Sports memorabilia investment often involves rare collectibles like autographed jerseys, limited-edition cards, and historic game-used items, known for their potential to appreciate significantly over time. Luxury handbag investment focuses on iconic brands such as Hermes, Chanel, and Louis Vuitton, where rarity, condition, and model exclusivity drive value increases. Explore the unique advantages and market trends of both investment types to make informed decisions.

Why it is important

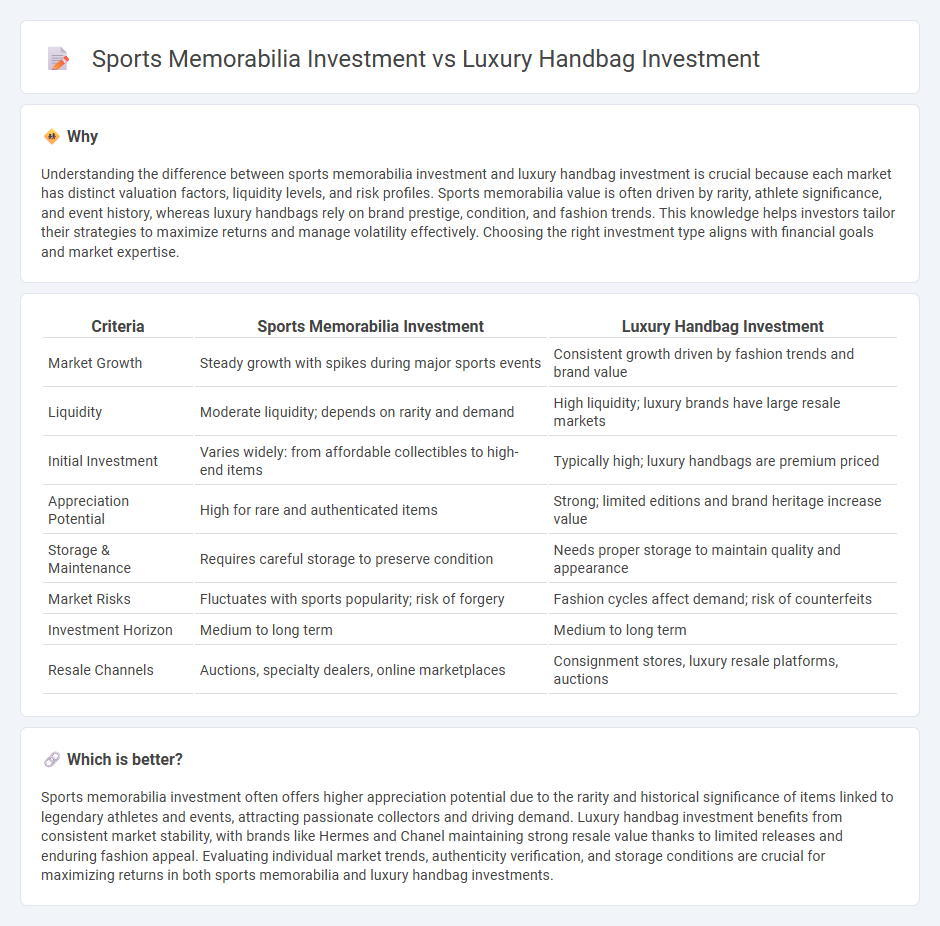

Understanding the difference between sports memorabilia investment and luxury handbag investment is crucial because each market has distinct valuation factors, liquidity levels, and risk profiles. Sports memorabilia value is often driven by rarity, athlete significance, and event history, whereas luxury handbags rely on brand prestige, condition, and fashion trends. This knowledge helps investors tailor their strategies to maximize returns and manage volatility effectively. Choosing the right investment type aligns with financial goals and market expertise.

Comparison Table

| Criteria | Sports Memorabilia Investment | Luxury Handbag Investment |

|---|---|---|

| Market Growth | Steady growth with spikes during major sports events | Consistent growth driven by fashion trends and brand value |

| Liquidity | Moderate liquidity; depends on rarity and demand | High liquidity; luxury brands have large resale markets |

| Initial Investment | Varies widely: from affordable collectibles to high-end items | Typically high; luxury handbags are premium priced |

| Appreciation Potential | High for rare and authenticated items | Strong; limited editions and brand heritage increase value |

| Storage & Maintenance | Requires careful storage to preserve condition | Needs proper storage to maintain quality and appearance |

| Market Risks | Fluctuates with sports popularity; risk of forgery | Fashion cycles affect demand; risk of counterfeits |

| Investment Horizon | Medium to long term | Medium to long term |

| Resale Channels | Auctions, specialty dealers, online marketplaces | Consignment stores, luxury resale platforms, auctions |

Which is better?

Sports memorabilia investment often offers higher appreciation potential due to the rarity and historical significance of items linked to legendary athletes and events, attracting passionate collectors and driving demand. Luxury handbag investment benefits from consistent market stability, with brands like Hermes and Chanel maintaining strong resale value thanks to limited releases and enduring fashion appeal. Evaluating individual market trends, authenticity verification, and storage conditions are crucial for maximizing returns in both sports memorabilia and luxury handbag investments.

Connection

Sports memorabilia investment and luxury handbag investment both capitalize on rarity and brand prestige to generate value appreciation over time. Collectors and investors leverage limited editions, exclusive collaborations, and cultural significance to drive market demand and enhance asset liquidity. Both markets benefit from growing global interest, authenticated provenance, and strategic auction placements that elevate investment potential.

Key Terms

**Luxury handbag investment:**

Luxury handbag investment offers a unique blend of aesthetic appeal and high resale value, with iconic brands like Hermes, Chanel, and Louis Vuitton consistently appreciating over time due to limited production and strong demand. These handbags often serve as tangible assets that hedge against market volatility, with rare models such as the Hermes Birkin fetching record auction prices. Discover more about the benefits and strategies behind investing in luxury handbags.

Brand provenance

Luxury handbag investment thrives on brand provenance, with iconic names like Hermes and Chanel commanding high resale values due to their heritage, craftsmanship, and rarity. Sports memorabilia investment depends heavily on the authenticity and historical significance of items tied to legendary athletes or milestone events, which can dramatically affect market demand and pricing. Discover more about how brand provenance shapes the value in these distinct collectible markets.

Limited edition

Limited edition luxury handbags, such as Hermes Birkin and Chanel Classic Flap, consistently appreciate in value due to their scarcity and high demand among collectors. Similarly, limited edition sports memorabilia, including signed jerseys or rare trading cards, offer substantial investment potential by combining rarity with cultural significance. Explore detailed market trends and expert insights to make informed investment decisions in these exclusive categories.

Source and External Links

The Complete Guide to Investing in Luxury Handbags - This guide highlights how luxury handbags, particularly from brands like Chanel, Hermes, and Louis Vuitton, have become lucrative investments due to their increasing value over time.

Passion Assets: The Luxury Handbag Market - This article discusses the luxury handbag market as a popular category of passion assets, offering potential for investment due to their ability to hold value over time.

More than just a purse: The investment side of luxury handbags - This article explores the investment potential of luxury handbags, noting their classification as one of the fastest-growing asset categories in the luxury space.

dowidth.com

dowidth.com