Royalty rights investing provides investors with ongoing income streams derived from intellectual property or natural resource revenues, offering a direct link to asset performance. Structured products combine derivatives and traditional securities to create tailored risk-return profiles, often with capital protection and predefined payout scenarios. Discover more about the advantages and risks of these investment strategies to enhance your portfolio diversification.

Why it is important

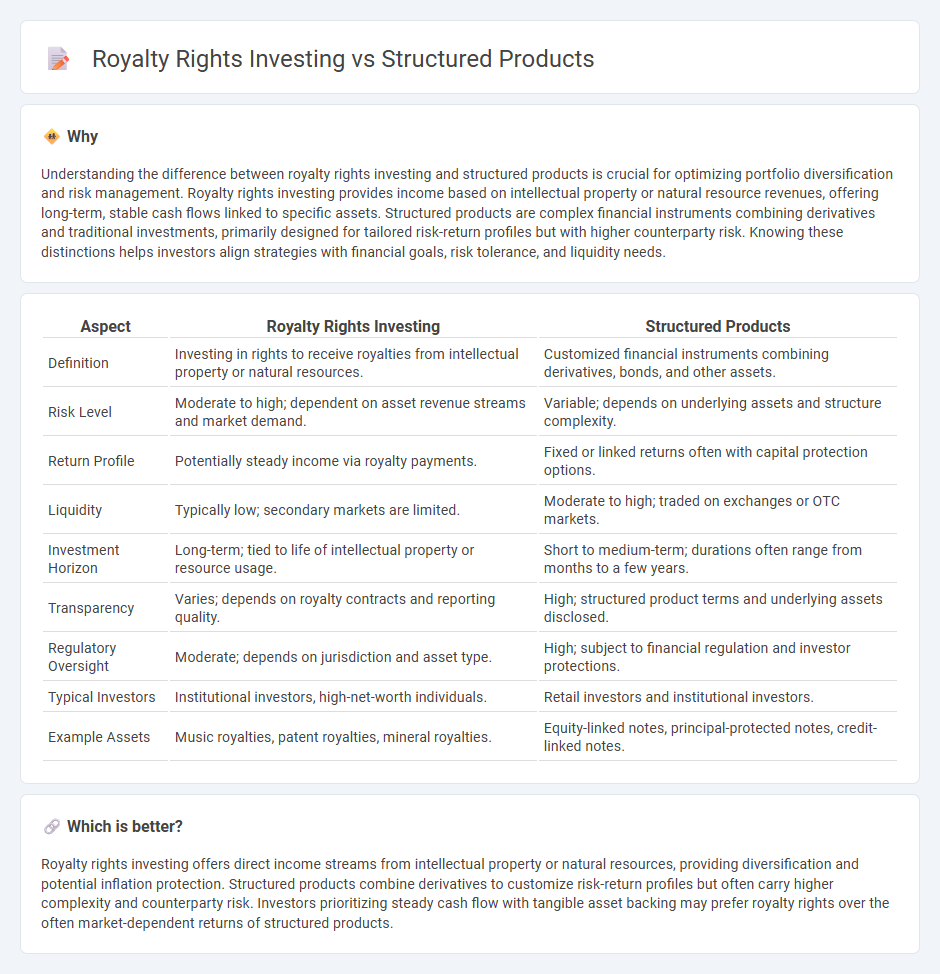

Understanding the difference between royalty rights investing and structured products is crucial for optimizing portfolio diversification and risk management. Royalty rights investing provides income based on intellectual property or natural resource revenues, offering long-term, stable cash flows linked to specific assets. Structured products are complex financial instruments combining derivatives and traditional investments, primarily designed for tailored risk-return profiles but with higher counterparty risk. Knowing these distinctions helps investors align strategies with financial goals, risk tolerance, and liquidity needs.

Comparison Table

| Aspect | Royalty Rights Investing | Structured Products |

|---|---|---|

| Definition | Investing in rights to receive royalties from intellectual property or natural resources. | Customized financial instruments combining derivatives, bonds, and other assets. |

| Risk Level | Moderate to high; dependent on asset revenue streams and market demand. | Variable; depends on underlying assets and structure complexity. |

| Return Profile | Potentially steady income via royalty payments. | Fixed or linked returns often with capital protection options. |

| Liquidity | Typically low; secondary markets are limited. | Moderate to high; traded on exchanges or OTC markets. |

| Investment Horizon | Long-term; tied to life of intellectual property or resource usage. | Short to medium-term; durations often range from months to a few years. |

| Transparency | Varies; depends on royalty contracts and reporting quality. | High; structured product terms and underlying assets disclosed. |

| Regulatory Oversight | Moderate; depends on jurisdiction and asset type. | High; subject to financial regulation and investor protections. |

| Typical Investors | Institutional investors, high-net-worth individuals. | Retail investors and institutional investors. |

| Example Assets | Music royalties, patent royalties, mineral royalties. | Equity-linked notes, principal-protected notes, credit-linked notes. |

Which is better?

Royalty rights investing offers direct income streams from intellectual property or natural resources, providing diversification and potential inflation protection. Structured products combine derivatives to customize risk-return profiles but often carry higher complexity and counterparty risk. Investors prioritizing steady cash flow with tangible asset backing may prefer royalty rights over the often market-dependent returns of structured products.

Connection

Royalty rights investing and structured products both offer investors unique ways to gain exposure to revenue streams and tailor risk-return profiles. Royalty rights provide income linked to intellectual property or natural resources, while structured products often embed these rights within customizable financial instruments to enhance liquidity and risk management. This connection allows investors to diversify portfolios by accessing alternative asset classes with predictable cash flows through structured investment vehicles.

Key Terms

**Structured Products:**

Structured products are tailored financial instruments combining derivatives and traditional assets to offer customized risk-return profiles, often linked to indices, equities, or commodities. They provide investors with principal protection or enhanced yield opportunities depending on market conditions and investment objectives. Explore the benefits and risks of structured products to optimize your portfolio strategy.

Underlying Asset

Structured products derive value from underlying assets such as stocks, bonds, or market indices, offering tailored exposure with predefined risk and return profiles. Royalty rights investing involves acquiring rights to future revenue streams generated by intellectual property, natural resources, or other income-producing assets, providing consistent cash flow linked directly to asset performance. Discover more about the nuances of underlying assets in these investment strategies to optimize portfolio diversification.

Capital Protection

Structured products offer capital protection by combining fixed income securities with derivatives to limit downside risk, providing principal preservation with potential upside linked to market performance. Royalty rights investing entails acquiring revenue streams from intellectual property or natural resources, which typically lack guaranteed capital protection due to revenue dependence on asset performance. Explore detailed insights on both investment types to understand their risk profiles and capital protection mechanisms.

Source and External Links

Understanding Structured Products - Structured products are investment products where returns are linked to the performance of underlying assets, using a combination of bonds and derivatives to achieve tailored risk-return profiles in various market conditions.

Structured product - Wikipedia - A structured product is a pre-packaged investment strategy based on securities, indices, commodities, or currencies, often incorporating derivatives to offer customized payoffs that depend on the performance of underlying assets.

Understanding Structured Notes With Principal Protection | FINRA.org - Structured products are designed to meet specific investment objectives by combining traditional securities (like bonds) with derivative components, offering returns based on a formula linked to the performance of reference assets, and sometimes providing principal protection features.

dowidth.com

dowidth.com