Litigation finance involves funding legal cases in exchange for a portion of the settlement or judgment, providing capital to plaintiffs who lack upfront resources. Royalty financing entails investors providing capital in return for a percentage of future revenue or royalties generated by a product or intellectual property. Explore the key differences and benefits of litigation finance versus royalty financing to make informed investment decisions.

Why it is important

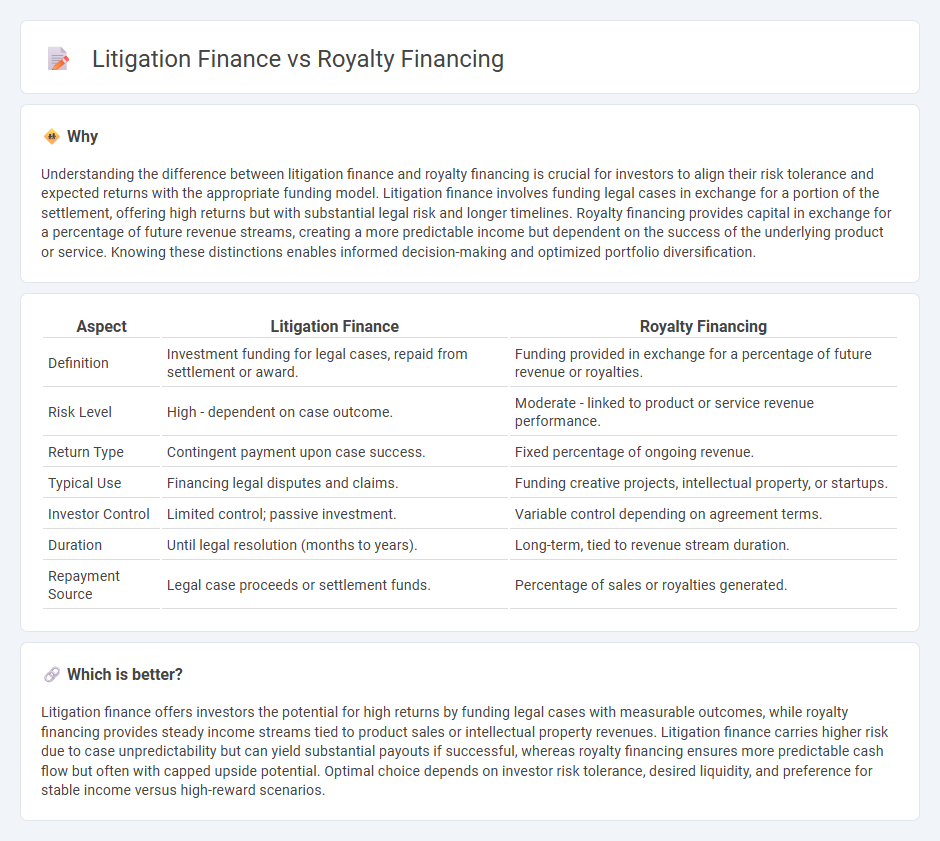

Understanding the difference between litigation finance and royalty financing is crucial for investors to align their risk tolerance and expected returns with the appropriate funding model. Litigation finance involves funding legal cases in exchange for a portion of the settlement, offering high returns but with substantial legal risk and longer timelines. Royalty financing provides capital in exchange for a percentage of future revenue streams, creating a more predictable income but dependent on the success of the underlying product or service. Knowing these distinctions enables informed decision-making and optimized portfolio diversification.

Comparison Table

| Aspect | Litigation Finance | Royalty Financing |

|---|---|---|

| Definition | Investment funding for legal cases, repaid from settlement or award. | Funding provided in exchange for a percentage of future revenue or royalties. |

| Risk Level | High - dependent on case outcome. | Moderate - linked to product or service revenue performance. |

| Return Type | Contingent payment upon case success. | Fixed percentage of ongoing revenue. |

| Typical Use | Financing legal disputes and claims. | Funding creative projects, intellectual property, or startups. |

| Investor Control | Limited control; passive investment. | Variable control depending on agreement terms. |

| Duration | Until legal resolution (months to years). | Long-term, tied to revenue stream duration. |

| Repayment Source | Legal case proceeds or settlement funds. | Percentage of sales or royalties generated. |

Which is better?

Litigation finance offers investors the potential for high returns by funding legal cases with measurable outcomes, while royalty financing provides steady income streams tied to product sales or intellectual property revenues. Litigation finance carries higher risk due to case unpredictability but can yield substantial payouts if successful, whereas royalty financing ensures more predictable cash flow but often with capped upside potential. Optimal choice depends on investor risk tolerance, desired liquidity, and preference for stable income versus high-reward scenarios.

Connection

Litigation finance and royalty financing both provide alternative funding solutions by leveraging future cash flows as collateral, enabling companies to access capital without traditional debt or equity dilution. Litigation finance involves investors funding legal cases in exchange for a portion of the settlement or judgment, while royalty financing allows businesses to receive upfront capital in return for a percentage of future revenue or profits. This connection highlights a trend in alternative financing strategies that focus on monetizing future income streams to support growth and liquidity.

Key Terms

Royalties

Royalty financing involves investors providing capital in exchange for a percentage of future revenue generated by a business or intellectual property, making it a flexible funding option tied directly to sales performance. Litigation finance offers capital to plaintiffs to cover legal fees, with repayment contingent on case outcomes, but royalties specifically target steady income streams from assets. Explore the unique benefits and strategic applications of royalties in financing to understand how they can optimize your investment portfolio.

Case merits

Royalty financing provides capital based on future revenue streams, aligning investor returns with the commercial success of a product or intellectual property, while litigation finance funds legal cases with repayment contingent on winning or settling the case, emphasizing the strength of case merits. Case merits are critical in litigation finance, as financiers assess the likelihood of success and potential recovery before investing; in royalty financing, case merits influence the valuation of projected revenues but are less immediate. Explore deeper insights into how case merits impact these finance structures and optimize investment decisions.

Revenue sharing

Royalty financing involves investors providing capital in exchange for a percentage of future revenue generated by a product or intellectual property, aligning returns directly with sales performance. Litigation finance, by contrast, funds legal cases with repayments commonly structured as a share of the settlement or judgment, not tied to ongoing revenue streams. Discover how revenue sharing structures affect risk and return dynamics in both financing models.

Source and External Links

Royalty Financing: Unlocking Value in the Life Sciences - Royalty financing is a capital-raising method where investors provide funds in exchange for a percentage of future revenues or cash flow, differing from traditional debt or equity financing by aligning investor returns directly with company performance without diluting ownership or requiring fixed repayments.

Royalty Financing: A New Source of Capital in Mining, Tech and Beyond - This form of alternative financing involves an upfront cash payment to a company in return for a share of future revenues or profits, serving as a non-dilutive and flexible financing option especially suited to startups and industries with uncertain returns like tech, life sciences, and mining.

Royalty Financing: An Appealing Alternative to Traditional Life Sciences Financing - Royalty financing offers investors quicker returns compared to equity investments by providing cash flow from royalty streams, supporting companies--particularly in life sciences--through funding in exchange for a percentage of future product sales or revenue.

dowidth.com

dowidth.com