Virtual land real estate offers investors unique opportunities through blockchain technology and digital scarcity, enabling asset ownership within virtual environments like metaverses. Physical land real estate remains a tangible asset with intrinsic value, providing steady income through leasing and potential appreciation in real markets. Explore the critical differences and advantages of virtual versus physical land investments to make informed financial decisions.

Why it is important

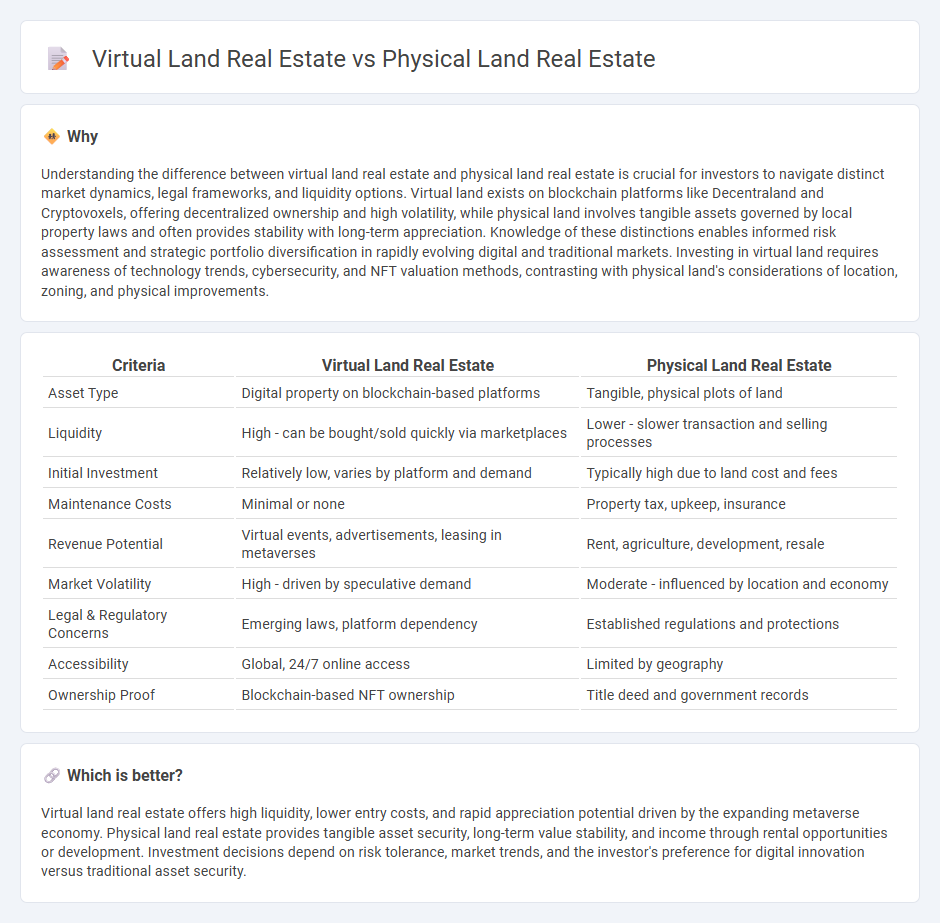

Understanding the difference between virtual land real estate and physical land real estate is crucial for investors to navigate distinct market dynamics, legal frameworks, and liquidity options. Virtual land exists on blockchain platforms like Decentraland and Cryptovoxels, offering decentralized ownership and high volatility, while physical land involves tangible assets governed by local property laws and often provides stability with long-term appreciation. Knowledge of these distinctions enables informed risk assessment and strategic portfolio diversification in rapidly evolving digital and traditional markets. Investing in virtual land requires awareness of technology trends, cybersecurity, and NFT valuation methods, contrasting with physical land's considerations of location, zoning, and physical improvements.

Comparison Table

| Criteria | Virtual Land Real Estate | Physical Land Real Estate |

|---|---|---|

| Asset Type | Digital property on blockchain-based platforms | Tangible, physical plots of land |

| Liquidity | High - can be bought/sold quickly via marketplaces | Lower - slower transaction and selling processes |

| Initial Investment | Relatively low, varies by platform and demand | Typically high due to land cost and fees |

| Maintenance Costs | Minimal or none | Property tax, upkeep, insurance |

| Revenue Potential | Virtual events, advertisements, leasing in metaverses | Rent, agriculture, development, resale |

| Market Volatility | High - driven by speculative demand | Moderate - influenced by location and economy |

| Legal & Regulatory Concerns | Emerging laws, platform dependency | Established regulations and protections |

| Accessibility | Global, 24/7 online access | Limited by geography |

| Ownership Proof | Blockchain-based NFT ownership | Title deed and government records |

Which is better?

Virtual land real estate offers high liquidity, lower entry costs, and rapid appreciation potential driven by the expanding metaverse economy. Physical land real estate provides tangible asset security, long-term value stability, and income through rental opportunities or development. Investment decisions depend on risk tolerance, market trends, and the investor's preference for digital innovation versus traditional asset security.

Connection

Virtual land real estate and physical land real estate share intrinsic value driven by location, scarcity, and market demand. Both assets rely on the principles of property ownership, appreciating through strategic development or market trends in their respective realms. Investors leverage virtual land for digital economies and metaverse experiences, while physical land offers tangible benefits like agriculture, construction, and natural resource exploitation.

Key Terms

Tangible Assets vs. Digital Assets

Physical land real estate comprises tangible assets with intrinsic value rooted in location, infrastructure, and natural resources, often appreciating over time due to scarcity and development potential. Virtual land real estate represents digital assets in metaverse platforms, offering innovative ownership, customizable environments, and new monetization opportunities without physical constraints. Explore more to understand the evolving dynamics and investment strategies between these contrasting asset classes.

Title Deed vs. Smart Contract

Physical land real estate is secured by a title deed, a legally recognized document proving ownership, typically recorded in governmental registries and protected by property laws. Virtual land real estate relies on smart contracts, self-executing codes on blockchain networks that verify ownership transparently and automate transactions without intermediaries. Explore further to understand the evolving legal frameworks and technological implications of these ownership models.

Location Valuation vs. Platform Scarcity

Physical land real estate valuation hinges on geographic location, accessibility, and local economic factors that determine market demand. Virtual land real estate value is driven by platform scarcity, user engagement, and the ecosystem's growth potential within decentralized metaverse environments. Explore the dynamics of both markets to understand how location and platform scarcity shape investment strategies.

Source and External Links

Understanding Real Property: Rights, Definition, & Examples - Pitt Law - Physical land real estate, or real property, includes the land itself plus anything permanently attached like buildings, natural resources, and certain fixtures, with ownership rights extending below and above the surface such as mineral and air rights.

Real Property vs. Personal Property - SmartAsset - Real property encompasses land and anything permanently attached to it, including not only physical assets but also intangible ownership rights such as possession, enjoyment, exclusion, control, and disposition.

Real Property vs. Real Estate | Definition & Differences - Lesson - Physical land real estate is defined as land and improvements permanently attached (like buildings, fences, trees), while real property refers to real estate plus the bundle of ownership rights associated with the land and its improvements.

dowidth.com

dowidth.com