Investing in sports team ownership shares offers unique opportunities tied to brand loyalty, fan engagement, and potential revenue from merchandising, ticket sales, and media rights. Private company equity investments provide access to diversified industries, strategic business growth, and potential dividends or capital appreciation based on company performance. Explore the advantages and risks associated with each to make an informed investment choice.

Why it is important

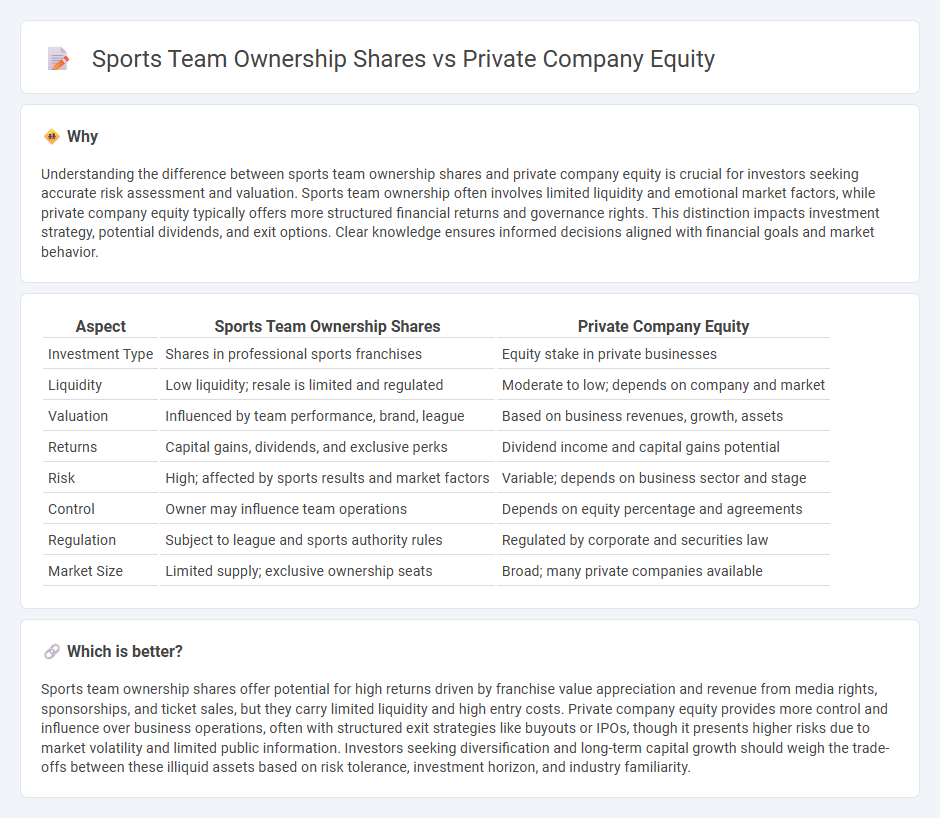

Understanding the difference between sports team ownership shares and private company equity is crucial for investors seeking accurate risk assessment and valuation. Sports team ownership often involves limited liquidity and emotional market factors, while private company equity typically offers more structured financial returns and governance rights. This distinction impacts investment strategy, potential dividends, and exit options. Clear knowledge ensures informed decisions aligned with financial goals and market behavior.

Comparison Table

| Aspect | Sports Team Ownership Shares | Private Company Equity |

|---|---|---|

| Investment Type | Shares in professional sports franchises | Equity stake in private businesses |

| Liquidity | Low liquidity; resale is limited and regulated | Moderate to low; depends on company and market |

| Valuation | Influenced by team performance, brand, league | Based on business revenues, growth, assets |

| Returns | Capital gains, dividends, and exclusive perks | Dividend income and capital gains potential |

| Risk | High; affected by sports results and market factors | Variable; depends on business sector and stage |

| Control | Owner may influence team operations | Depends on equity percentage and agreements |

| Regulation | Subject to league and sports authority rules | Regulated by corporate and securities law |

| Market Size | Limited supply; exclusive ownership seats | Broad; many private companies available |

Which is better?

Sports team ownership shares offer potential for high returns driven by franchise value appreciation and revenue from media rights, sponsorships, and ticket sales, but they carry limited liquidity and high entry costs. Private company equity provides more control and influence over business operations, often with structured exit strategies like buyouts or IPOs, though it presents higher risks due to market volatility and limited public information. Investors seeking diversification and long-term capital growth should weigh the trade-offs between these illiquid assets based on risk tolerance, investment horizon, and industry familiarity.

Connection

Sports team ownership shares and private company equity are interconnected through the concept of ownership stakes that represent partial control and financial interest in an entity. Both forms of equity grant shareholders voting rights, profit distributions, and influence over strategic decisions, making them attractive investment opportunities for high-net-worth individuals and institutional investors. Valuation methods, market demand, and regulatory frameworks similarly impact the liquidity and growth potential of ownership shares in sports teams and private companies.

Key Terms

Valuation

Private company equity valuation often relies on financial metrics like EBITDA multiples, discounted cash flow analysis, and comparable company benchmarks to determine ownership shares' worth. Sports team ownership shares are valued based on franchise revenue streams, brand strength, market size, and league profitability, frequently resulting in higher price multiples due to fan loyalty and media rights. Discover the intricate factors shaping valuation disparities between private company equity and sports team ownership by exploring detailed financial models and market dynamics.

Liquidity

Private company equity typically lacks liquidity as shares are not publicly traded and can only be sold through private transactions, often requiring lengthy approval processes. Sports team ownership shares offer limited liquidity, with sales usually restricted to existing partners or approved investors, and values influenced by market demand and team performance. Discover the nuanced differences in liquidity dynamics between these investment types and their impact on portfolio strategy.

Governance

Private company equity governance centers on shareholder rights, board oversight, and transparent financial reporting to maximize investment returns and ensure compliance with regulatory standards. In contrast, sports team ownership shares involve governance structures that balance competitive performance, fan engagement, and league-specific rules, often requiring collaborative decision-making among owners. Explore the nuances of governance models in both domains to understand their impact on operational success.

Source and External Links

What Does it Mean to Have Equity in a Private Company? - Owning equity in a private company means holding shares that represent an ownership stake, offering potential financial rewards and influence, but with limited liquidity compared to public markets.

Equity in Business: Types of Equity & How It Works - Private company equity usually comes as common or preferred stock, with common stock often granted to founders and employees, while preferred stock is typically issued to investors, each carrying different rights and risks.

Private Equity vs. Public Equity: How to Value a Job Offer - Private company equity is illiquid and hard to value, generally becoming cash only during a liquidity event like an IPO or acquisition, unlike public company equity which can usually be sold on the open market.

dowidth.com

dowidth.com