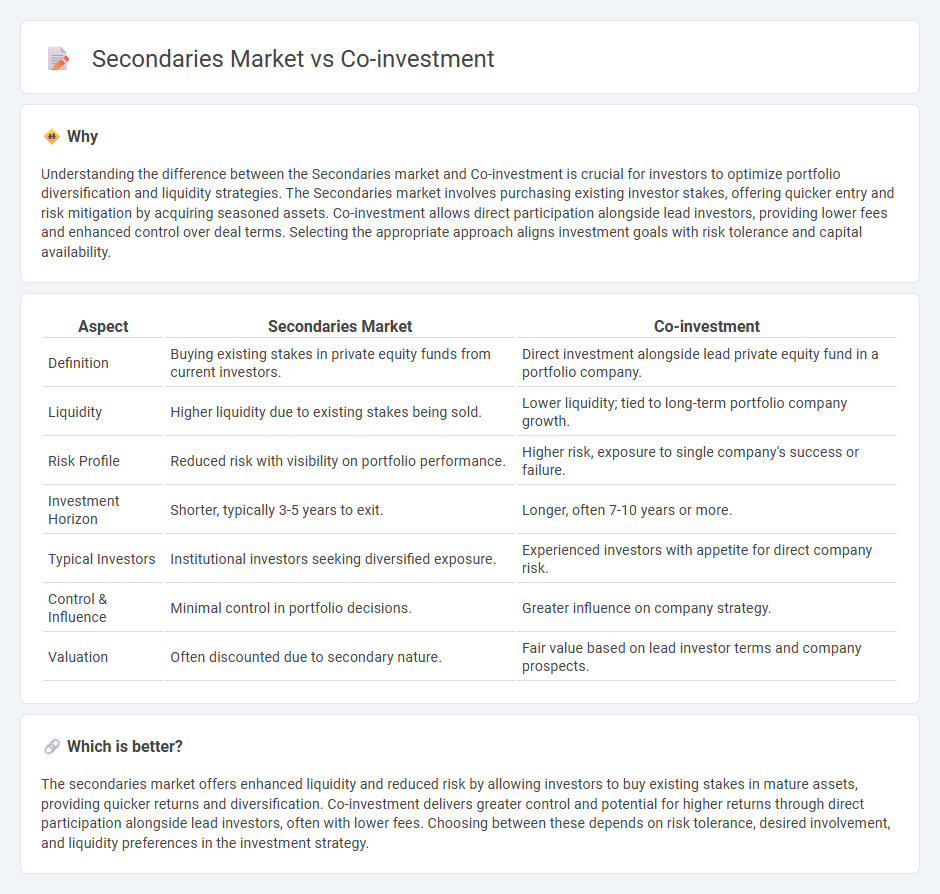

Understanding the difference between the Secondaries market and Co-investment is crucial for investors to optimize portfolio diversification and liquidity strategies. The Secondaries market involves purchasing existing investor stakes, offering quicker entry and risk mitigation by acquiring seasoned assets. Co-investment allows direct participation alongside lead investors, providing lower fees and enhanced control over deal terms. Selecting the appropriate approach aligns investment goals with risk tolerance and capital availability.

Comparison Table

| Aspect | Secondaries Market | Co-investment |

|---|---|---|

| Definition | Buying existing stakes in private equity funds from current investors. | Direct investment alongside lead private equity fund in a portfolio company. |

| Liquidity | Higher liquidity due to existing stakes being sold. | Lower liquidity; tied to long-term portfolio company growth. |

| Risk Profile | Reduced risk with visibility on portfolio performance. | Higher risk, exposure to single company's success or failure. |

| Investment Horizon | Shorter, typically 3-5 years to exit. | Longer, often 7-10 years or more. |

| Typical Investors | Institutional investors seeking diversified exposure. | Experienced investors with appetite for direct company risk. |

| Control & Influence | Minimal control in portfolio decisions. | Greater influence on company strategy. |

| Valuation | Often discounted due to secondary nature. | Fair value based on lead investor terms and company prospects. |

Which is better?

The secondaries market offers enhanced liquidity and reduced risk by allowing investors to buy existing stakes in mature assets, providing quicker returns and diversification. Co-investment delivers greater control and potential for higher returns through direct participation alongside lead investors, often with lower fees. Choosing between these depends on risk tolerance, desired involvement, and liquidity preferences in the investment strategy.

Connection

The secondaries market and co-investment strategies are interconnected through their shared focus on providing liquidity and access to private equity opportunities. Investors leverage the secondaries market to buy existing stakes in private equity funds, while co-investments allow direct participation alongside lead sponsors, reducing fees and enhancing portfolio diversification. Together, these mechanisms optimize capital deployment, improve risk management, and increase exposure to mature assets within private equity portfolios.

Key Terms

Direct Investment

Direct investment offers investors the opportunity to acquire equity stakes directly in companies, providing greater control and transparency compared to secondaries market transactions. Unlike secondaries, where existing investors buy or sell pre-owned fund interests, co-investments enable participation alongside lead investors, often with reduced fees and enhanced alignment of interests. Explore the differences between co-investment and secondaries to optimize your direct investment strategy.

Secondary Transactions

Secondary transactions in the secondaries market provide liquidity to investors seeking to buy or sell existing private equity fund interests, facilitating portfolio rebalancing and access to mature assets. Co-investment opportunities, while directly investing alongside fund managers in specific deals, differ by offering targeted exposure without additional fees but limited liquidity compared to secondary interests. Explore more about how secondary transactions optimize investment strategies and risk management in private equity portfolios.

Liquidity

Co-investment offers investors direct equity stakes alongside lead investors, providing potential for higher returns but limited liquidity due to longer holding periods. The secondaries market enables investors to buy and sell existing private equity interests, offering enhanced liquidity and faster capital deployment compared to primary co-investments. Explore the comparative benefits of liquidity in co-investment and secondaries markets to optimize your investment strategy.

Source and External Links

Equity co-investment - Wikipedia - An equity co-investment is a minority investment made directly into an operating company alongside a private equity sponsor, usually outside the existing fund structure, allowing co-investors to reduce fees while gaining exposure to attractive deals.

Six Things to Know About Co-investments - Cambridge Associates - Co-investments occur when limited partners invest directly alongside a general partner in a company, typically through a special purpose vehicle, providing passively managed investment opportunities with quicker decision timelines.

Great Fund Insights: Co-Investing 101: shared risk, shared reward - Co-investments are capital commitments by limited partners for single investments in vehicles structured to align with governance, tax, and economic considerations, often through dedicated or pooled vehicles, facilitating efficient access to selected deals.

dowidth.com

dowidth.com