Rare whisky bottles trading offers investors a unique asset class with limited supply and high appreciation potential driven by global demand and aging effects. Classic cars present an alternative investment with historical significance, rarity, and cultural appeal, often benefiting from vintage market trends and expert restorations. Explore the distinctive advantages and risks of each market to determine the best fit for your investment portfolio.

Why it is important

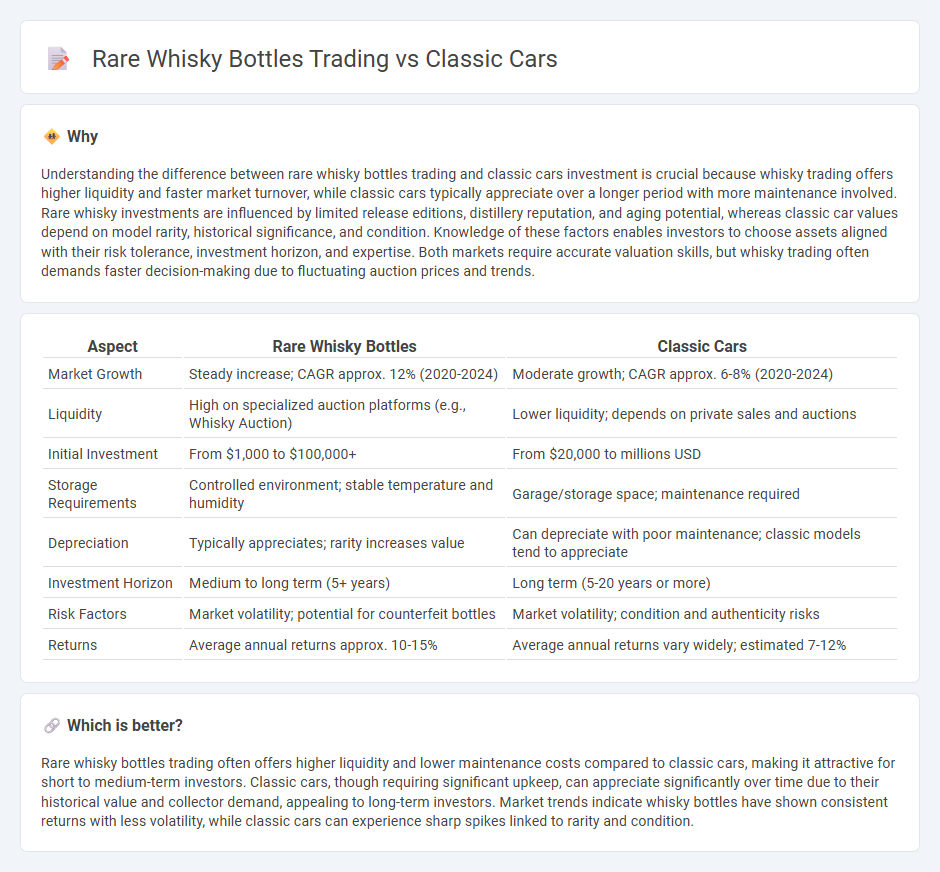

Understanding the difference between rare whisky bottles trading and classic cars investment is crucial because whisky trading offers higher liquidity and faster market turnover, while classic cars typically appreciate over a longer period with more maintenance involved. Rare whisky investments are influenced by limited release editions, distillery reputation, and aging potential, whereas classic car values depend on model rarity, historical significance, and condition. Knowledge of these factors enables investors to choose assets aligned with their risk tolerance, investment horizon, and expertise. Both markets require accurate valuation skills, but whisky trading often demands faster decision-making due to fluctuating auction prices and trends.

Comparison Table

| Aspect | Rare Whisky Bottles | Classic Cars |

|---|---|---|

| Market Growth | Steady increase; CAGR approx. 12% (2020-2024) | Moderate growth; CAGR approx. 6-8% (2020-2024) |

| Liquidity | High on specialized auction platforms (e.g., Whisky Auction) | Lower liquidity; depends on private sales and auctions |

| Initial Investment | From $1,000 to $100,000+ | From $20,000 to millions USD |

| Storage Requirements | Controlled environment; stable temperature and humidity | Garage/storage space; maintenance required |

| Depreciation | Typically appreciates; rarity increases value | Can depreciate with poor maintenance; classic models tend to appreciate |

| Investment Horizon | Medium to long term (5+ years) | Long term (5-20 years or more) |

| Risk Factors | Market volatility; potential for counterfeit bottles | Market volatility; condition and authenticity risks |

| Returns | Average annual returns approx. 10-15% | Average annual returns vary widely; estimated 7-12% |

Which is better?

Rare whisky bottles trading often offers higher liquidity and lower maintenance costs compared to classic cars, making it attractive for short to medium-term investors. Classic cars, though requiring significant upkeep, can appreciate significantly over time due to their historical value and collector demand, appealing to long-term investors. Market trends indicate whisky bottles have shown consistent returns with less volatility, while classic cars can experience sharp spikes linked to rarity and condition.

Connection

Rare whisky bottles and classic cars both represent tangible alternative investments that combine rarity, historical significance, and desirability among collectors. Their markets are driven by limited supply, provenance, and increasing demand, often yielding substantial returns over time. Investors are attracted to these assets for portfolio diversification and potential hedging against inflation.

Key Terms

Provenance

Provenance plays a crucial role in both classic car and rare whisky bottle trading, significantly influencing value and authenticity. Detailed histories and documented ownership enhance trust, driving demand among collectors and investors. Explore deeper insights into how provenance shapes these unique markets.

Authenticity

Authenticity is paramount in trading classic cars and rare whisky bottles, as provenance and verified history significantly influence their market value. Certified documentation, expert appraisals, and unique identifiers such as chassis numbers for cars or batch codes for whiskies ensure trust and rarity. Explore deeper insights into ensuring authenticity and securing your investment in these exclusive collectibles.

Market Liquidity

Classic cars generally offer lower market liquidity due to longer transaction times and niche buyer interest, whereas rare whisky bottles benefit from a growing global market and quicker sales driven by increasing collector demand. Both asset classes serve as alternative investments, but whisky often provides easier entry and exit points for traders. Explore the dynamics of market liquidity in these unique collectible markets to enhance your investment strategy.

Source and External Links

Classic Cars and Trucks for Sale - Classics on Autotrader - The premier marketplace to buy and sell classic cars including Chevrolet Corvette, Ford Mustang, Chevrolet Camaro, Porsche 911, and many more with thousands of listings nationwide.

Classic Cars for Sale near Baton Rouge, Louisiana - Extensive collection of classic cars available in Baton Rouge with popular makes such as Chevrolet, Ford, Cadillac, Jeep, and Ferrari among others for sale.

Classic Cars For Sale In Baton Rouge, LA - Carsforsale.com(r) - Listings of classic cars like 1967 Ford Mustang, 1988 Ford F-250, 1970 Pontiac Trans Am, and 1959 Chrysler Imperial available in Baton Rouge.

dowidth.com

dowidth.com